Are you looking for the priciest cryptocurrency? This article lists the top five valuable cryptocurrencies and explains their high prices.

Find out what makes Bitcoin, Ethereum, and other popular tokens unique.

Bitcoin (BTC)

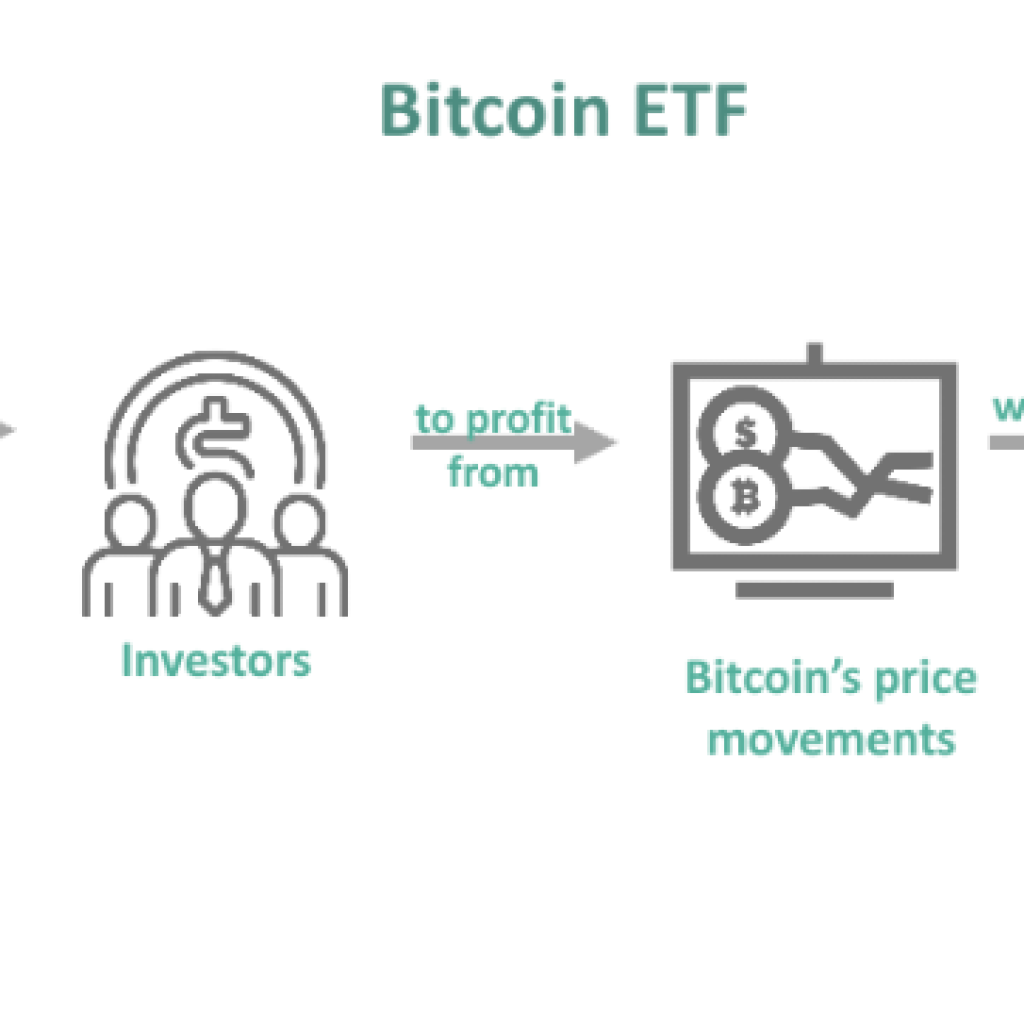

The original cryptocurrency, Bitcoin, has established itself well in many industries, including financial services, technology, entertainment, bitcoin slots, and even real estate.

Global financial institutions have accepted Bitcoin as a valid asset class, and major corporations like Tesla have begun using it for transactions.

Furthermore, due to its usage as a store of value, it has become increasingly well-liked in nations dealing with excessive inflation, cementing its moniker as “digital gold.”

The value of Bitcoin has only increased as a result of these occurrences. On October 8, 2024, Bitcoin was trading at $62,543, evidence of its dominance and sustained power in cryptocurrency.

Despite its high entrance barrier, Bitcoin is still a highly sought-after digital asset, holding over 45% of the overall market capitalization.

As the first cryptocurrency, Bitcoin is particular because of its historical significance and limited supply—there are only 21 million coins worldwide.

Because of this restriction, investors find it more appealing because they view it as a steady long-term investment and an inflation hedge.

Many people seeking a dependable digital asset to protect and increase their wealth are drawn to it due to its prominence in the financial world.

Ethereum (ETH)

The Ethereum platform, frequently considered the most essential cryptocurrency substitute for Bitcoin, has established a crucial position.

Unlike Bitcoin, it functions as a cryptocurrency and a cutting-edge blockchain platform, making it easier to create and deploy decentralized apps (DApps) and smart contracts.

Due to its dual functionality, Ethereum gained prominence in emerging domains such as non-fungible tokens (NFTs) and decentralized finance (DeFi).

With 120,38 million ETH in circulation, Ethereum is essential to the cryptocurrency industry’s operation. The Ether token is also essential for conducting transactions on its network.

Ethereum is a popular choice among investors because of its innovative potential and flexibility in supporting cutting-edge blockchain projects and applications.

