Netherlands-based crypto exchange Bitvavo and research firm Kaiko released a report on the state of the European crypto market. According to analysts, MiCA-compliant stablecoins dominated the European stablecoin market share in 2024.

A report by Kaiko and Bitvavo highlighted that MiCA-compliant stablecoins have captured Europe’s stablecoin market share. The researchers suggested that Coinbase largely drove the shift after promoting compliant assets.

MiCA-compliant stablecoins take over European crypto market

In a new report, Kaiko analysts highlighted Europe’s growing demand for cryptocurrencies. The research firm revealed rising euro-dominated trading volumes in 2024 signaled increased investor interest in the market.

Kaiko, in collaboration with Bitvavo, noted that euro-dominated trading volumes experienced their peaks in March and November. According to the analysts, November saw a weekly euro-dominated trade volume surge to over €10 billion. They attributed the rise to Bitcoin’s all-time high after the US general elections, which had a ripple effect across global markets.

The researchers also examined the euro’s role in global crypto adoption and region-specific dynamics that may have fueled the widespread adoption of stablecoins. According to the firm, the Euro was the third most traded fiat currency in the crypto market in 2024 after the US dollar and the Korean Won.

The researchers also noted a shift in the European stablecoin market. Kaiko analysts commented that euro-backed stablecoins experienced over $300 million in monthly volumes in 2024. They speculated the surge resulted from EURI stablecoin from Banking Circle after it was listed on Binance.

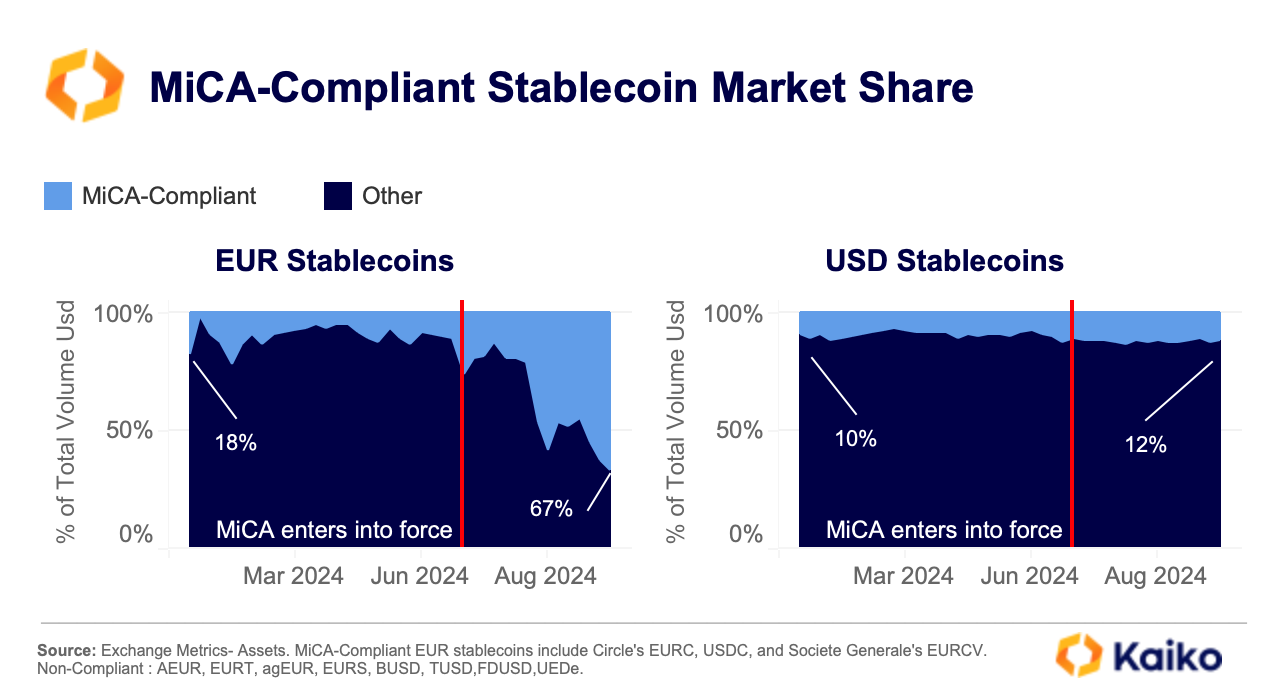

According to Kaiko analysts, MiCA complaint stablecoins also surged in 2024, especially after the June enactment of the Markets in Crypto Assets Regulation (MiCA). The MiCA regulation outlines the compliance standards for electronic money and asset-referenced tokens and is expected to be finalized by December 30, 2024.

The regulation reportedly aims to protect consumers in the European market and promote innovation. The Kaiko researchers commented the regulations have established a stable framework for investors in Europe, boosting long-term institutional interest.

They also noted the regulation led to exchanges delisting non-compliant stablecoins. For instance, they said Tether cited regulatory concerns in its November announcement that it would scrap off Euro-pegged stablecoins ahead of MiCA’s full implementation.

As a result, they highlighted that assets such as Societe Generale’s EURCV and Circle’s EURC dominated over 90% of the market share by November 2024.

Coinbase overtakes Binance as the leading market for EUR stablecoins

Kaiko research analysts, in an October report, noted that Coinbase overtook Binance as the leading platform for euro-backed stablecoins trading in August. The analysts revealed that while Coinbase promoted MiCA-compliant assets, Binance promoted non-compliant Euro stablecoins for non-European traders using its zero-fee model.

Coinbase later announced it would delist all non-compliant stablecoins from its platform by December 31st, 2024. The company pointed out the move was in compliance with MiCA’s stablecoin guidelines, which required issuers to acquire e-money authorization in at least one EU country.

Kiako analysts also suggested that MiCA regulation could positively influence USD-backed stablecoins, such as USDC. They suggested the delisting of non-compliant stablecoins would lead to their widespread adoption beyond Europe, increasing their market shares.

Kaiko analysts noted MiCA affected Decentralised exchanges(DeXs) outside Europe’s regulatory framework. They attributed this to the increased usage of USDT on DEXs as users sought assets not governed by MiCA to access liquidity. The analysts reported the trend was noticed on Uniswap, where USDT volume increased as opposed to USDC’s.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap