The MicroStrategy executive chair claimed Bitcoin was superior to gold and real estate and predicted that capital from those assets would make its way into the cryptocurrency.

Michael Saylor has no plans to sell Bitcoin, even as the holdings of his company MicroStrategy have swelled to reach an unrealized profit just shy of $4 billion.

“I’m going to be buying the top forever. Bitcoin is the exit strategy,” Saylor said, speaking to Bloomberg on Feb. 20 when asked if his firm would sell its 190,000 BTC stash — worth around $9.88 billion at current prices.

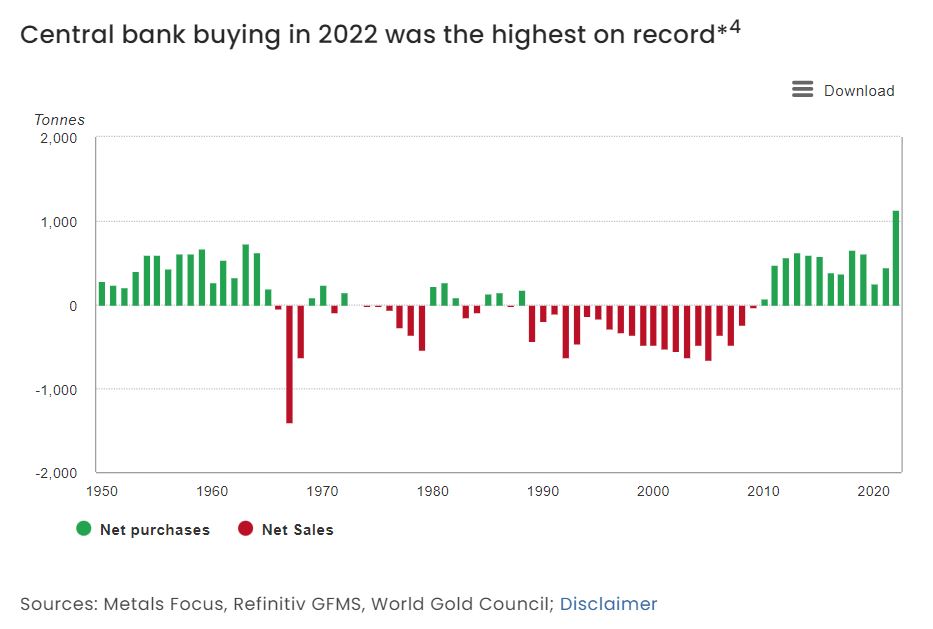

Outlining his bullish case for Bitcoin (BTC), Saylor claimed the cryptocurrency is “technically superior” to gold, the S&P 500 and real estate, despite each asset class having a far greater market capitalization than Bitcoin’s $1 trillion.