MicroStrategy’s Bitcoin holdings have passed $11 billion and its shares could gain from increased institutional Bitcoin demand and the cryptocurrency’s halving, says Benchmark.

MicroStrategy shares are a “buy” with a price target of $990 as the Bitcoin (BTC)-buying software firm is primed for major windfalls from institutional demand and April’s halving event, says investment banker Benchmark.

In a Feb. 27 research report, Benchmark senior analyst Mark Palmer wrote that MicroStrategy (MSTR) offered investors a “timely play” on the upcoming Bitcoin halving. The firm’s Bitcoin holdings have swollen to over $11 billion.

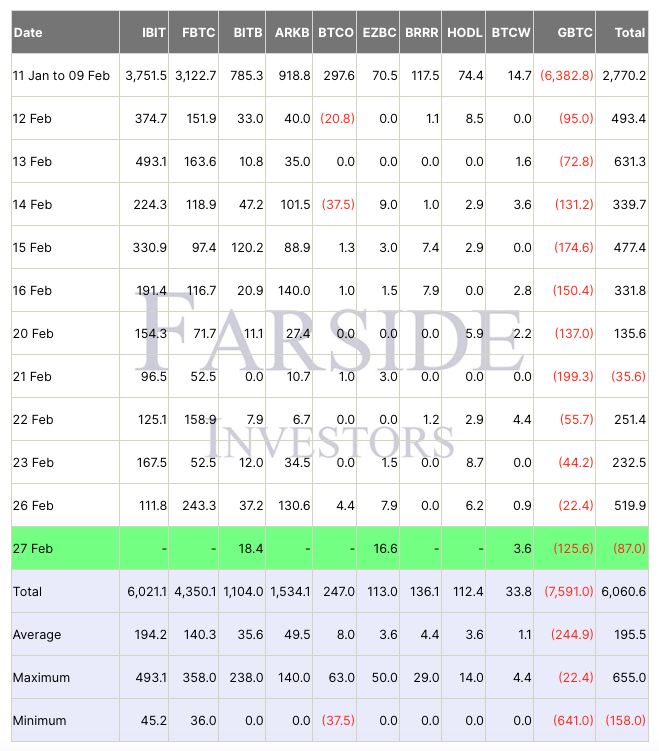

Palmer predicted MicroStrategy’s share price would also be buoyed by the increased demand for Bitcoin spurred by the new United States spot Bitcoin exchange-traded funds (ETFs).