The Mexican peso is turning heads and wallets alike as it climbs the ladder of global currencies, leaving the US dollar grappling with its depreciating charm.

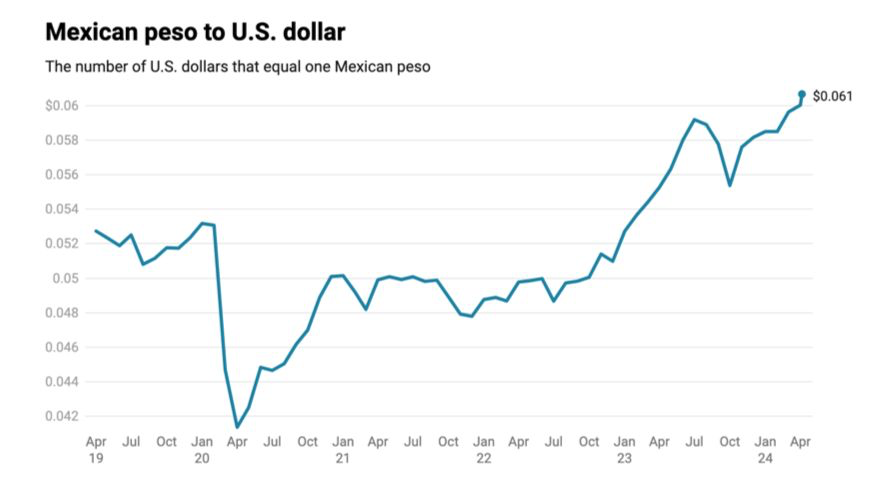

Recent trends showcase the peso’s rapid appreciation against a backdrop where the US dollar has been losing ground, marking a shift in economic dynamics that could redefine financial power balances.

Over the past several years, the value of the US dollar has notably decreased. Historical data indicates a staggering 90% reduction in the dollar’s purchasing power since it first entered circulation. This decline has pushed the dollar to new lows in terms of value, a phenomenon exacerbated by rising inflation and a ballooning debt burden in the US economy.

Amidst this, calls for moving away from dollar-centric trade and reserves have grown louder, paving the way for currencies like the peso to shine. As the dollar struggles, the peso has found new vigor, providing stiff competition to what many considered the world’s leading currency.

Financial Dynamics and Tourism Challenges

As the US continues to print money—trillions every quarter—the dollar’s value suffers directly, affecting its global standing. This massive issuance of currency, coupled with ongoing debt concerns where the US government faces trillions in interest payments, paints a bleak picture for the dollar.

Meanwhile, the peso’s rise is not without its complications. An increasingly strong peso is causing discomfort within Mexico’s tourism industry, as the cost for American tourists in Mexico skyrockets, leading to a noticeable drop in visits.

According to economic insights, with the peso appreciating by 15% to 20%, the purchasing power of American tourists in Mexico has diminished. This shift means that funds sent from the US to Mexico no longer stretch as far as they once did, impacting not only individual spenders but also broader economic interactions between the two nations.

Merchants in border cities like Tijuana feel the impact keenly. For decades, they have benefited from American dollars spent generously across shops and stalls. However, as the peso strengthens, those same dollars now buy less, causing frustration among vendors who find their earnings and purchasing power paradoxically reduced even as their currency grows stronger.

The Currency’s Broader Implications

The ongoing changes are a clear signal of the shifts in global financial currents, where dominance is no longer assured by historical supremacy. As the US dollar wanes under the weight of its own economic policies, the Mexican peso emerges as a testament to the potential of regional currencies in a multi-polar financial world.

These developments have broader implications, not just for traders and economists but for everyday citizens and policymakers. I, personally, foresee see a future where reliance on a single global currency might give way to a more diversified approach, potentially offering a buffer against the kinds of economic shocks currently witnessed in the US.

Furthermore, the situation poses crucial questions about the future of currency management and economic sovereignty. As nations watch the dollar’s struggles, the debate around monetary strategies, including potential changes to commodities like gold or other standards, gains traction. The historical reliance on fiat currencies, backed by nothing but government assurances, may see challenges as alternative models present themselves.