The Bitcoin halving event is sparking a major shift in the mining industry, and the stakes couldn’t be higher. Luxor’s eye-opening analysis predicts a whopping 600,000 S19 bitcoin rigs packing their bags and heading for greener pastures. The mass exodus from the U.S. to energy-affordable locales like Africa and South America is not just a trend; it’s a full-blown migration. Why? Because after the halving, the economics of Bitcoin mining are getting a serious makeover. Those S19 rigs, once the crown jewels costing up to a cool $11,500 each, will soon be fetching just around $350 post-halving. Talk about a markdown.

The Great Bitcoin Rig Shuffle

As we edge closer to the halving, a significant transformation is underway. About 6,000 of the older Bitcoin mining stalwarts in the U.S. are hitting pause and heading to a massive 35,000 square-foot Colorado Springs warehouse. There, they’ll get a makeover from SunnySide Digital before finding new homes overseas. This move isn’t just a refurbishing exercise; it’s a survival strategy in anticipation of the Bitcoin blockchain’s major quadrennial update.

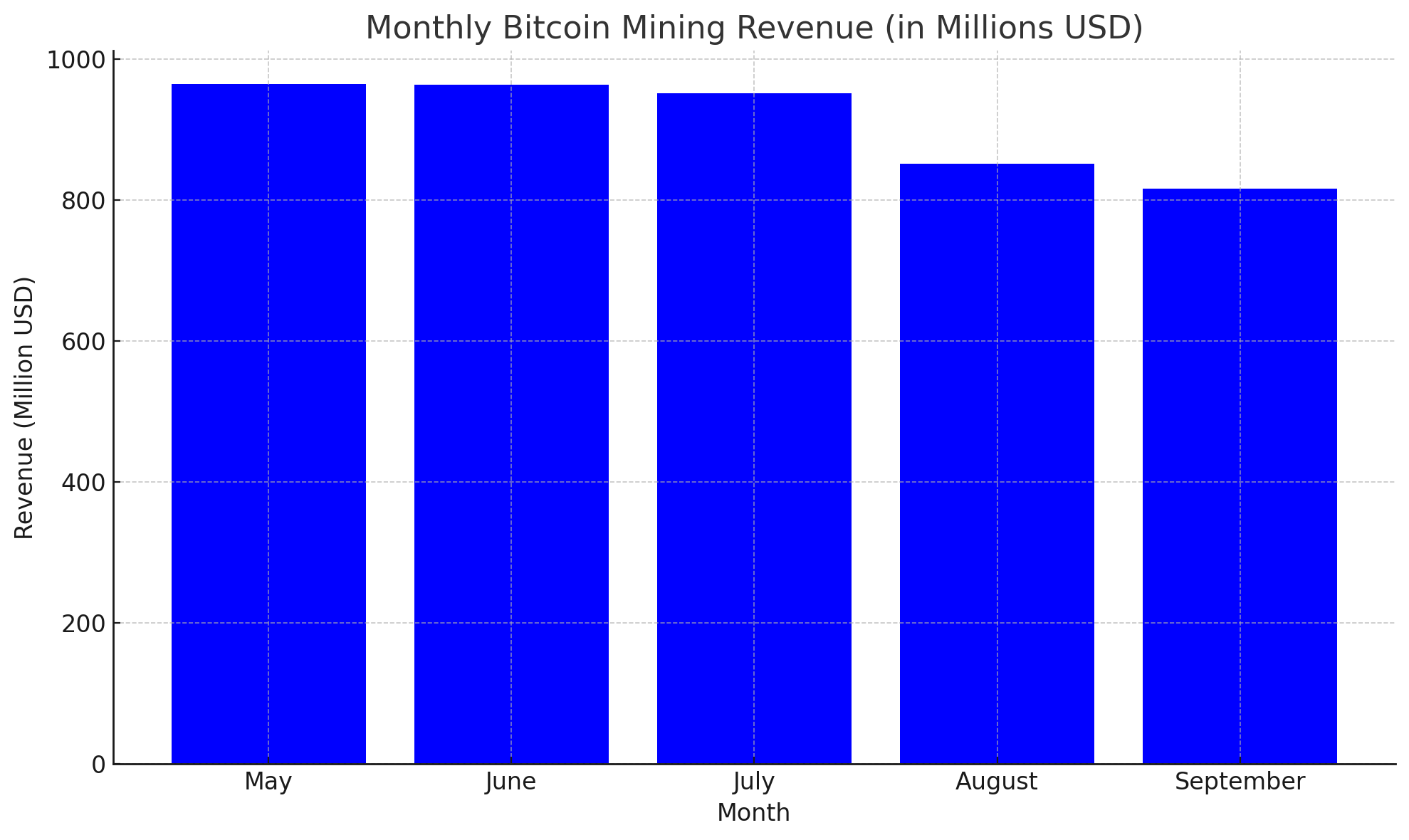

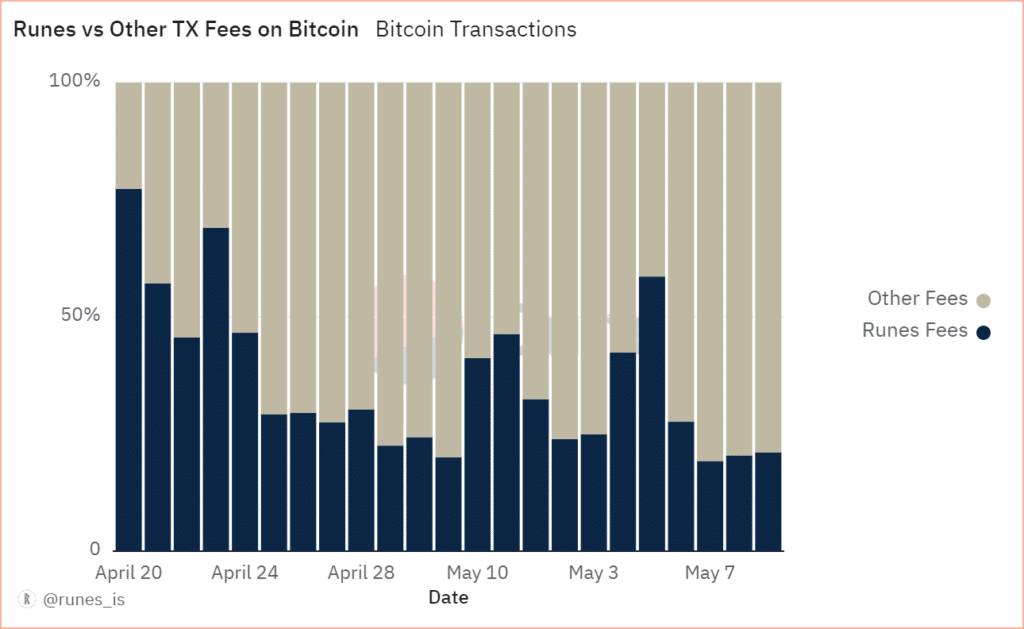

This halving isn’t just another calendar event; it’s a seismic shift that cuts the miners’ main income by half. Miners are in a race against time and efficiency, with electricity bills being the boss level they need to beat. Companies like Marathon Digital Holdings Inc. and Riot Platforms Inc. are on the frontline, navigating through the choppy waters of profit margins. The older, less efficient rigs might still have some fight left in them, but their battlefield is shifting away from the U.S.

Taras Kulyk of SunnySide Digital sees this migration as a logical move. By rehoming these digital workhorses to regions where electricity is as cheap as chips, there’s a new lease of life for them. Countries like Ethiopia, Tanzania, Paraguay, and Uruguay are becoming the promised lands for these old timers. And with the halving fast approaching, this migration is more of a sprint than a marathon.

