Nvidia stock is rallying again today, May 29, 2024, as it has moved past yesterday’s price cap of $1,128, reaching $1,146.28. Chip maker Nvidia’s share spiked 6% on Tuesday, hitting another record high. The silicon giant’s stock price crossed above $1,128 for the first time, increasing its market cap to $2.8 trillion.

Also read: Nvidia’s Stock Nears Record High as Earnings Approach

Nvidia’s stock also made another record, this time for the intra-day record high, as it touched $1,149 during the trading session, gaining 8% in a single day. At the time of writing, Nvidia stock has started to rally again, trading above $1,146. If the stock sustains this price mark, it will be its new all-time high.

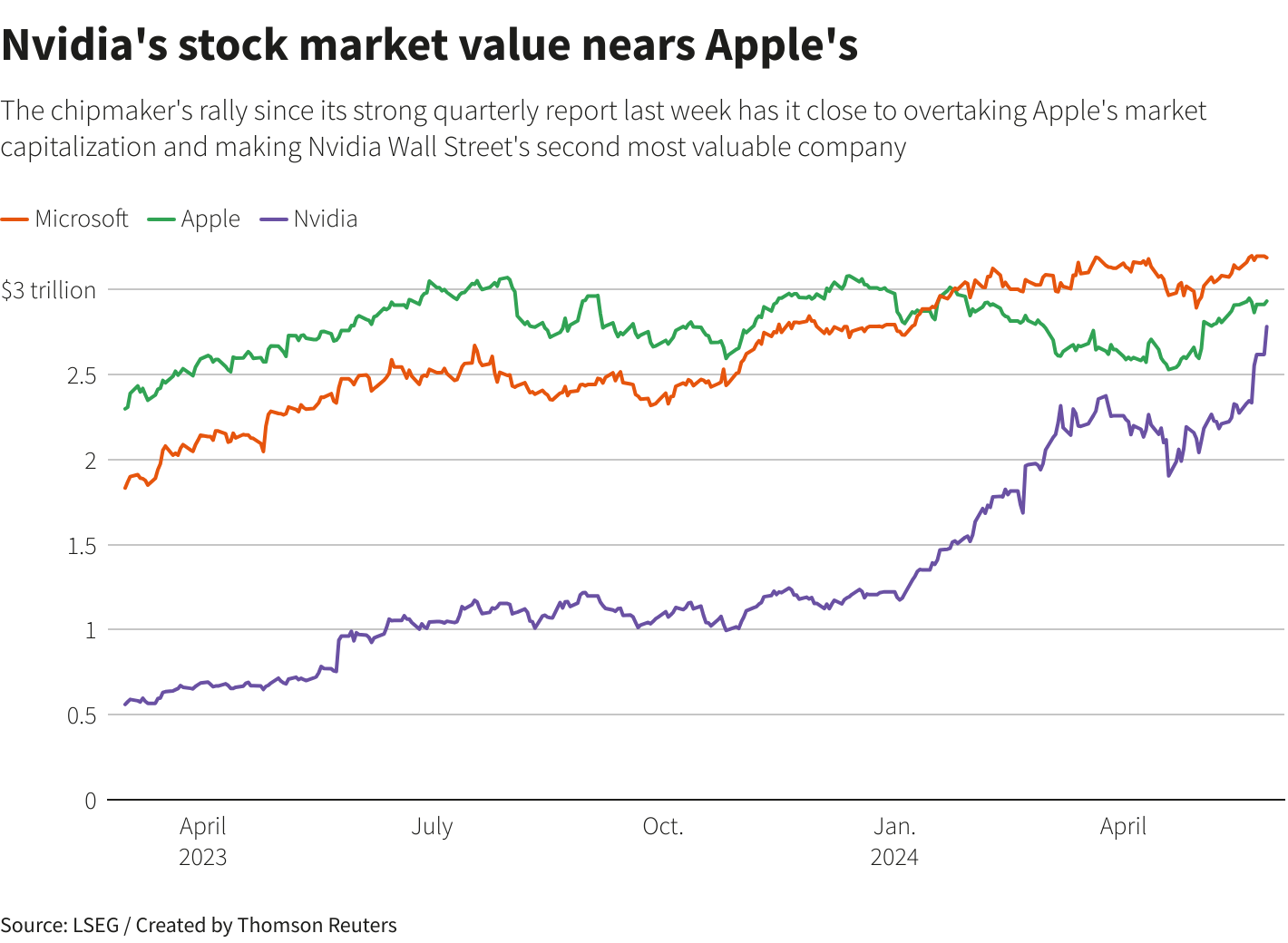

Nvidia’s Market Cap Nears $3 Trillion

Nvidia now ranks second to Apple, with a market capitalization of $2.9 trillion. As can be seen, it’s only $100 billion shy of Wall Street’s second-most valuable company, Apple. Microsoft still ranks first as the most valuable company in the world, with a market cap of $3.19 trillion.

The silicon giant’s stock is showing high volatility, which is rare for a multitrillion-dollar stock. Penny stocks are usually considered for high-profit margins as they swing wildly in just a few trading sessions. These wild swings provide traders with opportunities to pocket higher gains.

Also read: Amazon Is Struggling to Challenge Nvidia’s AI Chip Supremacy

However, this time, it’s Nvidia acting like penny stocks, marking astronomical gains. Nvidia recorded blockbuster earnings last week as it continued its ascend. During the last three days, it has grown by 20%, showing remarkable performance.

Nvidia is trading 36 times its forward profit estimates. The stock value increased threefold during 2023 and more than 100% in 2024.

Q2 Revenue Forecasts Also Have an Impact on Nvidia’s Stock Growth

Looking at the factors accelerating the stock’s growth, it becomes clear that its forecast for second-quarter (Q2) revenues is more than Wall Street expectations. Nvidia has increased by 13% since it announced the expected revenue growth.

Last week, the chip maker giant reported its first-quarter earnings, which increased 461% year over year. Nvidia’s revenue also grew by 262%, which was above investors’ expectations. Its data center segment is currently the best performer, as clients are buying its accelerators, which are considered the gold standard in the industry.

Also read: Wall Street Is Hunting AI Players Beyond Nvidia and Semiconductors

Another factor of excitement for investors is the announcement of a stock split. Nvidia announced a 10-for-1 stock split, which will be effective June 7. The stock split will bring the price down to $100 a share, but analysts are expecting that the split can go below this amount, further lowering the price.

Nvidia Is Considered To Be a Primary Beneficiary of the AI Boom

Since the stock was performing above expectations, traders were fearing a pullback because of the high surge in price. This time, Elon Musk came to the rescue when his firm xAI said in a blog post that Nvidia chips will be used to train chatbot Grok.

“xAI will continue on this steep trajectory of progress over the coming months, with multiple exciting technology updates and products soon to be announced.”

Musk.

The optimism was further boosted by the statement that xAI has raised $6 billion in its Series B funding round. Optimism still surrounds Nvidia, as it is considered among the top beneficiaries of the AI boom. Whenever a tech giant announces investment plans in AI infrastructure, a huge part of the investment moves towards Nvidia to understand this optimistic phenomenon.

Also read: Elon Musk’s xAI Raises $6B to Rival Google, OpenAI

During their first-quarter earnings calls, Google parent Alphabet and Meta announced heavy investments in AI infrastructure worth billions of dollars. Since Nvidia is producing the best GPUs for AI processing, analysts expect the funds will flow to Nvidia, which will keep the optimism going.

Cryptopolitan reporting by Aamir Sheikh