Bank of America analysts have emphasized the need for immediate action to address Nigeria’s rising inflation and undervalued currency. Inflation is expected to accelerate due to the removal of fuel caps and the depreciation of the nation’s currency. According to these analysts, the central bank may need to raise interest rates significantly to curb inflation, while the undervalued Nigerian currency, the naira, is predicted to appreciate against the dollar.

Rising inflation demands swift response

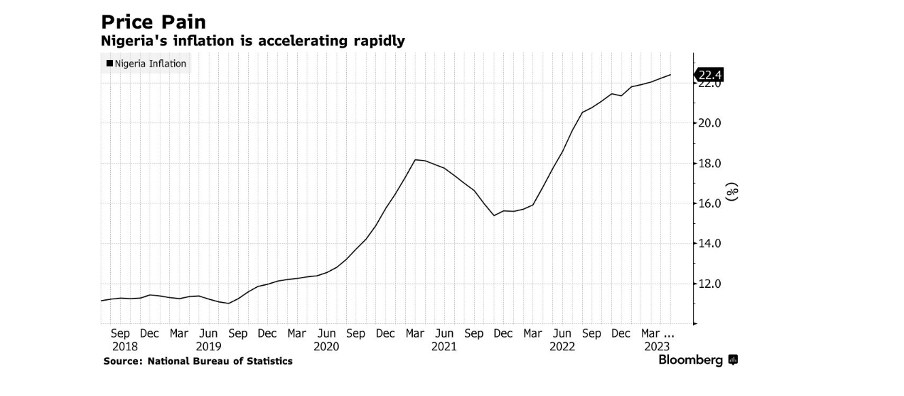

Nigeria’s inflation rate could reach 30% by the end of the year, up from 22.4% in May, warns Bank of America sub-Saharan Africa economist Tatonga Rusike. The removal of gasoline subsidies and the easing of currency restrictions by President Bola Tinubu in June have contributed to this inflationary pressure. In response, Rusike asserts that the central bank must take immediate monetary policy action, including significant interest rate hikes.

To curb the rising cost of goods and services, the central bank has already increased borrowing costs by 700 basis points since May last year. However, demonstrating a strong commitment to tackling inflation remains crucial to attracting foreign investors, who are monitoring the central bank’s response closely.

Foreign inflows hinge on monetary policy

Bank of America’s Rusike emphasizes the importance of reversing negative real interest rates to encourage foreign investment. Failure to address this issue would likely deter foreign inflows into the country. While Bank of America recommends aggressive rate increases, it acknowledges that the central bank may adopt a more measured approach.

Nigeria’s stabilization depends on receiving dollar inflows to address the undervalued naira. Bank of America predicts that the naira may appreciate to 680 per dollar by the end of the year, providing some relief. Currently, the naira is trading at 746.89 per dollar, according to the central bank’s data. Despite the challenges, recent policy decisions by the Nigerian government are viewed positively and are expected to lead to a potential rating upgrade, according to Bank of America’s report.

Undervalued naira and potential surpluses

Bank of America analysts assert that the Nigerian currency, the naira, is presently undervalued. The Central Bank of Nigeria’s decision to allow the naira to float freely initially resulted in a decline in its value. Subsequently, the naira has continued to depreciate against the dollar, with the exchange rate standing at 753 naira per dollar on June 26, according to the central bank’s data. On the parallel market, one U.S. dollar was buying 768 naira on July 1, 2023.

The analysts also suggest that higher oil revenues and a liberalized import regime could contribute to consistent current account surpluses for Nigeria. They further urge President Bola Ahmed Tinubu to address the issue of oil theft, as tackling this problem could significantly boost earnings from hydrocarbons and alleviate the country’s high debt service burden.

Conclusion

Nigeria is currently facing significant economic challenges, including mounting inflationary pressures and an undervalued currency. Bank of America analysts emphasize the urgent need for the central bank to take substantial measures, such as significant interest rate hikes, to address the rising inflation. Additionally, the undervalued naira is predicted to appreciate against the dollar, provided that foreign inflows increase. Higher oil revenues and a liberalized import regime present the potential for consistent current account surpluses. However, addressing issues like oil theft is crucial to realizing these benefits and easing Nigeria’s high debt burden.