According to the recent “MENA Investor Survey 2022-2023” report, 50% of all 83 fund managers and venture capitalists surveyed in the MENA region are already planning to increase their investments in blockchain infrastructure, metaverse projects, and decentralized finance in 2023. However, this is a testament to blockchain technology’s prevalence—inspiring investors worldwide.

Despite the global economic downturn in 2022, investment capital used to support the crypto sphere significantly exceeded that of 2021. According to reports, about $36.1 billion was raised in 2022, compared to only $30.3 billion in 2021.

Additionally, the MENA region saw a considerable investment in cryptocurrency and blockchain companies in 2022. For instance, RAIN Cryptocurrency Exchange was funded with $110 million from MENA investors like MEVP (Middle East Venture Partners), while BitOasis procured $30 million from UAE-based Wanda Capital and other entities.

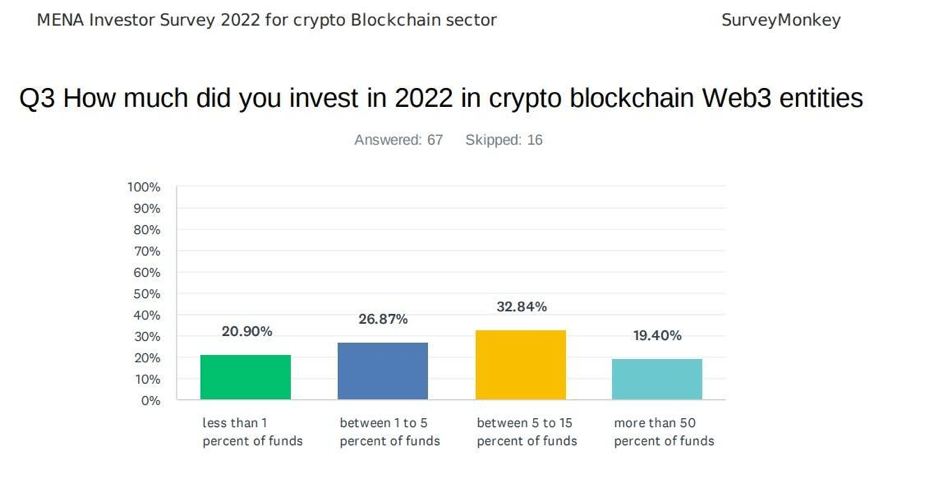

19% of venture capitalists have spent more than 50% of their funds on blockchain entities

The study also revealed that 19% of those surveyed had allocated more than half of their funds to crypto and blockchain-based businesses in 2022. Moreover, 33% had invested between 5-15% of their capital in crypto, while 27% had put 1-5%.

MENA venture capitalists to increase crypto investments despite the market downtrend in 2022

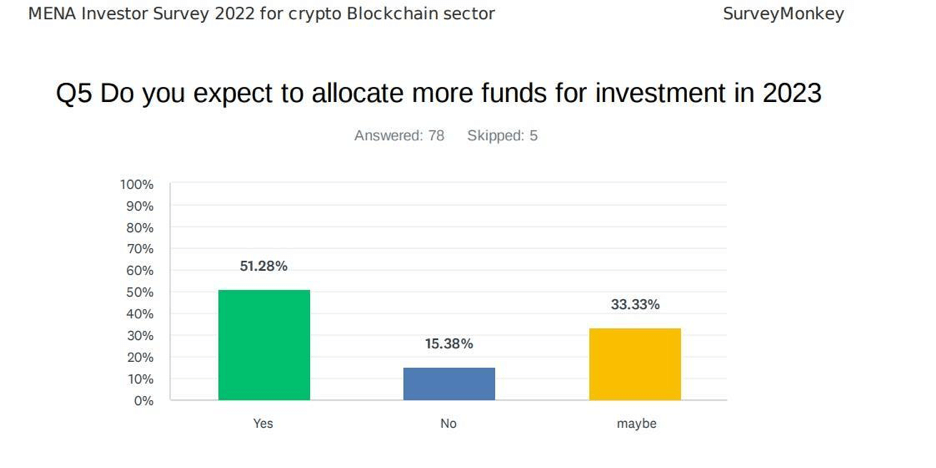

Even though the crypto market witnessed a downtrend in 2022, 51% of those surveyed responded that they would commit additional resources to blockchain and cryptocurrency companies in 2023. Only 15% answered no, while 33% were uncertain about their decision.

Nickel Digital Asset Management has reported that by 2023, UAE investors intend to build up their cryptocurrency investments dramatically. Companies like TradeDog Group’s TD Venture Capital are already taking action with the establishment of new funds, such as the Special Mode Fund— a $100 million venture geared specifically towards Web 3.0 and blockchain-related assets to help revive VCs struggling within the token markets.

In December 2022, Cypher Capital, an investment company based in the UAE, proudly announced the launch of a $200 million fund specialized in investments in Web 3.0 infrastructure and middleware. Moreover, Shorooq Partners declared in March 2022 that they would invest 150M into web3 startups. Additionally, January 2023 saw the first billion-dollar Venom Ventures Fund come to life due to an association between Iceberg Capital and Venom Foundation established within the UAE’s borders.

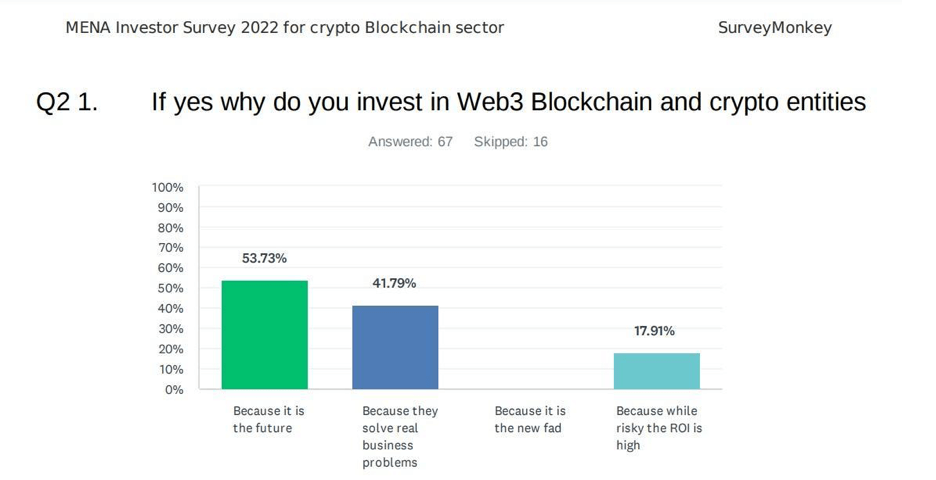

Blockchain technology and crypto are the future

Despite the chaos of 2022, 54% of survey participants responded that they invested in cryptocurrency and blockchain entities because these technologies are projected to shape our future, while 42% believed it was due to their potential to resolve several issues we encounter today.

It is essential to know that MENA investors have not wavered in their appetite for these investments. According to survey results, investor interest remains as strong as ever despite the bear market.