A deep-rooted distrust toward banks in many developed countries subsists, so crypto and fintech firms will firstly need to regain their trust.

A crypto and fintech “revolution” could solve the lack of financial inclusion in developing countries — but it first needs to gain the trust of the unbanked, according to a payments firm executive.

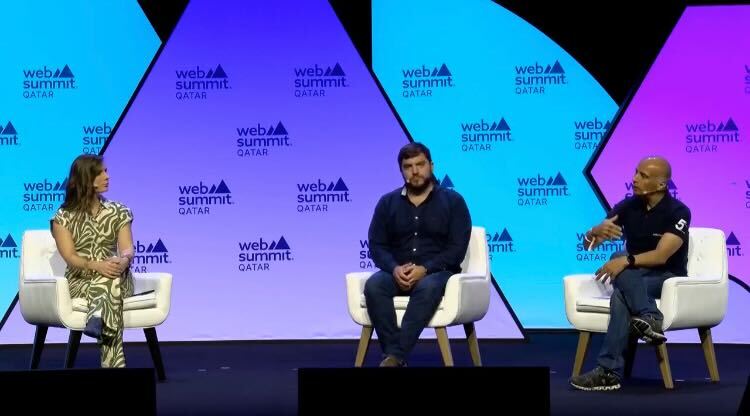

During a panel session at the Web Summit Qatar on Feb. 27 — Juan Pablo Ortega, a founder and CEO at online payment platform Yuno argued the biggest challenge to financial inclusion is distrust for anything other than cash — which he sees in high-inflation countries.

The panel was moderated by Cointelegraph’s ambassador and editor-at-large Kristina Lucrezia Cornèr.