Data shows the Litecoin mining hashrate is approaching a new all-time high, despite miners earning half the rewards since the halving.

Litecoin Mining Hashrate Is Close To Setting A New All-Time High

Like Bitcoin, Litecoin is a proof-of-work (PoW) network, meaning that chain validators called miners have to compete against each other using computing power to get a chance of hashing the next block.

The “mining hashrate” is an indicator that keeps track of the total amount of such computing power that miners have currently connected to the Litecoin network.

This computing power can be expensive, as aside from the initial cost of setting up the mining rigs, there is also the continuous running cost in the form of electricity bills.

Miners naturally pay these costs off using the revenue that they earn for mining on the network. There are two forms of revenue that miners receive: the transaction fees that they get for solving individual transactions and the block rewards that they earn for solving blocks.

The value of the first of these is mainly dependent on how congested the network is currently, as higher traffic incentivizes users to pay a higher fee in order to get their transfers prioritized.

The block rewards, however, remain fixed in value. These rewards are also the main income source of the Litecoin miners, so they depend on these rewards for paying off their costs.

There is one exception where the block rewards do change in value, though, and that is the periodic “halvings.” These events take place roughly every four years and permanently cut the block rewards on the network exactly in half.

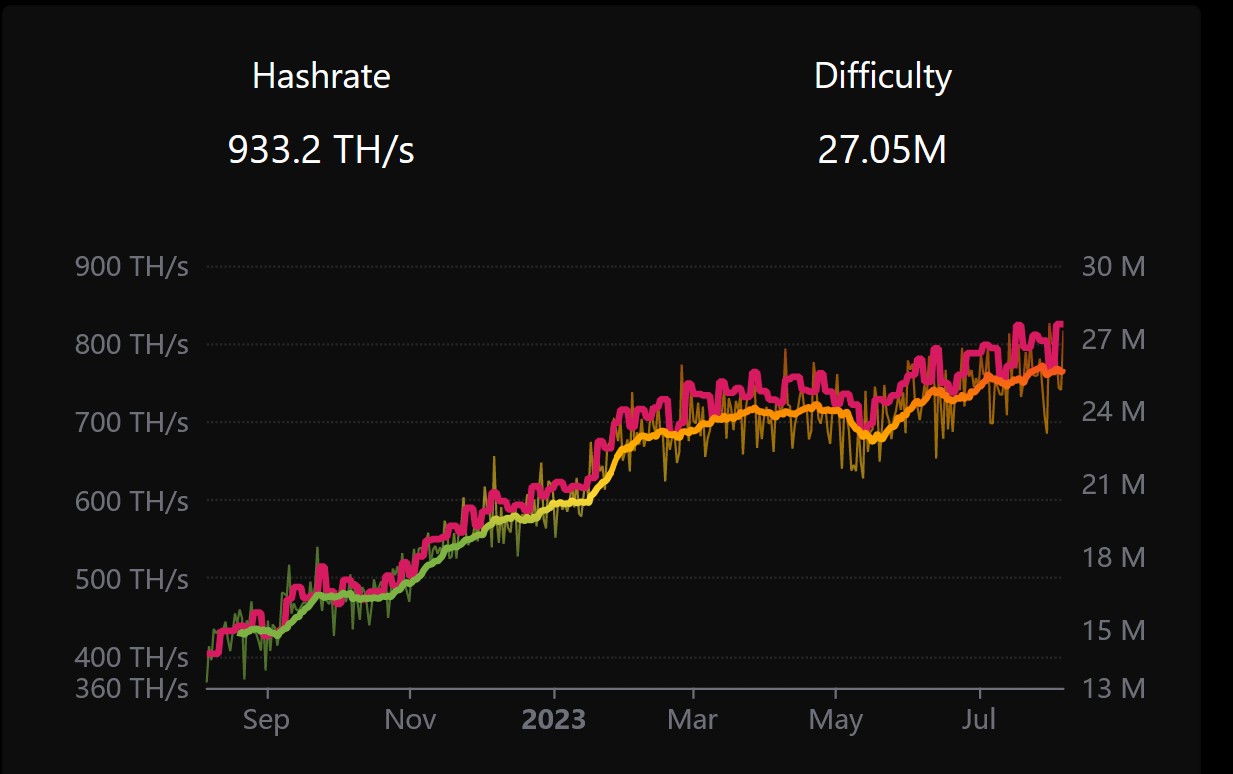

Just a few days back, the latest halving event took place and cut the cryptocurrency’s block rewards from 12.5 LTC to 6.25 LTC. Miners’ revenues have thus taken a large blow, but so far, it seems the mining hashrate hasn’t observed any negative effect, as the chart shared by the official Litecoin X account shows.

In the above graph, the Litecoin hashrate is the line with many short-term fluctuations, while the red-shaded line shows the data for the “difficulty,” an indicator that measures how hard it is to mine on the network currently. The third line here is the 7-day moving average (MA) of the mining hashrate.

The mining hashrate has increased in value recently, even reaching a new all-time high before falling once again. This suggests that miners have only connected more machines to the blockchain after the halving.

The mining difficulty is a reflection of the competition present on the blockchain, so this metric has also approached its ATH after the hashrate has done the same.

It’s unclear currently if the Litecoin mining hashrate can sustain these levels for long, as the revenue hit from the halving is sure to discourage some of the miners who had already been making little profits to begin with.

Usually, the only way for miners to continue to make the same or greater revenues after a halving is through price increases, as the value of their rewards naturally goes up with them. The LTC price, however, has instead plunged since the halving, so it would have rather put even more stress on the miners’ incomes.

LTC Price

At the time of writing, Litecoin is trading around $82, down 12% in the last week.