Miners are facing another month of thin margins, facing hard decisions on holding or selling their coins. The price to produce new Bitcoin (BTC) is near an all-time high, setting challenges to miners to cover costs.

Miners are facing the highest production costs in the history of Bitcoin (BTC). Since May 2024, the cost of mining one BTC has moved above the projected earnings from selling the coin. The miners can receive some inflows from block fees, but most operations are mining at a projected loss.

Bitcoin mining is also facing a paradox. The hashrate is at an all-time high at more than 723 EH/s, with robust growth and faster-than-usual block production. At the same time, miners are producing the last five months of supply at a loss. In the long run, the move may pay out, but miners are also running out of time when it comes to cheap mining.

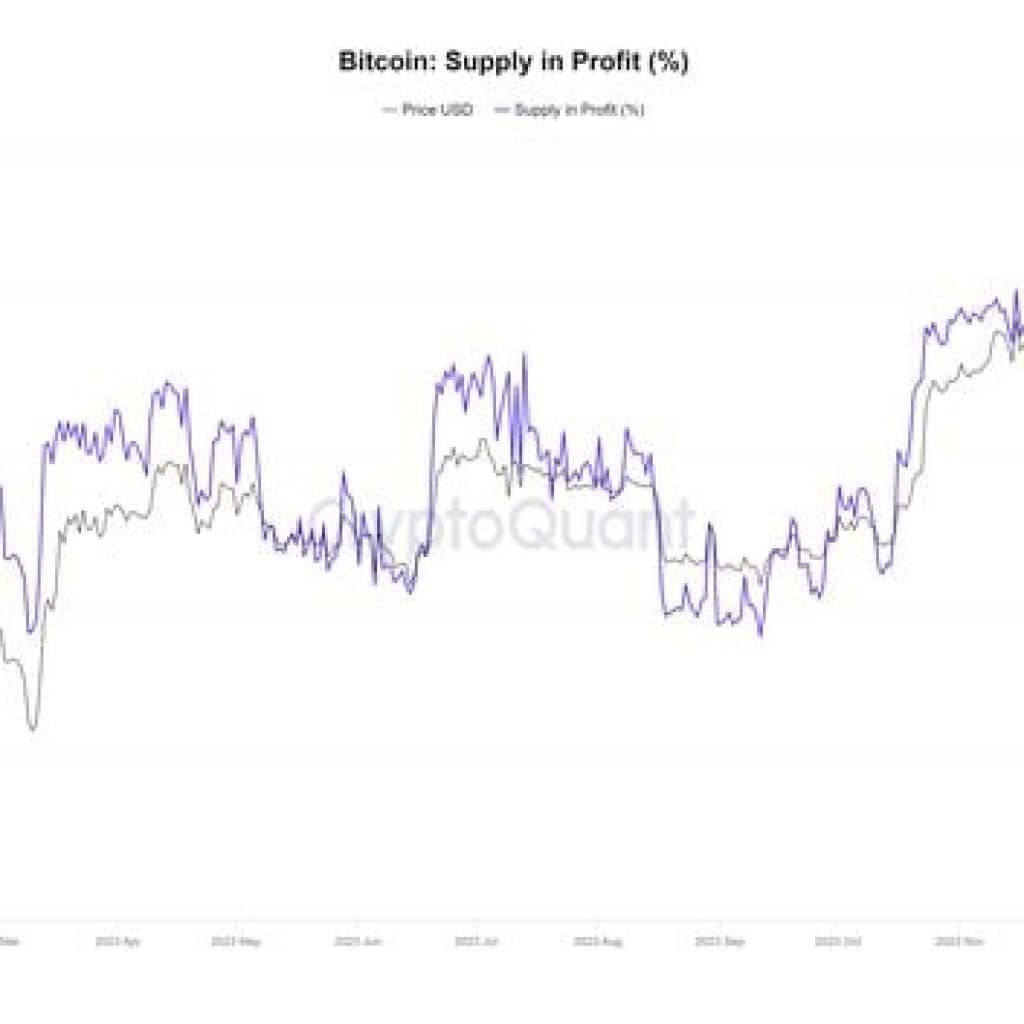

The cost basis of BTC jumped from around $24,000 in 2022 up to $75,000 during a recent peak of mining difficulty. Miners are still sitting on a relatively low-cost basis, mostly due to retaining reserves from the previous bear markets. But in September, miners retained fewer BTC, instead liquidating their rewards.

Miner costs may vary between operations, depending on investments and the addition of new equipment. On average, miners decreased the holding of new coins, but still retained a pooled balance of 1.7M to 2.06M coins, depending on the type of data recording. Some of the older coins can be sold at significant gains, helping to extend production times.

In the meantime, any BTC rally to a higher range would be helpful and extend operations. BTC miners are out of the capitulation danger zone in October, though they are working with rather thin margins, despite highly efficient equipment.

Miners also switch to retaining BTC whenever the coins are mined at a favorable cost basis. This reserve can cover costs for longer or turn some of the data centers profitable. The other source of revenue is transaction fees, which can make between 10% and 80% of the block reward. In the future, after the last BTC is mined, fees will be the only source of BTC revenues.

Mining becomes a high-investment activity

Mining is no longer an accessible, voluntary support of the network. Instead, mining operations are often only possible for large organizations. Even for small-scale miners, it may be easier to hire space in a remote data center or pay for a fraction of the hashrate, than to start competing with self-hosted machines.

Mining operations are also not looking to BTC as their only source of revenue, instead selling a package of services for clients seeking a mining share.

While trying to get a share of the last 2M BTC to be produced, miners are also expanding their capacities as builders of data centers. While BTC revenues may be diminishing, miners are also sitting on potentially lucrative energy contracts and strategic data center locations.

Miners benefit from the pivot to AI and data centers

While revenues from selling BTC may be slowing, corporate miners are also growing based on demand for data center space and power capacity.

The shares of corporate miners reflect their shift to AI technology and data centers. Core Scientific (CORZQ) is among this year’s gainers, with a growth of 228.12%. TeraWulf, Inc. (WULF) is the other big corporate miner with 253.51% in annual gains to $4.03. Core Scientific was among the leaders in securing locations and electricity contracts, including the 12-year agreement with CoreWeave for a 200MW facility and further expansions.

CleanSpark (CLSK) and Iris Energy LTD (IREN) were also in the green for the past year, with gains of 145.95% and 154.57%. CleanSpark built up contracts for 75MW in data and mining facilities. Iris Energy moved on from merely acquiring fast mining machines and secured a 600 MW contract.

The increased demand for AI and reliable energy may also mean third parties will be ready to finance some of the expenses, instead of relying on miners to finance the upgrading of their operations. Even in 2024, there is a clear difference between miners that retained their old model, and those that are setting up AI facilities and already diversifying their revenue streams.

Cryptopolitan reporting by Hristina Vasileva