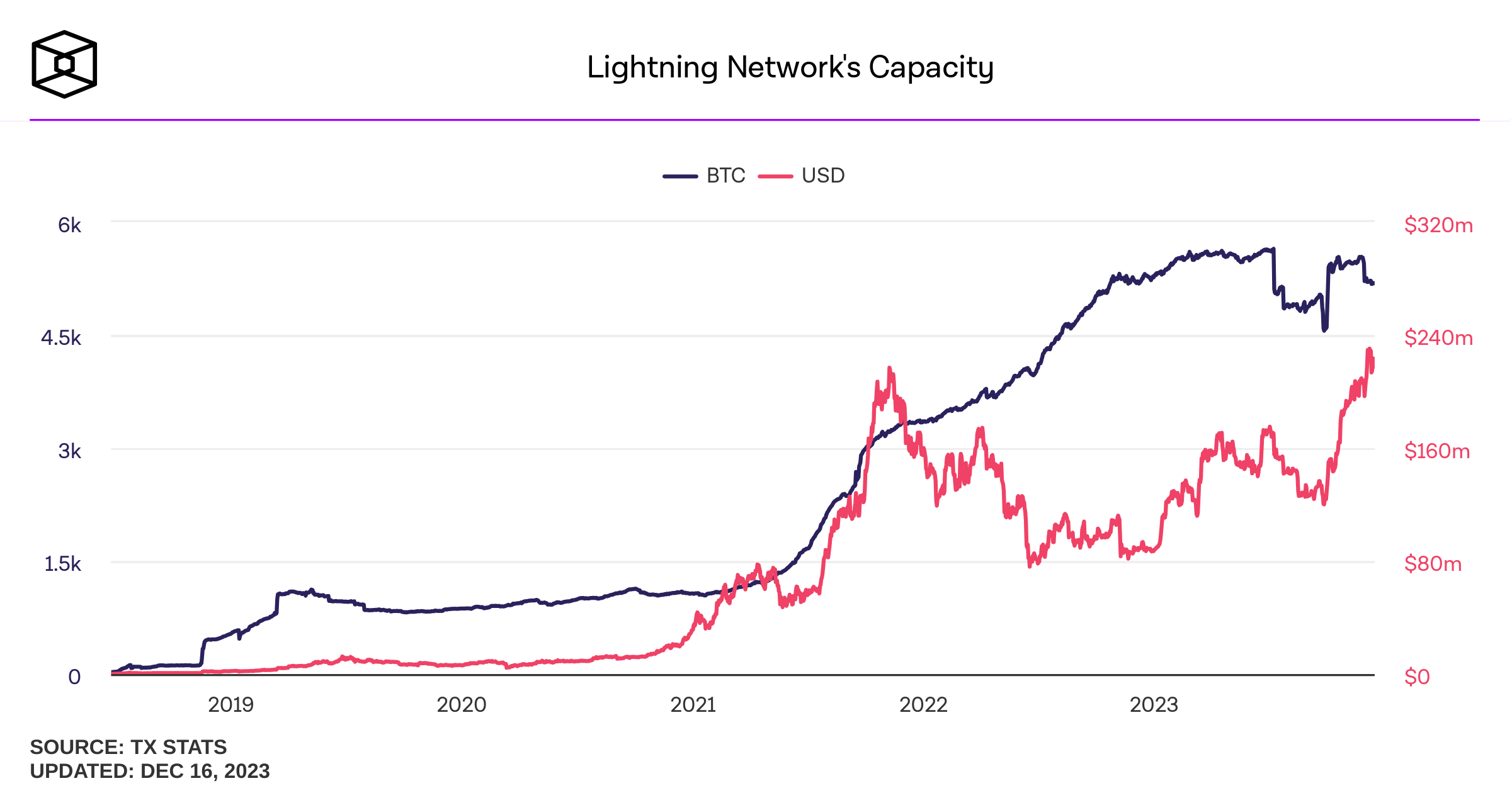

In recent market research conducted by Kaminari, the increased use of Bitcoin as a transactional layer has been attributed, in part, to the growing adoption of the Lightning Network (LN) by crypto platforms. The study reveals that Bitcoin’s transactional activity has experienced steady growth, with 40 million transactions settled in Q3 of 2023, indicating a significant uptrend.

Bitcoin transactions jump due to lightning network use

The Lightning Network, a layer 2 payment protocol built on the Bitcoin blockchain, has witnessed increased participation from crypto exchanges and other platforms. The number of companies in the LN ecosystem has surged from 94 in October 2021 to 179 companies across 28 categories, demonstrating a broadening interest in the technology. Centralized cryptocurrency exchanges have played a pivotal role in driving the adoption of the Lightning Network. Major exchanges like Binance, Okx, and Bitstamp have recently joined the LN ecosystem, contributing to Bitcoin’s increased use in transactions.

However, despite their potential to catalyze further LN adoption, only just over 6% of centralized crypto exchanges have integrated the layer 2 protocol into their platforms. The Kaminari market research report highlights that out of the 224 active centralized crypto exchanges, only 14 are currently connected to the Lightning Network. This statistic underscores the relatively low integration rate among exchanges, despite the positive impact on Bitcoin’s transactional capabilities. Additionally, the study identifies crypto wallets, both custodial and non-custodial, as significant growth vectors for the Lightning Network.

Centralized exchanges and challenges with lightning network

Similar to centralized exchanges, a majority of crypto wallets have yet to embrace the LN. Among the top 10 most popular wallets by user count, only Exodus and Bitpay have integrated Layer 2 technology, indicating a broader industry trend of cautious adoption. Looking ahead, the research report anticipates the impact of upcoming developments in the Bitcoin ecosystem, particularly highlighting the RGB and Taproot Assets protocols. These innovations, operating on Layers 2 and 3, are expected to facilitate the creation of stablecoins compatible with the Lightning Network.

The report suggests that this could lead to a substantial migration of USDT transactions from Tron and Ethereum to the Lightning Network, potentially involving billions of dollars daily. The integration of RGB and Taproot Assets is seen as a significant step toward expanding the use cases of the Lightning Network beyond simple transactions. These protocols are expected to introduce client-side validated state and smart contracts, unlocking new possibilities for decentralized finance (DeFi) applications on Bitcoin’s network.

The research conducted by Kaminari highlights the evolving landscape of Bitcoin’s transactional capabilities, attributing the growth in its use as a transactional layer to the increased adoption of the Lightning Network by crypto platforms. While centralized exchanges have played a crucial role in driving this adoption, the overall integration rate remains relatively low, indicating potential for further expansion. The upcoming RGB and Taproot Assets protocols are anticipated to bring about transformative changes, paving the way for stablecoin migration to the Lightning Network and fostering broader innovation within the Bitcoin ecosystem.