The US Securities and Exchange Commission (SEC) announced on Monday that the famous reality TV personality, Kim Kardashian, has agreed to settle the charges against her for unlawfully promoting the so-called “EthereumMax” crypto investment token.

Kim Kardashian settles with SEC

According to the SEC’s release, Kardashian will pay $1.26 million to the Commission in penalties, disgorgement, and interest. The reality star is also required to cooperate with the agency’s ongoing investigation.

The Commission charged the billionaire socialite for her role in promoting a crypto asset security by EthereumMax and failing to disclose the payment she obtained from the promotion. SEC found that Kim Kardashian was paid $250,000 for promoting the EthereumMax token.

Speaking on the matter, the director of SEC’s Division of Enforcement, Gurbir S. Grewal, said investors deserve to know whether the promotion of any security is unbiased. But Kardashian failed in her case.

The federal securities laws are clear that any celebrity or other individual who promotes a crypto asset security must disclose the nature, source, and amount of compensation they received in exchange for the promotion.

Gurbir S. Grewal

Having reached a settlement agreement, the SEC said Kim Kardashian would abstain from promoting any crypto asset securities for three years.

Floy Mayweather and Paul Pierce are also involved

Kim Kardashian was not the only celebrity involved in the EthereumMax shilling. Famous boxer Floyd Mayweather and former basketball player Paul Pierce were named in a lawsuit filed earlier this year by the disgruntled investors of the EthereumMax token.

The investors blamed the celebrities for promoting the token, which did perform well. In the lawsuit, they claimed to have incurred financial losses and sought payback from the celebrities who promoted the project on social media.

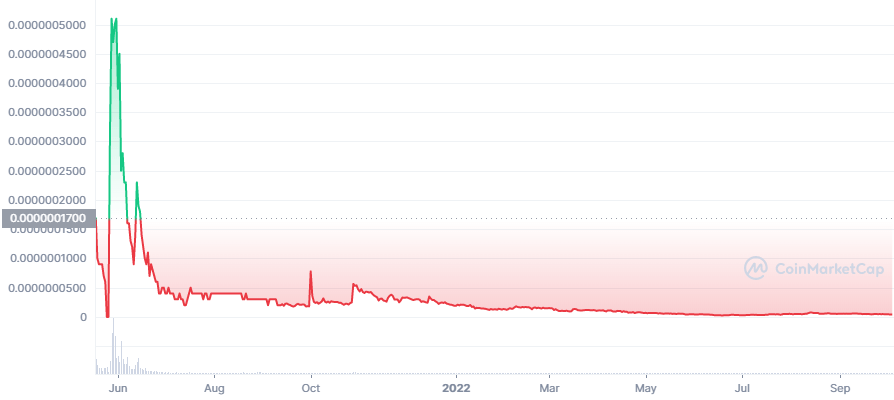

Shortly after EthereumMax began trading in May, the price skyrocketed to an all-time high of $0.00000092, according to Coinmarketcap data. Since then, the price of the token has crashed by 99%, which is indicative of a pump-and-dump scam.