TL;DR Breakdown

- NEAR Protocol price analysis suggests further downward movement

- The closest support level lies at $1.20

- NEAR faces resistance at $1.250

The NEAR Protocol price analysis shows that the NEAR price action has crumbled to the $1.20 mark after the bulls failed to maintain support at the $1.40 price level. Currently, the price action has fallen to the $1.20 level and seems to be moving further down.

The broader cryptocurrency market observed a negative market sentiment over the last 24 hours as most major cryptocurrencies recorded negative price movements. Major players include BNB and XRP recording a 9.56 and an 8.53 percent decline respectively.

NEAR Protocol price analysis: NEAR falls to $1.20

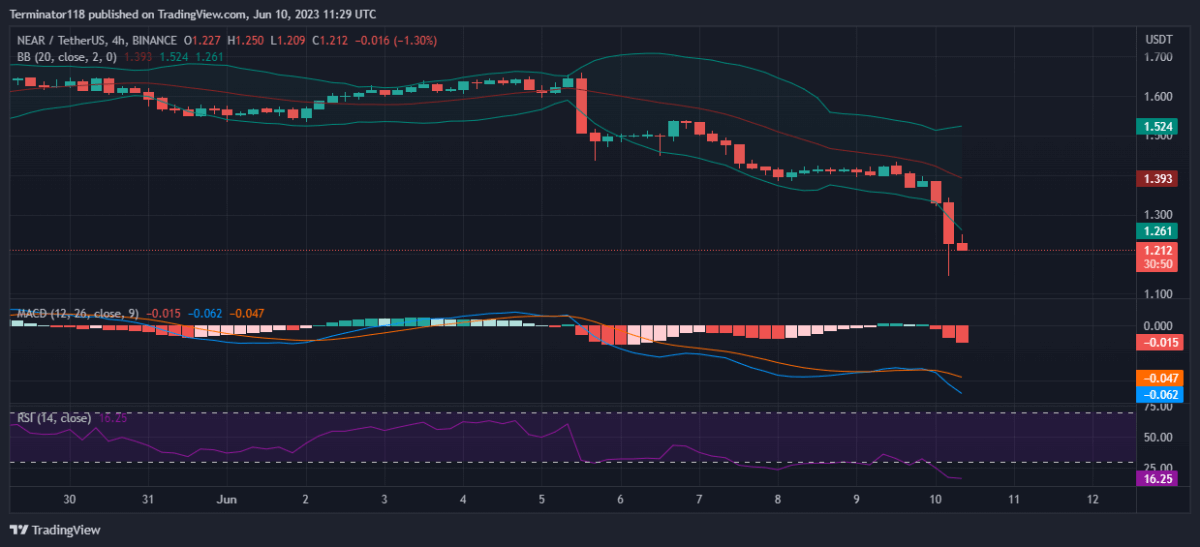

The MACD is currently bearish as expressed in the red colour of the histogram. Moreover, the indicator shows strong momentum at the press time as observed in the steep depth of the histogram. Furthermore, the darker shade of the indicator suggests an increasing bearish momentum as the price falls below the $1.30 support level.

The EMAs are trading below the mean position as net price movement over the last ten days remains strongly negative. Currently, the EMAs are trading far from each other showing strong bearish momentum at press time. On the other hand, the converging EMAs suggest a slowly decreasing bearish momentum.

The RSI dipped into the oversold region today as selling pressure escalated in the morning causing a steep price drop to the $1.250 mark. At press time, the indicator trades deep in the oversold line at the 16.25 index level as the price suggests strong bearish dominance with the upwards slope suggesting an increasing bullish pressure at the current price level.

The Bollinger Bands are currently wide as the price action observes high volatility across the short-term charts. Moreover, as the price moves down from the $1.30 mark, the bands will show further divergence. At press time, the bands’ lower limit provides support at the $1.261 mark while the upper limit presents a resistance level at the $1.524 mark.

Technical analyses for NEAR/USDT

Overall, the 4-hour NEAR Protocol price analysis issues a strong sell signal at press time with 16 indicators supporting the bears. On the other hand, only one of the indicators supports the bulls showing little to no bullish presence. At the same time, ten indicators sit on the fence and support neither side of the market.

The 24-hour NEAR Protocol price analysis also shares this sentiment and issues a sell signal with 15 indicators supporting the bears against only two supporting the bulls. The analysis shows bearish dominance across the mid-term charts with a low bullish presence at the current price level. Meanwhile, the remaining nine indicators remain neutral and do not issue any signals at press time.

What to expect from NEAR Protocol price analysis?

The NEAR Protocol price analysis shows that the NEAR Protocol market is currently in a bearish rally as the price action observed a breakdown from the $2.40 mark to the $1.20 price level. However, the bulls made some recovery and the price has risen back to the $1.20 mark.

Traders should expect NEAR to observe sideways movement at the current price level before the price action continues its downward motion. The suggestion is reinforced by the drift between the short and medium-term charts that suggest bullish and bearish trends respectively. The price can be expected to move down to the $1.150 mark.