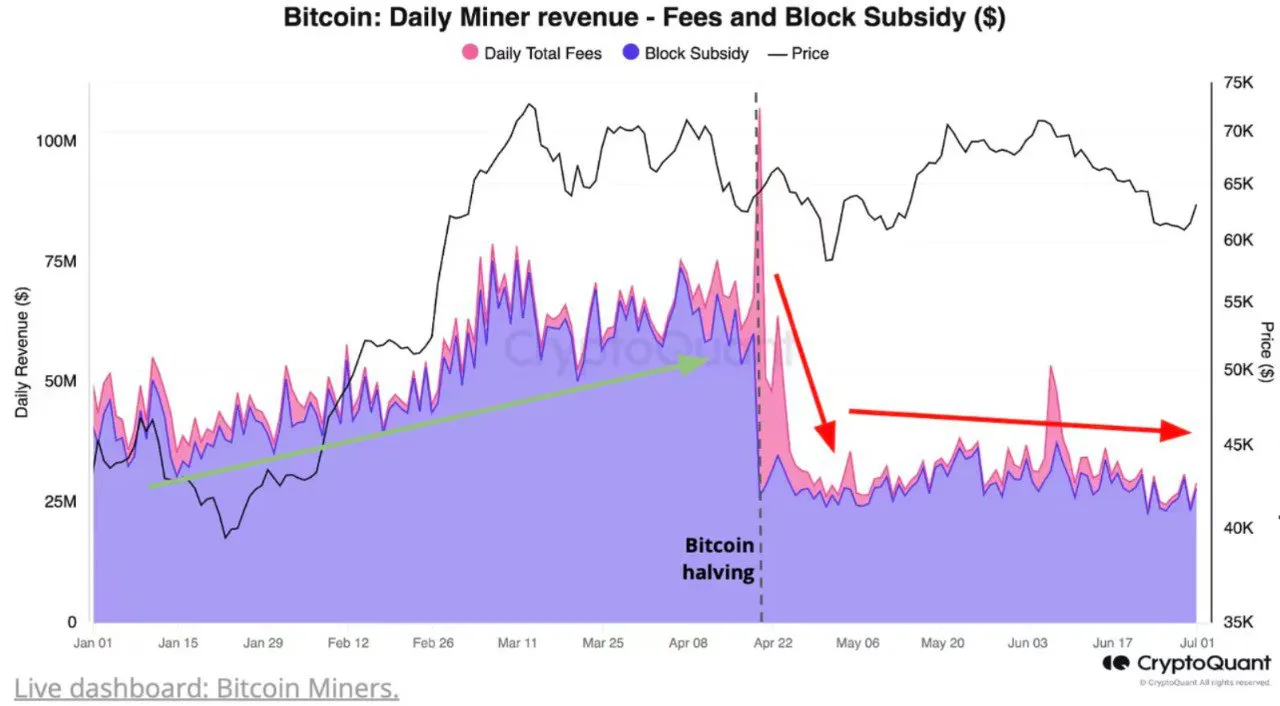

Bitcoin’s latest halving event, on April 19th, reduced miner compensation for mining new blocks by half. Since then, the Bitcoin network has shown signs of miner capitulation, according to CryptoQuant. Miners began to turn off inefficient mining equipment and sell their BTC.

Also read: LayerZero price rising following Binance listing: 5 other new crypto listings to watch

CryptoQuant suggests the capitulation signs began shortly after Bitcoin’s periodic halving event. The data revealed that Bitcoin miners have been significantly “underpaid” since April 19th. CryptoQuant data revealed that the daily miner outflows declined to $29 million from a high of $79 million recorded on the 6th of March.

Miners initially benefited from the inception of Bitcoin Ordinals and the Runes protocol. These protocols provided additional miner revenue worth millions in the form of network fees. In its first week, the Runes protocol alone generated 2,129 bitcoins worth $135 million. CryptoQuant data indicated that revenue generated from these protocols is now down to 3.2% of the total miner revenue and has been declining since April.

The capitulation process has involved miners turning off inefficient equipment that no longer operates profitably. Bitfarms, a Canadian-based miner, announced on June 1st that it had replaced 39,000 miners with new efficient and profitable mining equipment.

Bitcoin computational power drops with miner reserves at a 14-year low

According to the blockchain analytics firm, Bitcoin hashrate hit a record high on April 27th but has since dipped by 7.7%. These figures represent a fall toward the four-month low. The declining hashrate is a result of a drop in miner participation triggered by miners switching off inefficient mining equipment.

The data also showed an increase in miner outflow activity. According to CryptoQuant, these outflow changes indicate possible Bitcoin liquidations from miners. The blockchain explorer also revealed that miners are facing financial difficulties. The challenges have prompted them to sell some of their holdings and shut off unprofitable miners.

Bitcoin’s halving is approaching its 3-month anniversary. The active supply has decreased significantly within the last 90 days. The reduction in volume and active on-chain transactions translates to a decrease in miner revenue from associated transaction fees. In June, IntoTheBlock detailed that BTC miner reserves dropped to a 14-year low of 1.90 BTC.

Also read: CryptoQuant: Optimism may prevail as holders hope for longer bull market

Miner capitulation has historically been associated with a plunge in BTC prices, as per CryptoQuant. The lowest hashrate recorded occurred when the FTX exchange imploded, causing panic across the crypto sector. BTC price fell from a high of $69,000 to a low of $17,000. However, the asset’s price began to ascend gradually as the FTX dust cooled off.

Cryptopolitan reporting by Collins J. Okoth