Coinspeaker

Ledger Launches Institutional-Grade Trading Network for Crypto Custody

On June 28th, crypto custody company Ledger announced the launch of “Ledger Enterprise TRADELINK”, a custodial trading network for institutions aiming to revolutionize this segment.

According to Ledger, the crypto wallet company has signed contracts with several partners to carry out its new project, which eliminates unnecessary complexities in the crypto market that are under scrutiny by regulators. Among the cryptocurrency companies and partners that have signed with Ledger are Bitstamp, Bitazza, CEX.IO, Coinsquare, Crypto.com, Damex, Flowdesk, Huobi, Uphold, NDAX, Wintermute, and YouHodler.

Ledger Significantly Improves the Security and Speed of Transactions

One of the most significant advantages of Ledger Enterprise TRADELINK is that it leverages end-to-end hardware security, providing 100% self-custody. This eliminates exposure to third parties and allows for asset recovery in case of emergencies. Moreover, it greatly reduces transaction times by 80%, optimizing trading strategies. The best part is that it doesn’t charge anything for transactions carried out on the platform.

Sebastien Badault, VP Enterprise at Ledger, stated in an interview with Coindesk that the company’s new solution connects custodians, OTC brokers (outside an exchange), and exchanges, eliminating regulatory risks that have recently caused havoc to cryptocurrency companies in the US.

Furthermore, the Ledger executive pointed out that the company is preparing to face an even more restrictive regulatory scenario in the crypto industry. Therefore, one way to mitigate operational risks is to align fund managers (individuals or companies managing other people’s money) with multiple custody partners (entities responsible for storing and safeguarding crypto assets).

“Looking ahead, there may be many more regulations regarding the ability to distribute your risks, so aligning fund managers with multiple custody partners will definitely be a major advantage.”

US Regulators vs Crypto Industry

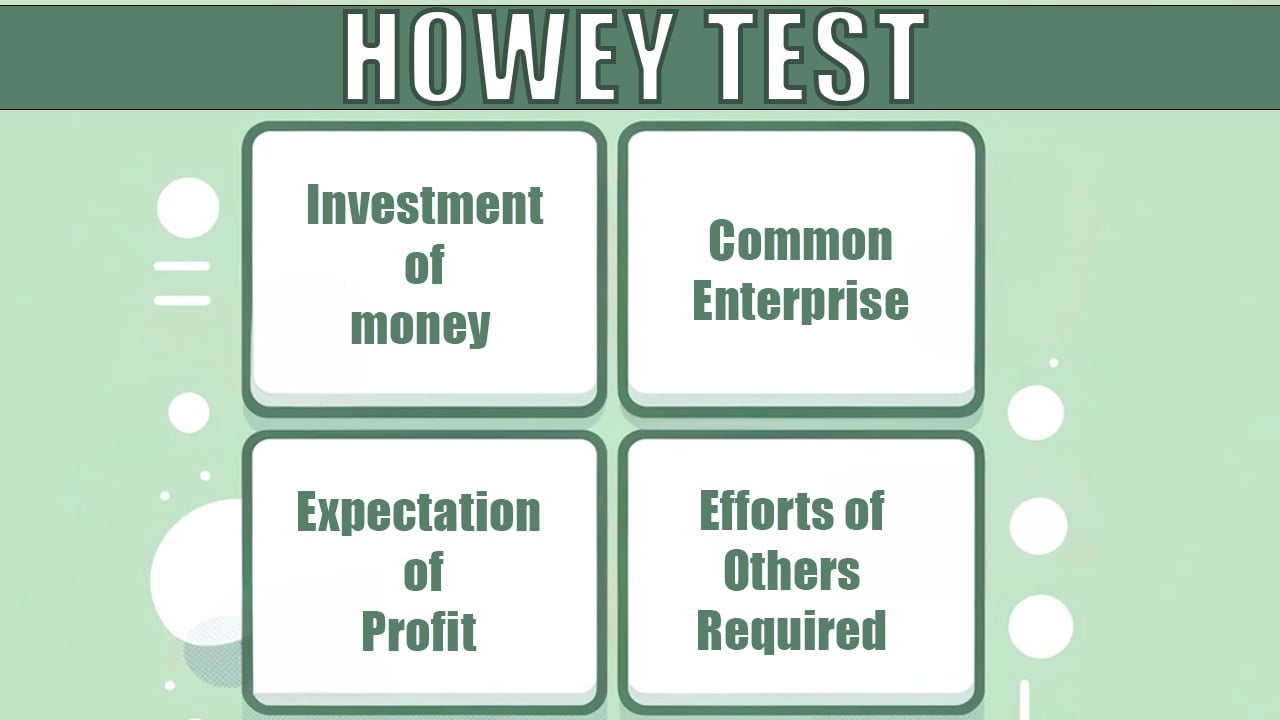

Recently, the SEC sued the two largest cryptocurrency exchanges in the United States, Binance and Coinbase, for violating securities laws, which has generated fear among many investors due to the reach of both exchanges.

However, institutional investors do not feel threatened by the US Securities and Exchange Commission (SEC). Recently, BlackRock, the world’s largest asset manager, filed an application to register a Bitcoin spot exchange-traded fund (ETF), restoring the hope for funds to reapply for their ETFs with the regulator.

The news of BlackRock’s Bitcoin ETF has sparked new applications from several major funds, such as WisdomTree, Invesco, and Valkyrie, which had previously received a resounding “no” from the SEC.

Therefore, Ledger’s new enterprise trading network could boost institutional trading, despite the regulatory uncertainty prompted by the SEC.

Ledger Launches Institutional-Grade Trading Network for Crypto Custody