Low-income households with high crypto exposures saw the largest increase in mortgage and auto loan originations and balances, US Treasury research revealed.

More lower-income households are using gains made from crypto investing to take out mortgages, according to a report by research economists at the United States Treasury.

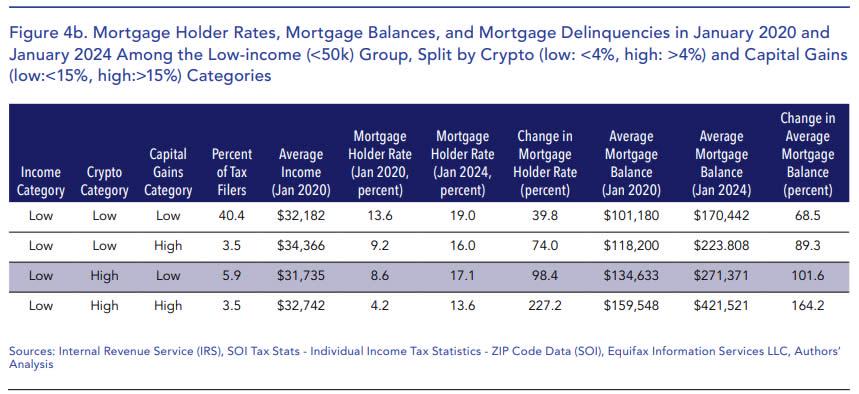

In low-income households, “crypto sales may have supported access to larger mortgages through bigger down payments,” researchers Samuel Hughes, Francisco Ilabaca, Jacob Lockwood, and Kevin Zhao wrote in a Nov. 26 report for the Treasury’s Office of Financial Research.

“The increase in borrowing is especially striking among low-income households in high crypto exposure areas,” they added.