On-chain data shows the Litecoin network has continued to see adoption recently as the coin’s halving is only 10 days away now.

Litecoin Addresses With 100+ LTC Have Continued To Rise Recently

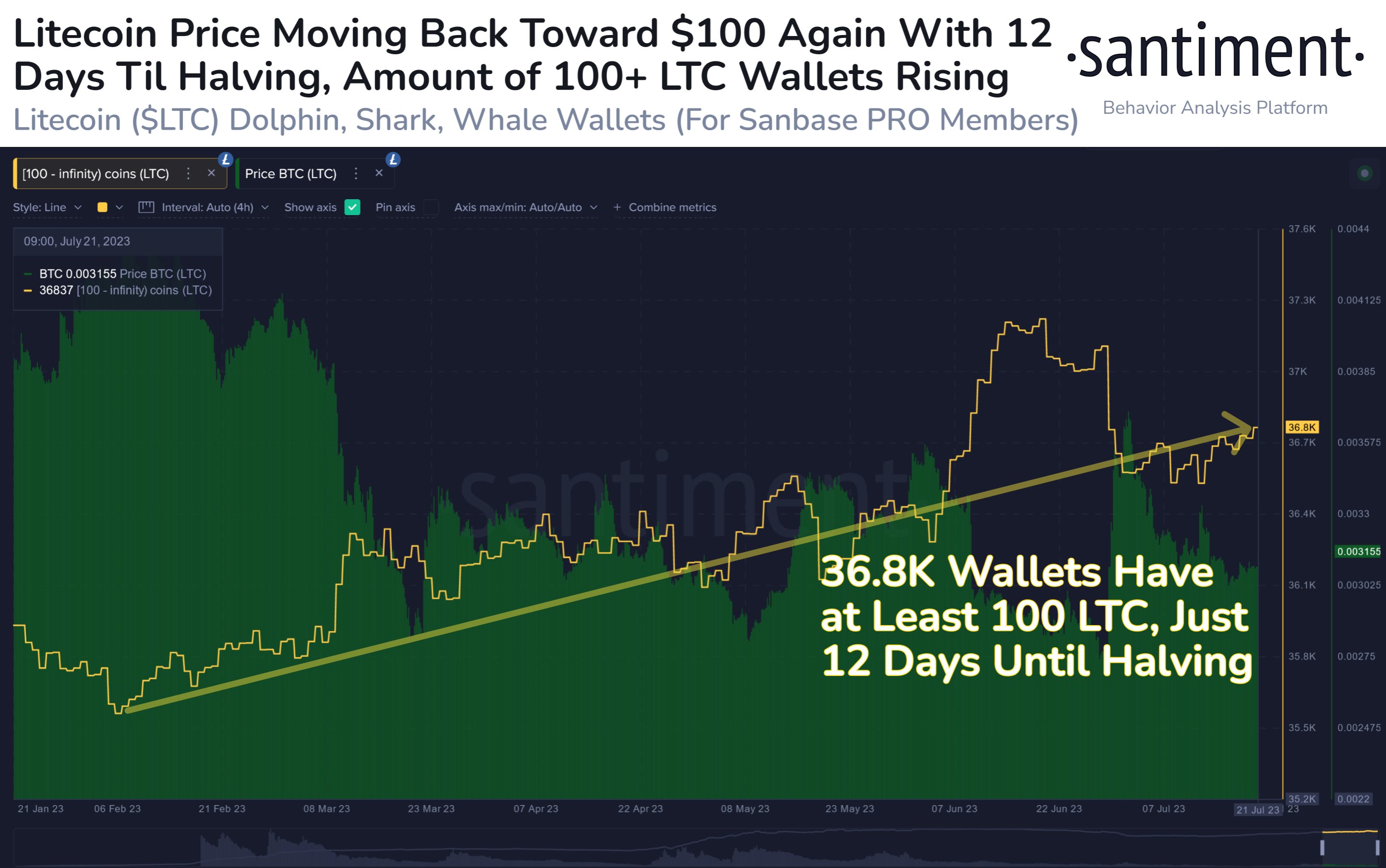

According to data from the on-chain analytics firm Santiment, new addresses have been constantly coming up on the network during the past 24 weeks. The indicator of interest here is the “Supply Distribution,” which keeps track of the total number of wallets that belong to each of the groups in the market.

These address groups are defined on the basis of the amount of LTC balance. For example, the 1-10 coins group includes all investors or addresses on the network holding between 1 and 10 LTC right now.

The relevant addresses here are those holding at least 100 LTC currently, so all the address ranges above 100 LTC have been combined here (naturally, the upper bound here would be infinity).

Now, below is a chart that shows how the total number of Litecoin addresses belonging to this particular coin range has changed during the last few months:

As displayed in the above graph, the Litecoin wallets holding at least 100 LTC have been going up in number during the last few months. This overall uptrend would suggest that the asset has been seeing more adoption from decently sized investors (like dolphins, sharks, and whales).

Such growth of the network is naturally a constructive sign for LTC, as a larger investor base means that there is potentially more fuel available for building up sustainable moves in the asset.

In the last 24 weeks or so, 1,185 new Litecoin addresses with more than 100 tokens in them have appeared on the network, taking their total number to about 36,800.

A few days back, an analyst on Twitter pointed out another bullish sign for the cryptocurrency: the whales (that is, the largest entities on the blockchain) have been participating in some rapid accumulation, as the combined supply held by them has registered a sharp increase.

These positive developments for Litecoin have come as the halving of the cryptocurrency approaches closer. The “halving” here refers to a periodic event where the asset’s block rewards are cut in half.

Historically, halvings have been associated with a bullish narrative, as following them the supply growth of the asset is constrained, since the block rewards that miners receive are the only way to introduce new tokens into circulation.

Halvings take place about every four years and the next one is supposed to happen in approximately 10 days. It now remains to be seen how the LTC price will behave in the leadup to this much-anticipated event, as well as how it will do following it, given these green signals in the coin’s underlying metrics.

LTC Price

At the time of writing, Litecoin is trading around $89, down 1% in the last week.