Liquity price analysis is bearish today as the market is in a downward trend. The price has been decreasing over the past 24 hours, and it looks like this trend will continue in the near future. The bears are in control of the market, and it’s likely that we will see further declines as the day progresses. The price is currently below the $1.26 level, with a decrease of 3.79% at the time of writing. It is important to note that while LQTY prices may be bearish right now, there is still potential for a rebound in the near future. Traders should watch closely for any signs of upside momentum before entering into any positions.

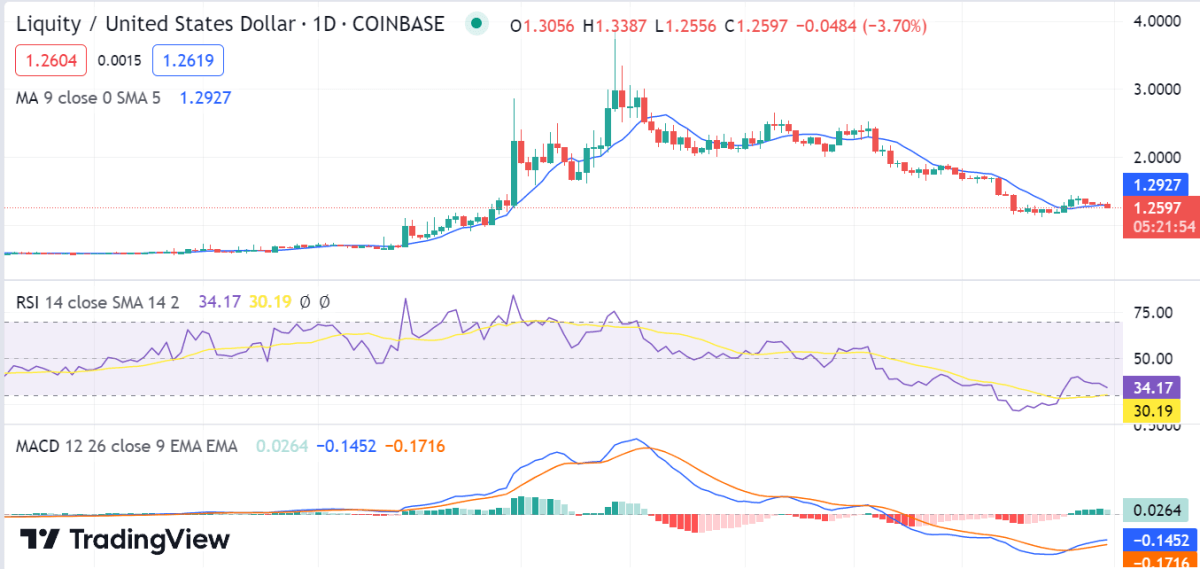

Liquity price analysis 1-day chart: LQTY price dips to $1.26 showing a negative sign

The 1-day Liquity price analysis shows a downward trend and bearish sentiment in the market. The bulls have been unable to break through the $1.727 resistance level, leading to a decrease in price over the past 24 hours. The bears seem to be taking control of the market, and it looks like this trend will continue in the short term. The 24-hour trading volume has increased to $11 million, signifying that the bears are in control of the market. The overall sentiment for Liquity remains bearish, and traders should be cautious when entering into any positions.

The relative strength index (RSI) is currently at 34.17, indicating that the price is in bearish momentum. Additionally, the MACD has crossed below the signal line, further confirming a bearish trend. The MA 50 and MA 200 have both crossed below the current price, signaling that the trend is likely to continue in the near future.

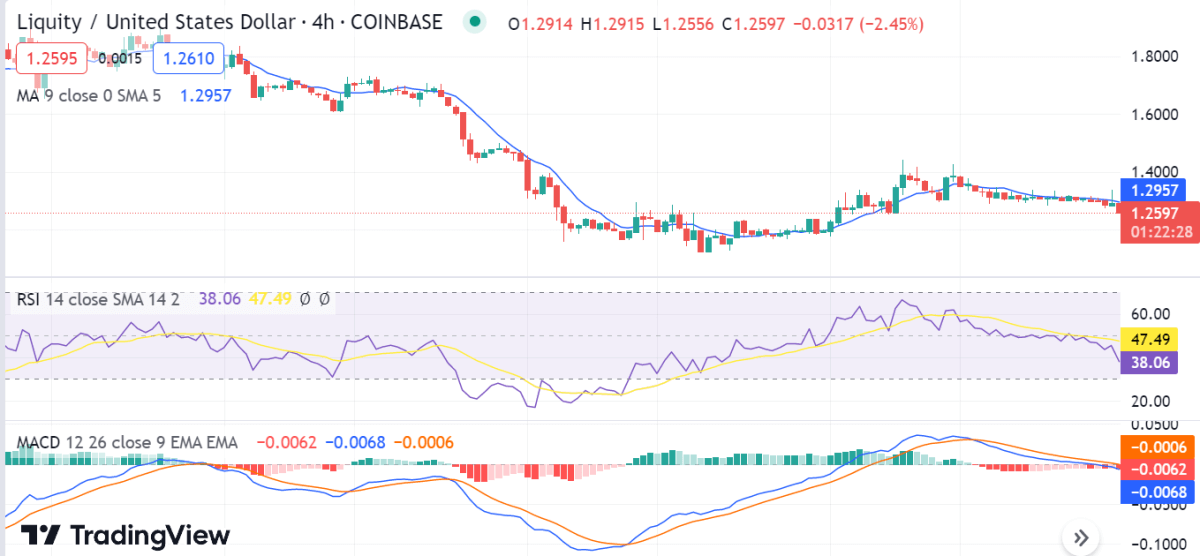

LQTY/USD 4-hour price chart: Latest development

The 4-hour Liquity price analysis also shows a bearish trend in the market. The price has decreased by 3.79% over the past four hours, and it looks like this bearish sentiment will continue in the near future. The bears have been able to push the price below $1.26, indicating that they are in control of the market. It is likely that we will see further price declines as long as the bears remain in control of the market.

The MACD indicator is trending lower and about to enter the bearish territory, which is a sign that the sellers are in control of the market. The MA 50 and MA 200 have both crossed below the current price level, suggesting that there is further downside potential. The relative strength index (RSI) is at 38.06, indicating that the market is still in a downward trend.

Liquity price analysis conclusion

In conclusion, Liquity price analysis remains bearish at this point in time, and traders should be cautious when entering into any positions. It is possible that we could see some upside momentum if the bulls are able to break through the resistance level. On the other side, if the bears remain in control of the market, we could see further declines in price. Therefore, it is important to watch closely for any signs of a potential rebound before entering any position.