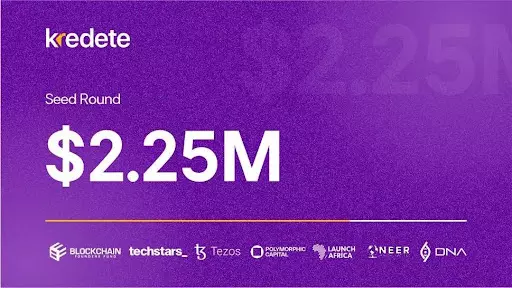

August 30, 2024 – Kredete, a financial software platform focused on enabling African immigrants to build credit and send money back home, has raised $2.25 million in seed funding. The round was led by Blockchain Founders Fund, with participation from notable investors including Techstars, Tezos Foundation, Polymorphic Capital, Launch Africa, Neer Venture Partners and DNA Fund. The round also included contributions from angel investors who have backed successful payment ventures like Wise and Western Union.

Bridging a Financial Gap for African Immigrants in the Diaspora

Kredete is addressing a significant gap in financial services for African immigrants who often struggle to build credit in their new countries while continuing to support their family back home. The platform allows users to send money to over 20 countries with low fees, and each transaction contributes to their credit score in their new country. This unique approach leverages blockchain technology to create an affordable, seamless solution that helps users build a financial foundation in their new home.

Turning Remittances into Credit Building

“Kredete is transforming a routine necessity—sending money back home—into a powerful tool for credit building,” said Amar Odedra, Head of VC at Trilitech, Tezos R&D Hub, a key partner in Kredete’s mission. “This practical application of blockchain technology is making a real difference in the lives of African immigrants, allowing them to establish credit histories and integrate more effectively into the financial systems of their new countries.”

“The team at Kredete is redefining the way financial services can empower African immigrants globally,” said Aly Madhavji, Managing Partner at Blockchain Founders Fund. “By leveraging blockchain technology, Kredete is not only facilitating seamless money transfers on-chain but also enabling users to build credit and gain access to critical financial resources. This innovative approach is a game-changer for African immigrant communities striving to establish themselves in new countries.”

Strong Growth and Team

Since launching, Kredete has experienced rapid growth, with its user base surpassing 300,000 and transaction volumes exceeding $100 million. On average, users have seen their credit scores increase by 23 points within 6 months of using the platform, highlighting the platform’s significant impact on financial inclusion.

Hakeem Oriola joined Kredete as CTO, where he leads all engineering efforts, ensuring the platform’s technological foundation is both robust and scalable. Ebuka Arinze, the Chief Product Officer, drives product strategy and innovation, focusing on delivering cutting-edge financial solutions tailored for African immigrants. Fey Sowunmi, as the head of the Customer Experience team, ensures that every user interaction is seamless and intuitive, upholding Kredete’s commitment to exceptional service.

Scaling and Expanding Services

Kredete’s future vision is to scale its money transfer services to all African countries, expanding beyond the 20 currently available. The platform also plans to introduce additional financial products tailored specifically for African immigrants in the diaspora, including credit cards, auto loans, and mortgage loans. Long term, Kredete aims to build a comprehensive financial ecosystem that meets the unique needs of African immigrants, helping them navigate and thrive in their new financial environments.

“Kredete is more than just a remittance service; it’s a gateway to financial inclusion for African immigrants in the diaspora,” said Adeola Adedewe, Founder/CEO of Kredete and a First Generation African Immigrant. “Our goal is to empower our users to build a secure financial future, no matter where they are migrating into.”

Leveraging Crypto rails for Cost-Effective Transfers

Kredete’s use of stablecoin drastically reduces transfer fees to less than a dollar, setting it apart from traditional remittance services. This cost efficiency makes Kredete an attractive option for African immigrants looking for affordable and reliable money transfer services.

Looking Ahead

As Kredete continues to grow, it is poised to become a key financial service provider for African immigrants moving to North America. By making it easier for immigrants to build credit and manage their financial lives, Kredete is helping to create a more inclusive and equitable financial future.For more information, visit here.

Disclaimer

Opinions stated on CoinWire.com do not constitute investment advice. Before making any high-risk investments in cryptocurrency, or digital assets, investors should conduct extensive research. Please be aware that any transfers and transactions are entirely at your own risk, and any losses you may experience are entirely your own. CoinWire.com does not encourage the purchase or sale of any cryptocurrencies or digital assets, and it is not an investment advisor. Please be aware that CoinWire.com engages in affiliate marketing.