Market turbulence and liquidations broke down the accumulation and earnings for Ethereum (ETH) whales. On-chain data shows some of the whale wallets moved to sell their holdings, either to lock in gains or cover loans.

While overall Ethereum (ETH) whales returned to accumulation mode, market turbulence also caused sell-offs. Data for large-scale transactions saw thousands of ETH move to centralized exchanges or to protocols for covering loans.

Even institutions like Amber Group and liquidity builder Cumberland resorted to selling ETH in the short term. The sale of 6,443 ETH on Tuesday added to the overall downward price action. Whale selling arrived after a nine-day streak of outflows from some of the biggest Ethereum ETFs.

The ETF net sell-offs is the result of Grayscale shedding its tokens, while other funds do not add new tokens and show slower demand.

Even with selling pressure, ETH recovered to $2,503.03, after a rapid correction. Open interest fell in the past day to around $7.7B. As of August 28, ETH longs are still the dominant position, following short liquidations.

Whales take losses on ETH

Even previously successful whales took losses at the $2,400 level, liquidating some of the ETH acquired at a much higher range.

Market turbulence also hit smart traders hard!

11 hours ago, a whale deposited 8,825 $ETH ($24.1M) to #Binance, leaving behind 10,619 $ETH ($28.5M) with an est. total loss of $15.7M (-23%) from the ongoing 3rd $ETH trade.

This whale previously excelled, earning ~$38M (+26.7%)… https://t.co/QOjHO7b0Qx pic.twitter.com/uPGTPDSJVO

— Spot On Chain (@spotonchain) August 27, 2024

The wallet in question accumulated ETH even before the August 5 correction, while the asset was expected to rally after the official ETF launch.

Other whales accumulated for a long time, but managed to sell near market lows for the past month. The whale wallet, tagged as “token millionnaire” by Nansen, holds multiple stablecoins and targets DeFi activity. The wallet’s biggest holding is currently DAI, a token to be swapped soon into USDS.

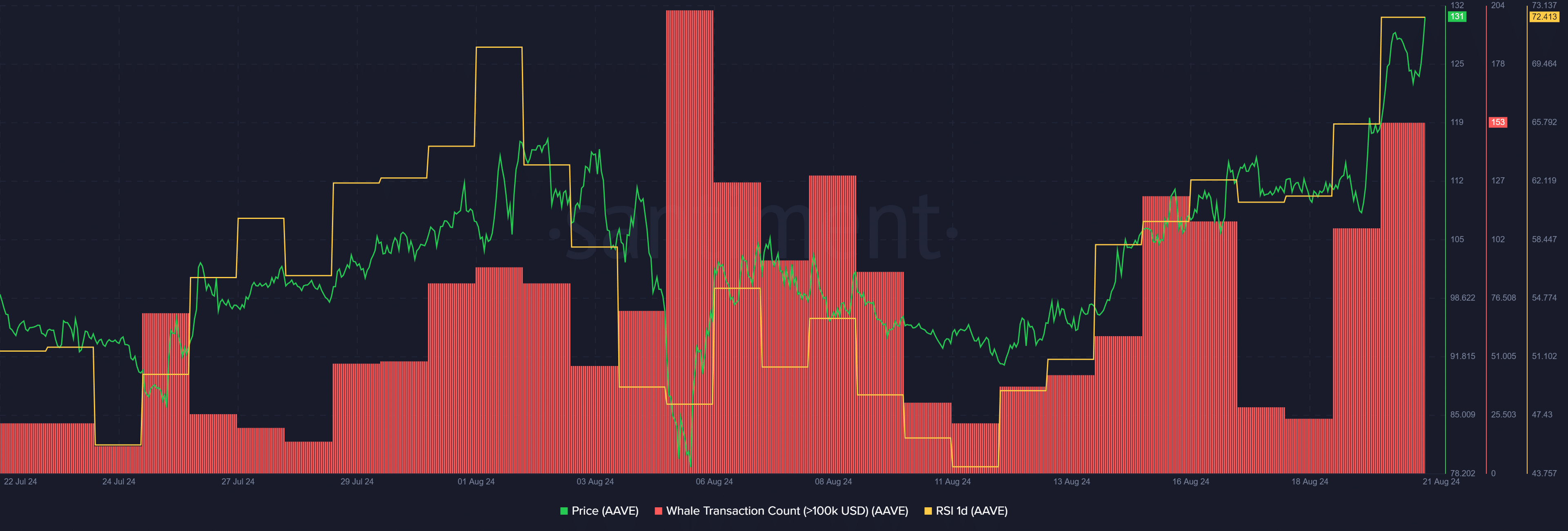

Whale wallets are also moving out of staked ETH positions and into main net ETH. Once again, the final destination of the whale’s wallet was Binance, to sell a total of 5,145 ETH. Two additional wallets were also pressured to sell ETH to avoid a liquidation on the Aave lending protocol. The total sell-offs reached 8,208 ETH.

Among significant sellers in the past week, the Ethereum Foundation also chose the moment to top up its fiat budget. The Foundation sold near the market’s local top, just before an 8% crash. The sale of 35K ETH happened through the Kraken spot market. Additionally, the Ethereum Foundation announced it has a $100M fiat budget and will continue to sell ETH to secure the funding each year.

For now, the sell-off is still comparatively smaller to the accumulation of ETH. However, in the short term, profit-taking may cause loss of momentum on an already depressed ETH. Analysts see net selling as a major weakness, as the expected ETH rally failed to materialize. For now, ETH sentient for both smart money and retail remains slightly bullish.

However, the bullish metric is based on short-term trader behavior. Overall, Ethereum faces more negative sentiments as it underperformed other blue chips Bitcoin (BTC) and Solana (SOL) during the 2024 bull cycle.

ETH network adds more than 16K new tokens

New production is among the biggest sources of net ETH inflows. For the past week, the network produced 16,872 ETH, retaining most tokens due to a slower burn rate.

Activity from Ethereum already shifted to several L2 chains, leaving the main net with a lower burn rate. ETH issuance inflation expanded from around 0.53% in the past quarter to 0.73%. The total supply of ETH is now more than 120.3M, after starting the year at 120.07M. In the past month alone, the network produced 39,523 ETH, prepared to be absorbed by the market.

The Ethereum network is also abandoning the narrative of being sound money, which may explain some of the sell-offs. Instead, ETH is back to being a utility token, carrying and securing L2 transactions. The current inflation trend reversed after ETH spent months as a deflationary token.

The “ETH is dead” narrative is often repeated in the past weeks. The success of L2 to scale Ethereum is often viewed as a failure. Most L2 try to lock in liquidity, essentially fragmenting the market.

At the same time, the Ethereum network and the staking mechanism remain essential to secure L2. Each Ethereum block contains a growing number of blobs from L2 protocols, showing the essential need to secure rollup chains.