Investors, prepare for a transformative move in the RWA investment landscape! MAIV (Multi Asset Investment Vehicle), an RWA platform, launched its $MAIV token on Fjord Foundry on May 16, 2024. This launch presents potential investors with an excellent opportunity to invest in real estate-backed RWAs at attractive prices, offering access to high-yield, secure investments in tokenized Real World Assets (RWAs).

RWAs are revolutionizing the investment landscape. RWA crypto tokens, backed by tangible assets, are gaining traction as a new investment type, allowing the finance world and investors to profit indirectly from physical assets.

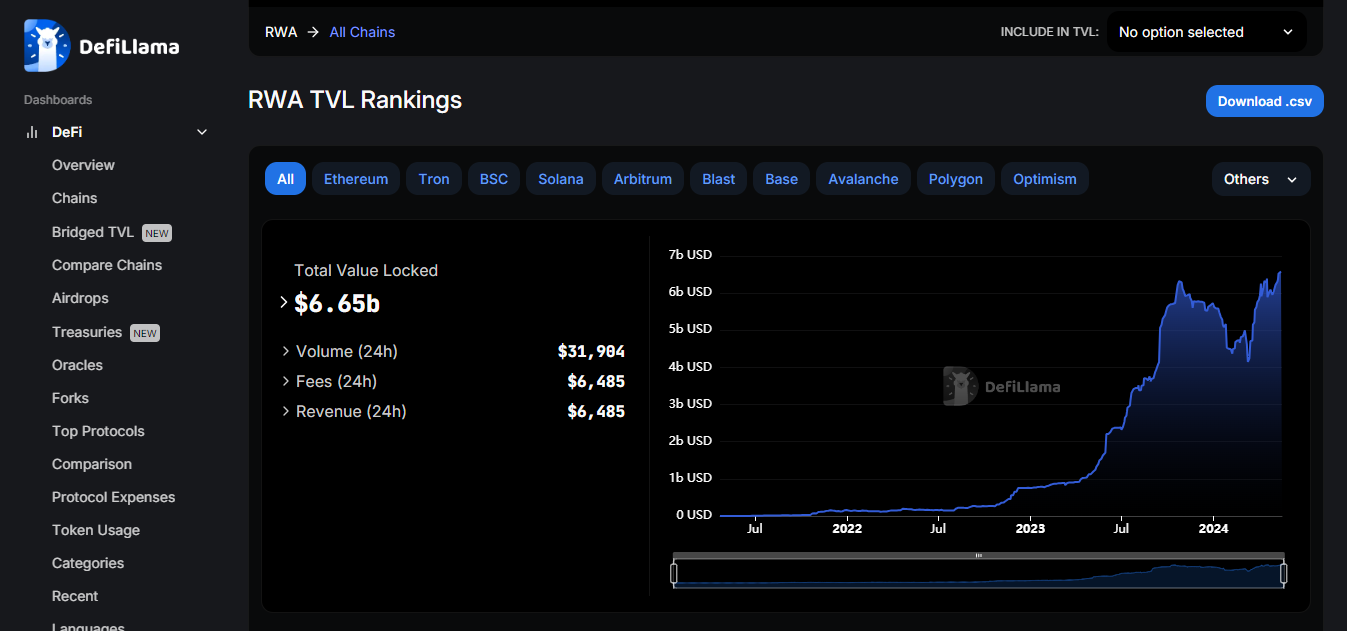

BlackRock, the world’s largest asset manager, recently launched a Bitcoin ETF and, in collaboration with Securitize, plans to tokenize $10 trillion of its assets, marking a significant step towards digitizing traditional investment instruments. This trend is supported by DeFiLama’s report, which shows an all-time high of $6.65 billion in total volume locked in RWA projects.

RWA tokens are generating significant buzz in the cryptocurrency world by bringing real-world assets like real estate, bonds, and luxury items onto the blockchain. Reports suggest that RWAs could become a $10 trillion market by 2030, making them an excellent tool for investment diversification, with real estate at the forefront.

While many companies tokenize real estate and distribute rental income through ownership-based tokens, MAIV takes a different approach, viewing this market as risky with potentially lower returns. Instead, MAIV offers a unique investment model that maximizes security and profitability. Here’s how.

What is MAIV?

MAIV is a real estate investment platform that allows investors to purchase tokenized real estate during the construction phase, offering a valuable avenue for portfolio diversification. Unlike many companies that tokenize real estate and distribute rental income via ownership-based tokens, MAIV stands out by focusing on minimizing risks and maximizing returns.

MAIV provides a unique investment opportunity in Real-World Assets (RWAs), securing investors’ funds through the intrinsic value of the assets. By supplying developers with upfront capital for land acquisition, MAIV accelerates property projects and offers investors lucrative financing options. Historically, such investment opportunities were limited to the wealthy, but MAIV democratizes access, enabling everyone to invest in profitable and secure real estate backed by tangible assets.

This innovative model emphasizes stability and higher returns by maintaining a lien on the land throughout the project. Investors benefit from secure investments backed by real-world assets, with developers guaranteeing returns through contracts. MAIV opens up high-yield, secure investment opportunities to a broader range of people, providing market-leading returns typically beyond the reach of the average investor.

