Coinspeaker

MicroStrategy Misses Chance for S&P 500 Inclusion, Reports Q1 2024 Losses

MicroStrategy, the world’s biggest corporate holder of Bitcoins, reported its Q1 2024 results on Monday, April 29, with a net loss of $53 million. For the first quarter, the company revealed a $191.6 million digital asset impairment loss, jumping 10x in the same period a year before.

In comparison to Q1 2023, the revenue generated by MicroStrategy for Q1 2024, also dropped by 5.5%, reaching $11.52 million. On the other hand, the company hasn’t yet adopted the new digital asset fair value accounting standard, which otherwise would have considered the 65% surge in BTC price during Q1 2024.

As a result, MicroStrategy’s carrying value of BTC holdings stood at $5.07 million at a price of $23,680 per Bitcoin, as per the traditional method, With new accounting standards and a fair value approach, this could be $15.2 billion.

As per Benchmark’s research note last week, numerous companies that possess Bitcoin have chosen to adopt the new ASU 2023-08 guidance early. To qualify for potential inclusion in the S&P 500 by the index committee, a company must demonstrate positive earnings in its latest quarter. However, MicroStrategy missed this chance while reporting net losses during Q1 2024.

MicroStrategy Buys More Bitcoins

In an announcement on Monday, MicroStrategy Executive Chairman Michael Saylor announced that the company purchased an additional 122 Bitcoin worth $7.8 million in April. This takes the company’s total BTC holdings count to 214,000 Bitcoins, now valued at $$13.5 billion, purchased at an average price of $35,180.

In April, @MicroStrategy acquired an additional 122 BTC for $7.8 million and now holds 214,400 BTC. Please join us at 5pm ET as we discuss our Q1 2024 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/h40yyrgEb0

— Michael Saylor⚡️ (@saylor) April 29, 2024

Speaking on the development, Phong Le, President and Chief Executive Officer at MicroStrategy, said:

“In the first quarter we raised over $1.5 billion by executing again on our capital markets strategy including two successful convertible debt offerings. We acquired 25,250 additional bitcoins since the end of the fourth quarter, our 14th consecutive quarter of adding more Bitcoins to our balance sheet. We believe that the combination of our operating structure, bitcoin strategy, and focus on technology innovation provides a unique opportunity for value creation for our shareholders.”

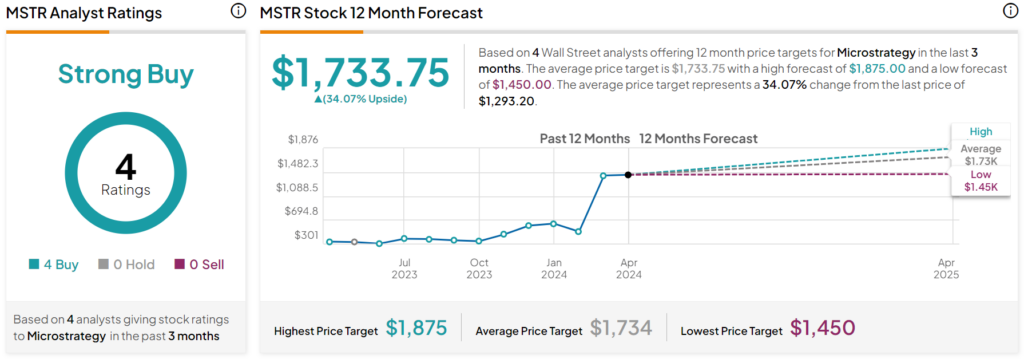

MicroStrategy (MSTR) saw a 3.3% decline in its stock during after-hours trading following the announcement. The substantial 65% surge in Bitcoin triggered an exceptional rally for MicroStrategy in the first quarter, with its stock skyrocketing over 170% to reach $1704 by March’s end. However, MicroStrategy’s stock has since retreated to $1,292.

If the inclusion of MicroStrategy into the S&P 500 had happened, the MSTR would have resumed the rally again to $1,800.

MicroStrategy Misses Chance for S&P 500 Inclusion, Reports Q1 2024 Losses