Nearly eighteen months after launching its in-house Central Bank Digital Currency (CBDC), the eNaira, Nigeria is witnessing increased adoption as its national fiat currency faces severe shortages. This dire situation was caused by the central bank’s decision to replace old bank notes with bigger denominations in response to rising inflation. CBDCs have long been regarded as a viable alternative to traditional fiat currencies, yet their implementation has yet to be fully realized. However, Nigeria is leading the way in demonstrating the potential of CBDCs in modernizing national currency systems.

Nigeria’s sudden lack of physical cash forced citizens to use the eNaira, leading to a 63% increase in the value of eNaira transactions up to 22 billion Naira ($47.7 million). This is all the more impressive, considering that cash still accounts for roughly 90% of all transactions within the country. In addition, Godwin Emefiele, the Governor of the Central Bank of Nigeria, noted that the number of CBDC wallets had increased over 12-fold since October 2022, with over 13 million CBDC wallets now in circulation.

The introduction of demonetization in Nigeria significantly reduced the circulating cash supply from 3.2 trillion Naira to 1 trillion Naira. The country minted over 10 billion eNairas and implemented direct payouts using CBDCs in government initiatives and social schemes to promote CBDC adoption to compensate for this. Developing nations have found CBDCs to be a viable alternative to the traditional fiat economy, allowing them to reduce operating costs while strengthening their Anti-Money Laundering measures.

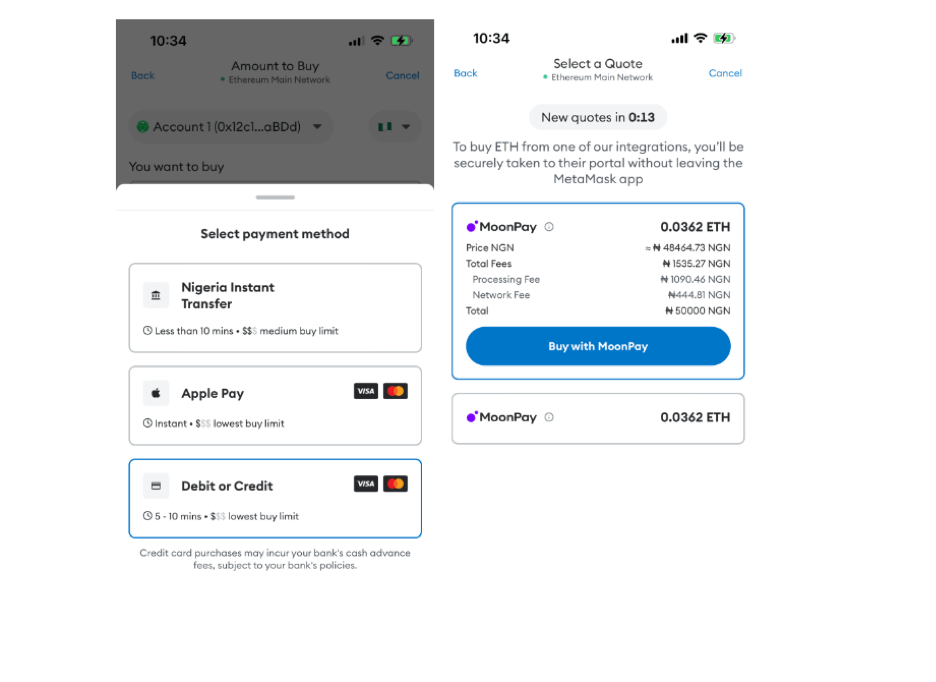

Governor Emefiele noted that the eNaira has become a popular electronic payment channel for financial inclusion and social interventions. As the country faces a cash crunch, Nigeria’s citizens now have an additional option to access cryptocurrencies. ConsenSys, the parent company of MetaMask, recently announced its MoonPay integration, allowing Nigerians to purchase crypto through bank transfers.

The MetaMask mobile and Portfolio DApp have been enhanced with the addition of a new feature that allows users in Nigeria to purchase crypto without using credit or debit cards – as shown in the above screenshot. This simplifies the buying process and provides additional accessibility for users within the region.