Experienced Leadership and Strategic Partnerships at the Helm

MAIV is guided by a leadership team with over 200 years of combined experience in finance, technology, and blockchain. Nicolas Taggart, the CEO and Founder, holds an MSc in Construction and Project Management from Queens University and has extensive real estate development experience. Sane Stewart, Co-founder, has an MSc in Management & Corporate Governance from the University of Ulster and a decade-long career in technology consulting.

Key team members include Alan Graham, a construction expert with 20 years of experience; Ryan Duffy, a Commercial Analyst with a background in Quantity Surveying and Construction Law; Pranav Agarwal, CSO with a strategy consulting and venture building background; and Mona Tiesler, an Advisor with expertise in Distributed Ledger Technology and Financial Services.

MAIV partners with leading Web3, Tech, and FS organizations to design and support its platform. Collaborations include

- Foundership, a global emerging-tech accelerator, empowering startups in Web3 and GenAI

- Transak, the top Fiat on/off ramp for crypto transactions

- NonceBlox, experts in blockchain architecture with clients like Polygon and Sandbox

- Pixelplex, a Web3 and blockchain software leader

- Sumsub, a KYC/AML service provider

- AWS for cloud services

MAIV’s ecosystem, supported by legal, PR, media, and technology partners, offers investors high-yield opportunities with annual returns of 12% to 20% on projects in the UK, Europe, and the UAE.

The MAIV token: Utilities

The $MAIV token, launching on Fjord Foundership, offers several key benefits:

- Subscription: Acts as a membership key, granting access to the MAIV platform’s suite of products. Users can lock tokens to join various investment pools.

- Staking: Token holders can stake $MAIV to earn voting rights and additional tokens, with the weight of votes determined by the duration and quantity staked.

- Governance: Used for voting on platform decisions, with weighted voting based on staked amount and duration. Projects can stake tokens for advantages, driving demand.

- Launchpad: Provides early access to seed-stage crypto projects. Subscribers lock $MAIV tokens to secure allocations, ensuring early access and locking value within the token.

- Portfolio Access: MAIV allocates profits to luxury real estate. Users can lock tokens to secure stays at these properties and gain access to exclusive events, with a gamified staking process for stay dates.

$MAIV Tokenomics

- Token name: $MAIV

- Total supply: 10,000,000,000 (10 billion)

| Description of Token Use | Description | Total Supply | Percent of Total supply |

| Ecosystem | 3 months cliff, then 24 months of linear vesting | 2,600,000,000.00 | 26.00% |

| Liquidity | 100% at TGE | 250,000,000.00 | 2.50% |

| Company Reserve | 3 months cliff, then 24 months linear vesting | 1,400,000,000.00 | 14.00% |

| Team | 3 months cliff, then 24 months linear vesting | 2,000,000,000.00 | 20.00% |

| Advisors | 3 months cliff, then 24 months linear vesting | 200,000,000.00 | 2.00% |

| Marketing | 10% at TGE, no cliff, then 12 months linear vesting | 800,000,000.00 | 8.00% |

| Staking | 24 months of linear vesting | 1,300,000,000.00 | 13.00% |

| Seed | 15% at TGE, no cliff, 12 months linear vesting | 250,000,000.00 | 2.50% |

| KOL | 25% at TGE, no cliff, 6 months linear vesting | 200,000,000.00 | 2.00% |

| Public (Fjord Foundry) | 100% at TGE | 1,000,000,000.00 | 10.00% |

Once the LBP staking is over, the $MAIV token will be listed on premier exchanges.

Read: How to participate in Fjord Foundry’s LBPs

Conclusion

The launch of the $MAIV token on Fjord Foundry represents a significant advancement in the RWA investment landscape, democratizing access to high-yield, secure investments previously reserved for the wealthy. With a focus on minimizing risks and maximizing returns, MAIV’s innovative approach to tokenizing real estate-backed RWAs offers a valuable opportunity for investors.

Supported by a seasoned leadership team and strategic partnerships with industry leaders, MAIV is well-positioned to deliver robust and stable investment opportunities. The $MAIV token not only provides access to a range of investment pools and governance rights but also unlocks exclusive benefits such as early access to seed-stage crypto projects and luxury real estate stays.

Investors can look forward to the potential for substantial returns, with a structured tokenomics plan ensuring a balanced and fair distribution of tokens. As the $MAIV token gears up for listing on premier exchanges post-LBP staking, now is the time for investors to participate and capitalize on this groundbreaking opportunity in the realm of Real World Asset investment.

Disclaimer

Opinions stated on CoinWire.com do not constitute investment advice. Before making any high-risk investments in cryptocurrency, or digital assets, investors should conduct extensive research. Please be aware that any transfers and transactions are entirely at your own risk, and any losses you may experience are entirely your own. CoinWire.com does not encourage the purchase or sale of any cryptocurrencies or digital assets, and it is not an investment advisor. Please be aware that CoinWire.com engages in affiliate marketing.

Meet the

Meet the  Ready to meet the minds transforming

Ready to meet the minds transforming