MicroStrategy stock trades at a premium to its Bitcoin holdings mainly due to its leveraged strategy and cash flows from its software business.

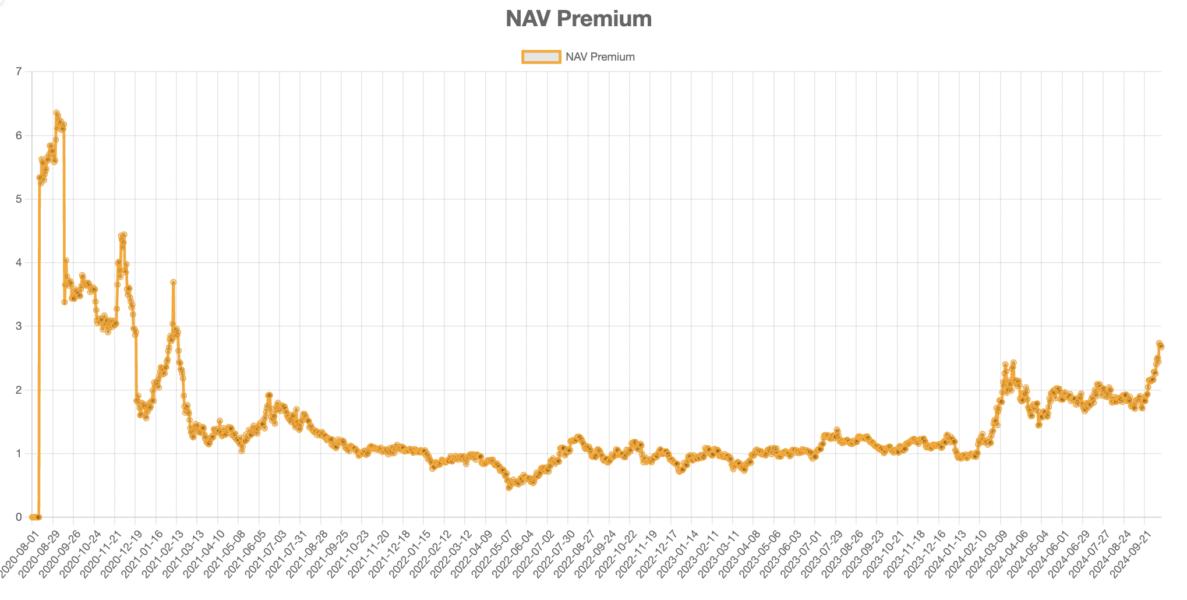

MicroStrategy’s (MSTR) net asset value premium to its Bitcoin (BTC) holdings has grown to its highest in three years, reaching approximately 270% as of Oct. 14, according to MSTR-Tracker.

MicroStrategy NAV premium to its Bitcoin holdings. Source: MSTR-Tracker.com

The NAV premium is measured after dividing MSTR’s market capitalization by the value of its Bitcoin holdings. A higher NAV, therefore, shows that holding a share of MSTR has provided investors with a yield 2.7 times higher than simply holding Bitcoin directly.