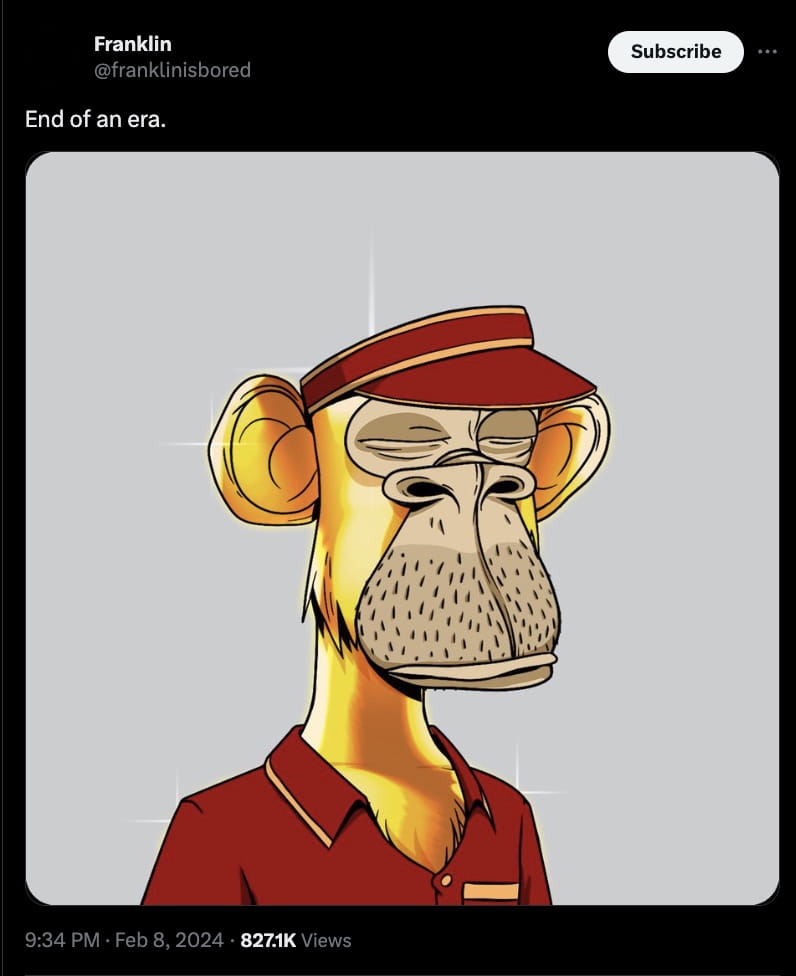

In a move that has sent ripples through the Non-Fungible Token (NFT) community, Franklin, a widely recognized NFT collector and trader, has made headlines by selling a cornerstone of his collection.

On February 11, the NFT world watched as Golden Monkey Bored Ape Yacht Club #1726 (BAYC), a piece emblematic of Franklin’s identity within the digital sphere, was sold for an eye-watering 275 ETH, translating to approximately $670,000. This sale not only marks a significant financial transaction but symbolizes the end of an era for one of the community’s most influential figures.

A golden legacy: Bored Ape Yacht Club #1726

The Bored Ape Yacht Club has emerged as a cultural phenomenon within the NFT space, representing not just a collection of digital art but a symbol of status and community. BAYC #1726, known affectionately as the Golden Monkey, has stood out within this illustrious group for its unique attributes and the prominence of its owner. Franklin, known for his astute trades and significant influence in the NFT market, had made Golden Monkey his digital persona, embodying the intersection of art, identity, and digital ownership that NFTs represent.

The sale of BAYC #1726 is not just a transaction; it’s a narrative of change within the dynamic world of NFTs. Priced at 275 ETH, the value of this sale underscores the high stakes and significant financial implications of trading in this digital marketplace. As the NFT market continues to evolve, the sale of such a notable piece highlights the fluid nature of digital assets and the ever-changing landscapes of ownership and value.

Franklin’s impact on the NFT community

Franklin’s decision to part ways with the Golden Monkey has sparked discussions and speculation across the NFT community. Franklin’s movements within this space are closely watched as a trader who has significantly impacted market trends and valuations. The sale of BAYC #1726 not only marks the end of an era for Franklin but also signals potential shifts in the market dynamics of the Bored Ape Yacht Club collection and the broader NFT ecosystem.

This event has prompted reflections on the relationship between digital identity and asset ownership. For many in the NFT space, the avatars and pieces they collect are more than just investments; they are extensions of their digital personas and communities. The sale of such a prominent piece raises questions about the future of digital identity and the role of significant NFTs in shaping online personas and communities.

Looking Ahead: The Future of NFT Trading and Digital Identity

As the dust settles on the sale of Golden Monkey BAYC #1726, the NFT community is left to ponder what the future holds for NFT trading and digital identity. Franklin’s move could inspire other collectors to reevaluate their portfolios, potentially leading to a reshuffling of notable pieces within the market. Moreover, this sale highlights the liquidity and volatility of the NFT market, characteristics that attract traders and collectors alike but also introduce a level of unpredictability.

The NFT ecosystem is at a crossroads, with the sale of BAYC #1726 symbolizing the constant evolution of digital ownership and identity. As new collections emerge and the landscape of digital art and assets continues to expand, the stories of traders like Franklin and iconic pieces like the Golden Monkey will serve as milestones in the ongoing narrative of NFTs.

Conclusion

The sale of Golden Monkey Bored Ape Yacht Club #1726 by Franklin is a landmark event in the NFT community, closing a significant chapter for one of its most prominent figures. This transaction reflects the dynamic nature of the NFT market, the complex interplay between digital identity and ownership, and the continual evolution of digital art and assets. As the community looks forward, the legacy of BAYC #1726 and its impact on the NFT landscape will undoubtedly continue to influence discussions and decisions for years to come.