Crypto investment products have seen a notable surge in investor interest, marking their 4th consecutive week of substantial inflows. According to recent data from CoinShares, these products attracted roughly $598 million in investments over the past week alone.

This influx of capital brings the year-to-date inflows to $5.7 billion, indicating a sustained appetite for digital assets among institutional and retail investors alike.

Amidst this surge in investment, it is noteworthy that the influx has been primarily driven by the introduction of new spot Bitcoin exchange-traded funds (ETFs) in the United States. These ETFs have quickly gained traction, attracting massive amounts in net flows.

CoinShares’ Head of Research, James Butterfill, highlighted the significance of these inflows, noting that they account for 55% of the record inflows witnessed throughout 2021.

Regional Trends And Asset Performance

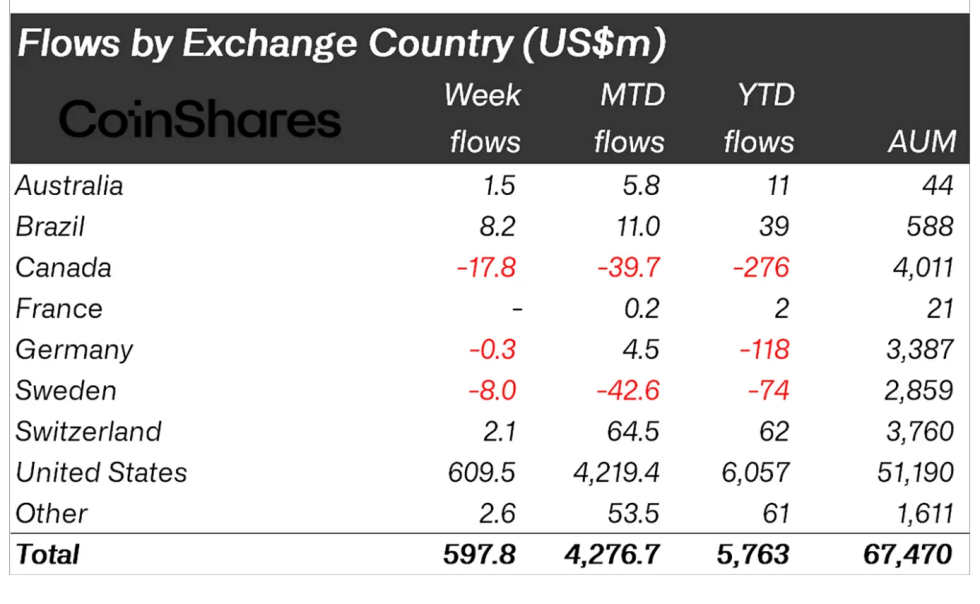

The data also reveals interesting regional trends in crypto investment. US-based funds led the way with the largest inflows, totaling approximately $610 million. However, despite this positive momentum, Grayscale, an “incumbent issuer,” experienced outflows of $436 million.

Meanwhile, Brazil and Switzerland recorded modest inflows of $8.2 million and $2.1 million, respectively. On the other hand, Canada saw the largest outflows of nearly $20 million from digital asset investment products.

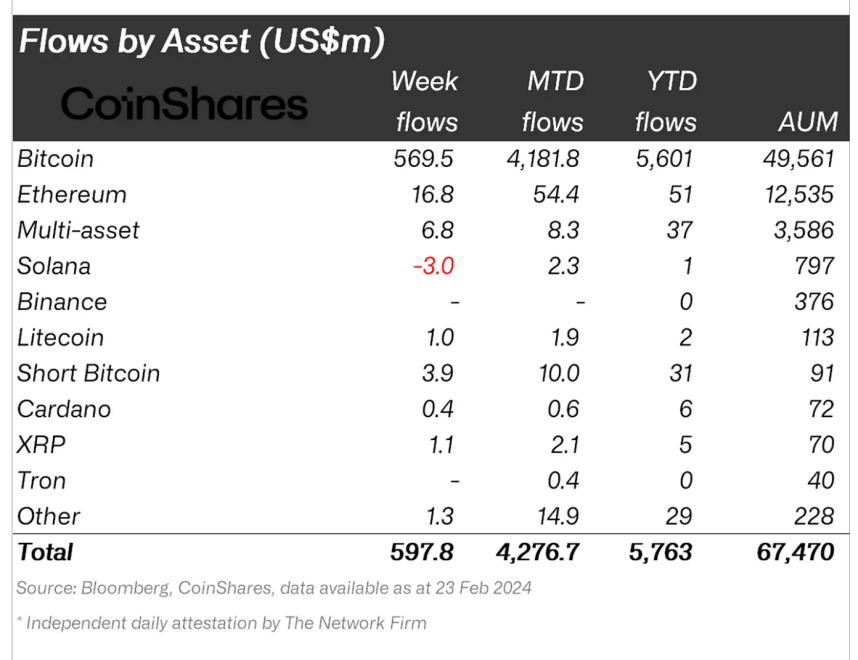

Bitcoin-based funds dominated the inflows, attracting $570 million in investments. This surge is dominated by spot Bitcoin ETFs in the US, which have accumulated over $5.5 billion in net flows since their launch earlier this year.

Ethereum products also experienced notable inflows, totaling $17 million. Additionally, Chainlink and XRP-based funds saw significant inflows of $1.8 million and $1.1 million, respectively.

Crypto Market Outlook And Investor Sentiment

Despite the positive momentum in crypto investment products, certain assets faced challenges. Solana investment products saw outflows for the second consecutive week, accumulating to a total of $3 million.

Butterfill attributed this downturn to the network’s recent temporary downtime. Furthermore, blockchain-related stocks saw persistent outflows totaling $81 million. According to Butterfill, this indicates a sense of caution prevailing among investors in the present market conditions.

It is worth noting that the overall trajectory of the global cryptocurrency market has been largely positive. Notably, the total market capitalization of crypto assets has recently surpassed the $2 trillion mark and shows a further increase of nearly 1% over the past 24 hours.

This surge in market capitalization can be attributed to the significant gains observed in cryptocurrencies such as Bitcoin and Ethereum, along with other major digital assets in the market. Despite experiencing a minor decrease of 1.7% in the past week, Bitcoin has maintained a substantial growth rate of over 20% throughout the past month.

Featured image from Unsplash, Chart from TradingView