Defunct crypto exchange Mt. Gox reportedly moved 500 Bitcoin (BTC) worth $35 million to cold storage wallets. The news comes after the exchange announced it would delay customer repayments by a year following a major hack in 2014.

Mt. Gox reportedly moved 500 BTC, worth around $35 million at current market value, to unknown addresses. On-chain analysis from the blockchain intelligence platform Arkham identified two transactions transferring Bitcoin associated with the exchange.

Mt. Gox Postpones Deadline to Repay Creditors

Bitcoin, associated with the collapsed crypto exchange Mt. Gox, is moving again. Blockchain intelligence firm Arkham identified two transactions in which the exchange transferred 500 BTC to cold storage on November 1st. The 31.78 and 468.24 BTC transactions to two unmarked addresses mark the first major coin movement from Mt. Gox wallets in a month. According to Arkham, around 44,905 BTC, worth around $3.1 billion, remains in Mt. Gox-associated wallets.

The now-collapsed Mt. Gox was a Tokyo-based crypto exchange hacked in 2014. During the attack, hackers gradually drained 850,000 BTC, forcing the exchange to shut down and file for bankruptcy. Law enforcement managed to recover 140,000 BTC years after the attack, and Mt. Gox creditors are finally getting back their funds after a rehabilitation proposal was approved in 2021.

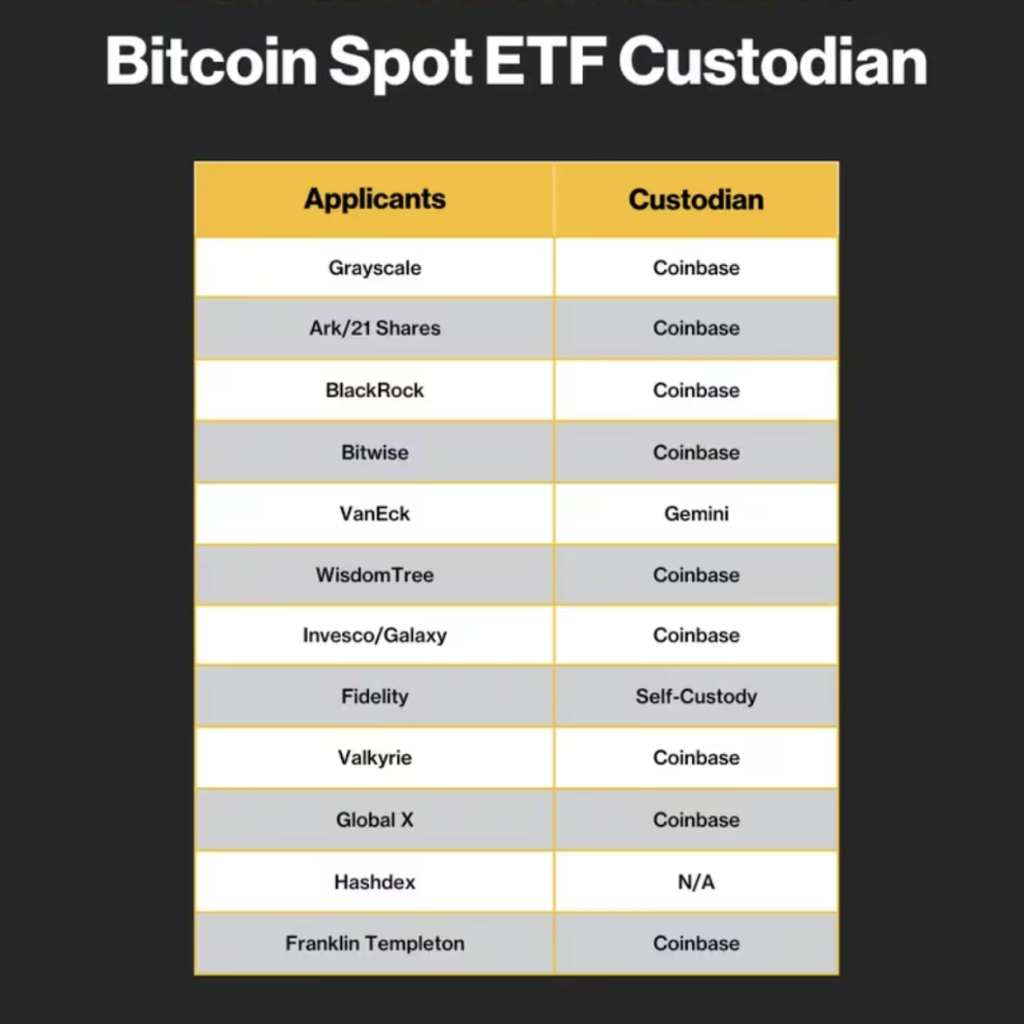

After almost a decade of waiting, creditors are facing more setbacks. Crypto exchanges Kraken, Bitstamp, Bitbank, SBI VC Trade, and BitGo are in charge of distributing repayments to the fallen exchange’s creditors. While some repayments have already been made, it does not appear that all creditors will see the funds soon. Earlier this month, Mt. Gox announced the deadline to make repayments has been extended until October 2025, leaving traders in the lurch for another year.

In a statement, Mt. Gox said:

“However, many rehabilitation creditors still have not received their Repayments because they have not completed the necessary procedures for receiving Repayments.”

The exchange also cited “issues arising in the Repayments process” for creditors not receiving payments.

Mt. Gox Transfers Leave Market Unsettled

Mt. Gox was one of the first Bitcoin exchanges in the world and facilitated around 70% of global BTC transactions at one point. The exchanges’ glory was short-lived after a series of security breaches devasted the company.

Market participants are, however, concerned about the repayments given the vast amount of BTC involved in the matter. Previous BTC transactions by Mt. Gox spooked market participants, sparking concern over a potential selloff. Creditors are set to profit handsomely after the repayments due to the difference in BTC’s price now compared to when the breach took place.

Bitcoin witnessed a massive run earlier this week after it breached the $70,000 mark, coming close to its ATH of $73,800. BTC has since pulled back and is currently trading at $69,268.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.