The US Congress could catalyze a more significant shift than introducing spot Bitcoin ETFs. Bitwise Chief Investment Officer Matt Hougan’s view underscores a pivotal moment for the crypto industry.

Hougan suggests that 2024 could see “groundbreaking” legal frameworks that pave the way for mainstream stablecoin adoption, which might profoundly impact the crypto ecosystem.

A Legislative Leap Forward

Recent remarks by Maxine Waters, Ranking Democrat of the House Financial Services Committee, highlighted progress towards stablecoin regulation.

Waters’ announcement that she and Committee Chair Patrick McHenry are close to finalizing a stablecoin bill indicates bipartisan momentum, which could soon materialize into law.

Matt Hougan emphasized the underappreciated significance of this development in his recent communication to Bitwise clients. He believes comprehensive legislation could anchor stablecoins in the mainstream financial system, potentially enhancing their role in global economics.

Hougan identifies multiple drivers behind the bipartisan push for stablecoin legislation. One significant factor is the potential for stablecoins to “bolster” the US dollar’s dominance as the global reserve currency.

Moreover, stablecoins are major purchasers of US Treasuries, placing them among the top sovereign holders globally.

The economic incentives are equally compelling, according to Hougan. For instance, Tether’s profitability with minimal staff compared to traditional banking giants like Goldman Sachs illustrates the operational efficiency and financial potential of stablecoins. Such dynamics are enticing Wall Street to advocate for entry into the stablecoin arena.

The Bitwise CIO noted:

You can bet your bottom stablecoin: Wall Street is lobbying to be let into the stablecoin game.

The Bigger Picture For Crypto Investors

The passage of stablecoin legislation could redefine the landscape of financial transactions. Institutions like JPMorgan might transition from crypto skeptics to proponents, integrating blockchain technologies into their operations.

Hougan predicts that adopting crypto wallets, combined with the efficiency of blockchain-based payment systems, could soon become standard, driven by innovations such as Stripe’s “pay with stablecoins” feature and Visa’s analytics on rising stablecoin usage.

While stablecoins do not offer appreciation potential, investors can find opportunities in the infrastructure supporting them.

Hougan points to Layer 1 blockchains like Ethereum and Solana, which host substantial stablecoin volumes and many decentralized applications (DeFi).

As the legislative environment becomes more favorable, these technologies are poised for significant growth, reflecting a broader acceptance and integration of crypto into mainstream finance. Hougan concluded:

In other words: Crypto is poised to take another huge leap into the mainstream.

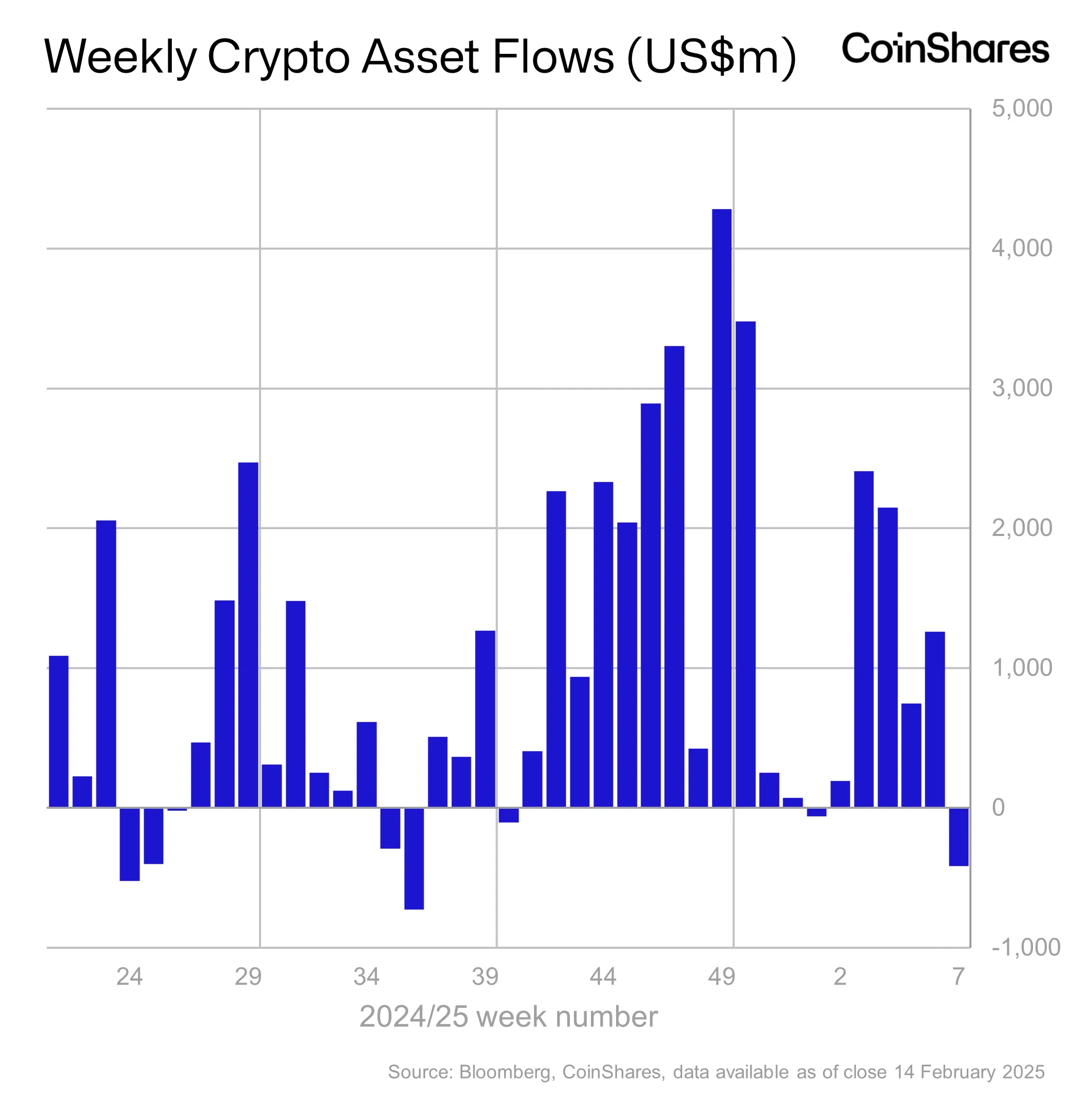

Meanwhile, the stablecoin market remains strong, with a capitalization of approximately $166 billion, according to DeFIllama. In contrast, the inflows and outflows in the spot Bitcoin ETF market have been less substantial, highlighting a shift in investor focus as of now.

Yesterday’s ETF flows by @FarsideUK were negative once again, with $83.6 million of outflows.$GBTC had $82.4 million of outflows. Fidelity did $2.8 million of outflows, Bitwise $3.8 million.

Blackrock holding at 0 for 3rd day in a row.

Price dumped after hours because of DTC… pic.twitter.com/ocUF6zUroH

— WhalePanda (@WhalePanda) April 27, 2024

Featured image from Unsplash, Chart from TradingView