Binance Coin (BNB)

Binance Coin (BNB), first introduced as an ERC-20 token on the Ethereum network, has grown to be a significant player in cryptocurrency.

After switching to its own Binance Chain, BNB’s value skyrocketed by 575,119% from its low starting point of $0.10 in 2017, underscoring its increasing use and ubiquity within the Binance-managed ecosystem.

BNB is multifaceted; it can be used for travel reservations, to facilitate payment processing services, and to receive discounts on trading fees on the Binance platform.

The intentional act of burning coins regularly reduces their total availability, enhances their rarity, and naturally increases their value.

Because of its versatile use and the thoughtful economic principles that underpin it, Binance coin BNB is a valuable addition to any collection of varied cryptocurrency investments.

Solana (SOL)

Ever since its launch in March 2020, Solana has gained significant traction by addressing the scalability issues that other blockchain technologies face.

Because of its creative architecture, Solana is one of the fastest platforms in the blockchain space, processing up to 65,000 transactions per second.

A special fusion of Proof of Stake and Proof of History protocols optimizes transaction validation and increases overall network productivity, enabling this amazing processing capacity.

Solana is becoming increasingly popular due to its ability to support large-scale applications and solutions for decentralized finance (DeFi), as evidenced by its constantly growing market valuation.

Its ability to process transactions in parallel strengthens this throughput capability. Therefore, in the highly competitive field of blockchain systems currently available on the crypto market, Solana stands out as a formidable opponent with the potential to substantially impact a wide range of industries dependent on defi projects.

Toncoin (TON)

Toncoin, first developed under the name Gram by Telegram, has undergone a significant transformation.

Now that the TON Foundation is in charge of its operations, the cryptocurrency is known for its quick and eco-friendly transactions.

The market price of Toncoin increased in 2023 after a TON-based wallet was included in the Telegram app. Since then, it has decreased from its peak of $8.24.

Because of its distinctive beginnings and the continuous support it receives from the foundation and community, Toncoin remains a valuable asset despite these fluctuations in the market.

Its technological foundation and incorporation into a popular communication platform give it a distinct advantage in the crowded cryptocurrency market.

Factors Influencing Cryptocurrency Prices

A plethora of complex elements influence the value of cryptocurrency. The basic idea of supply and demand has a significant impact. Prices are frequently increased when demand for limited coins outpaces supply.

Cryptocurrency prices are heavily influenced by the feelings that permeate the market, typically influenced by emotional states such as anxiety or acquisitiveness among investors.

It is well established that regulatory news—from court cases or legislative changes—causes significant market volatility.

Additionally, liquidity is a crucial component. Because they are easier to buy and sell, cryptocurrencies with higher liquidity typically have more stable price levels.

Beyond this, a cryptocurrency’s attractiveness to the investment community is greatly influenced by tokenomics, the economic framework, and incentive systems built into the architecture of the coin.

Understanding these diverse influencers is essential for anyone hoping to ride the waves of the always-shifting cryptocurrency market environment.

How To Invest in Expensive Cryptocurrencies

Entering the realm of expensive cryptocurrencies requires careful study and calculated investing methods.

Reputable cryptocurrency exchanges like Coinbase, Kraken, and Gemini offer platforms for investors to purchase these virtual goods.

It is crucial to evaluate the exchanges that a specific coin is listed on because this has a big impact on its liquidity and accessibility.

Fractional trading of cryptocurrencies is now supported by several brokerages, enabling people to invest in high-quality value coins without having to buy them all.

Prospective investors should thoroughly investigate a cryptocurrency’s key features, such as its usefulness in real-world scenarios and the reliability of its inventors, before making any financial commitment.

If you want extra security for large investments, you should use hardware wallets or reputable custodial services rather than storing assets directly on exchange platforms.

Rather than acting on impulse, investors who rigidly follow measured techniques are more likely to make wise decisions that lead to long-term prosperity with their Bitcoin holdings.

Risks of Investing in High-Value Cryptos

Investments in cryptocurrencies, such as Bitcoin and other valuable ones, are fraught with risk. The sharp price swings of these digital assets have the potential to cause abrupt value shifts and consequent losses for investors.

Cyberattacks and security lapses routinely affect the Bitcoin industry. Since cryptocurrency transactions are finalized and cannot be undone, errors could result in irreversible financial losses.

High-value cryptocurrencies are frequently the focus of scams that put investors at further risk.

Investors must acknowledge that modifications in regulatory rules have the potential to impact the stability and value of cryptocurrencies substantially.

Those interested in investing in this field should watch closely for any changes to the laws governing cryptocurrency regulation and ensure they only invest money they can afford to lose entirely without suffering any consequences.

Understanding these inherent hazards is critical. It allows investors to take protective measures that successfully shield their holdings of digital assets against unforeseen losses.

Diversifying Your Crypto Portfolio

Diversifying one’s investments is essential for risk management in the bitcoin market. By spreading your investment among several cryptocurrencies, you can mitigate the effects of volatility and lower the chance of suffering significant losses.

Stablecoins, DeFi platform assets, and different use-case cryptocurrencies are all good additions to a well-rounded portfolio that will increase overall holdings diversity.

Time diversity, which involves making investments at different times, can increase returns while lowering risk.

Building a diverse portfolio of investments protects against significant value declines and helps to ensure more steady returns. Adding bitcoins to a broader financial strategy might be very beneficial.