A Global Game of Musical Chairs

The mining rig migration is not just about moving from point A to B. It’s a global game of musical chairs with high stakes. Ethan Vera of Luxor Technology paints a picture of 600,000 S19 series rigs, the cream of the current mining crop, leaving the U.S. dust for the more economically viable landscapes of Africa and South America. This isn’t just a shift; it’s a strategic relocation for survival.

Bitcoin mining is a tough game, with rewards halved every four years to maintain the digital currency’s scarcity. The upcoming halving, slashing rewards to 3.125 Bitcoin from 6.25, makes the hunt for cost-effective mining even more crucial. With the price of Bitcoin swinging like a pendulum, the pressure is on to find new efficiencies or face extinction.

The drop in rig prices post-halving is anticipated like a plot twist in a thriller novel. Last year, an S19 could set you back about $7,030. Fast forward, and we’re looking at a dramatic price plunge to around $356 after the halving. This price rollercoaster is a clear signal: the old guard needs to adapt or step aside.

The migration isn’t just a hardware shuffle; it’s a quest for the holy grail of lower electricity costs. Nuo Xu’s journey from Texas to Ethiopia and Nigeria is more than a business trip; it’s a mission to find a new home for his 6,000 rigs where electricity is a bargain, and the mining game can still be profitable.

Electricity prices are the heart of the matter. In Ethiopia, power is cheap, regulations are easing up, and the mining ecosystem is booming. SunnySide’s Kulyk is eyeing a deal that could see up to 40,000 rigs make their way to Ethiopia, signaling a major shift in the digital mining landscape.

Not every rig makes the journey overseas. For some, especially those owned by publicly traded companies, the leap is too great, with shareholder concerns and logistical headaches keeping them stateside. Bit Digital Inc. is one such example, with older computers gathering dust in a Houston warehouse, waiting for Bitcoin’s price to soar and justify their resurrection.