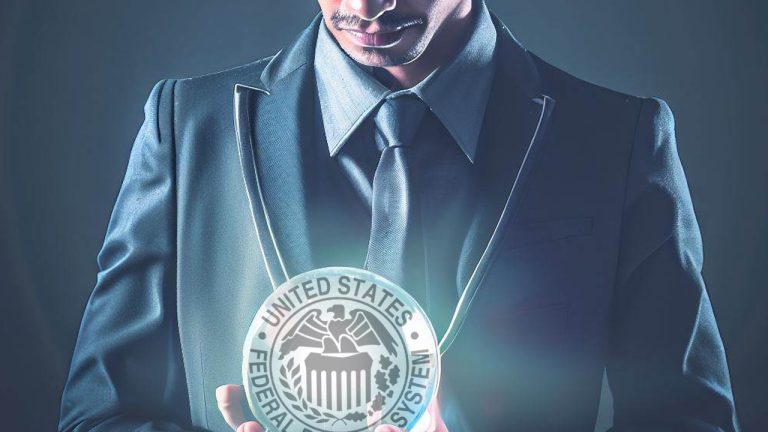

According to the CME Group Fedwatch tool on Thursday, there was a 51% probability of a quarter-point rate increase during the upcoming Federal Open Market Committee (FOMC) meeting on June 14. Just a fortnight ago, the Fedwatch tool indicated a slim possibility of the federal funds rate reaching 5.50% next month. The following day on Friday, the Fedwatch tool now shows a 37.7% chance.

From Slim Odds to High Probability: Fedwatch Tool Indicates Higher Chance of June Rate Hike

Until recently, many investors and market analysts held the belief that the likelihood of the U.S. Federal Reserve’s FOMC raising the benchmark bank rate in June was extremely low. Set to convene on June 14, 2023, the FOMC appeared to have only a 20.1% probability of implementing a quarter-point hike, according to the CME Fedwatch tool’s data on May 9.

The Fedwatch tool employs futures contract prices to provide an estimated probability of interest rate adjustments determined by the U.S. Federal Reserve before their official decisions. By May 14, 2023, the chances of a rate hike dwindled even further to a mere 15.5%, leaving an overwhelming 84.5% probability that the federal funds rate would remain unchanged.

June rate hike is now "game on" pic.twitter.com/ViyomZwMvj

— Jim Bianco biancoresearch.eth (@biancoresearch) May 25, 2023

Jerome Powell, the chair of the Federal Reserve, has dropped hints suggesting that the Fed might hit pause on rate hikes during the upcoming FOMC meeting in June. The most recent increase in rates, a 25 basis points (bps) hike, took place on May 3, marking the tenth consecutive rise since March 2022.

Despite emphasizing the soundness and resilience of the U.S. banking system, the FOMC acknowledged the possibility of “appropriate” further policy adjustments. Jumping ahead to the present day on May 25, a dive into data from the Fedwatch tool reveals a 51% probability of a 25bps increase occurring on June 14.

On Thursday, the tool indicated a nearly balanced 49% chance of the rates staying the same. While the Fedwatch tool boasts a track record of accuracy, a few skeptics have pointed out rare instances when it missed the mark. It’s also worth noting that the Fedwatch tool’s predictions can fluctuate as the central bank’s FOMC meetings draw nearer. The Fedwatch tool’s prediction on Thursday follows the recent rate hike remarks from JPMorgan Chase boss Jamie Dimon.

During the bank’s investor day event, Dimon confidently expressed to analysts that it is only logical to anticipate higher rates moving forward. Although he didn’t specifically mention the June 14 meeting, he did acknowledge the possibility of the rate climbing as high as 6% to 7%.

As of now, the federal funds rate stands at 5-5.25%, marking its highest point in nearly 16 years. Powell, at the press conference held on May 3, addressed the concept of the peak interest rate, remarking that “we may not be far off” and even suggesting that “we’re possibly even at that level.” Following the 51% figure recorded on Thursday, the following day, chances of the rate increasing by 25bps dropped to 37.7%.

What are your predictions regarding the possibility of a June rate hike? Share your insights and thoughts in the comments section below.