Bitcoin remaining range-bound below $100,000 could be a net positive for Ether’s price and invite more investment into the world’s second-largest cryptocurrency.

Investor demand for leveraged Ether-based trading products is skyrocketing, showcasing increasing momentum that could take the world’s second-largest cryptocurrency above the $4,000 psychological mark.

Investors are increasingly looking to open leveraged Ether (ETH) positions that allow the temporary borrowing of funds to increase the size of a trader’s position.

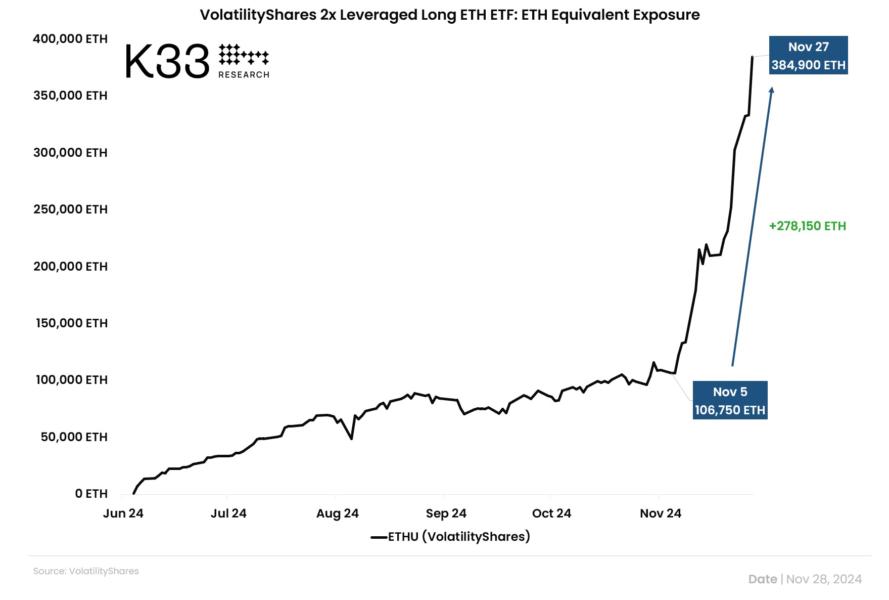

Demand for leveraged the VolatilityShares 2x Ether exchange-traded fund (ETF) rose over 160% since Nov. 5, according to Vetle Lunde, head of research at K33 Research, who wrote in a Nov. 28 X post: