Only 3% of the traders purchasing tokens on Pump.fun made more than $1000. At the same time, less than 0.8% of the traders have made $10,000+ trading memecoins on the platform.

These figures from a Dune dashboard suggest that most traders on the platform haven’t had any profitable trades despite the fact that thousands of tokens are launched on the platform every 24 hours.

60% of traders on Pump.fun lost money

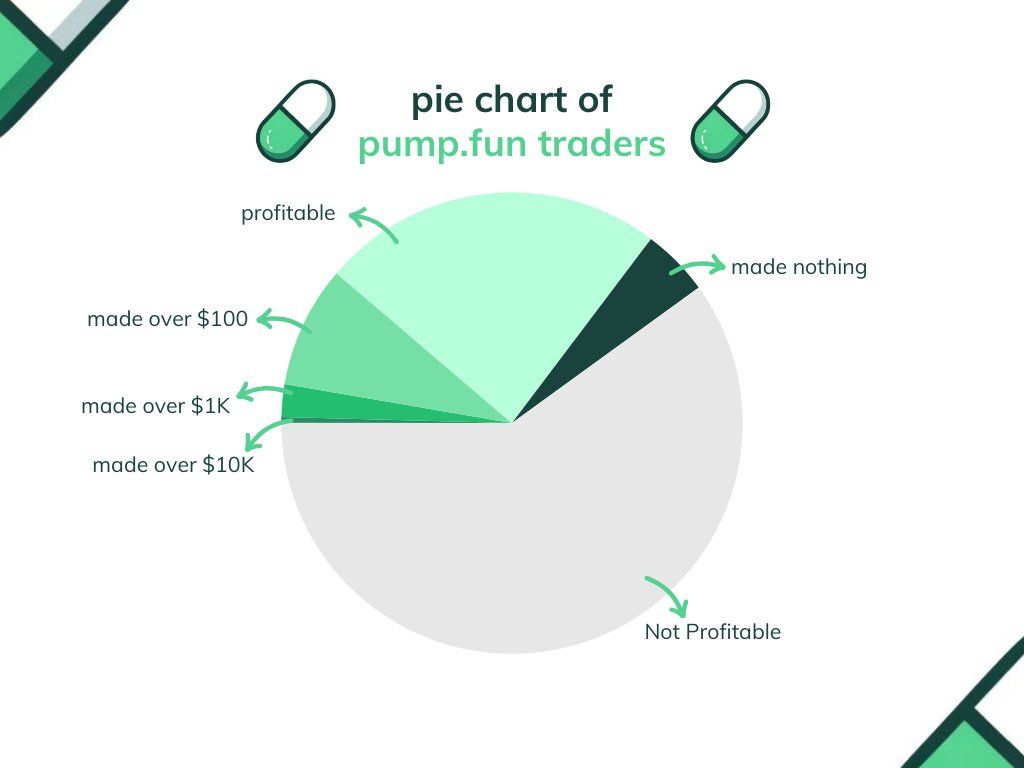

A crypto influencer recently shared a pie chart of pump.fun trader data in an X post based on another post by a user with the handle @Adam_Tehc.

According to the chart, 60% traders have lost money, 4.7% of them made no money at all, while 24% of the traders made less than $100.

On the other hand, those who made more than $100 stand at 11.2%, and only 3% made more than $1,000. Even rare are the traders who made above $10,000 (0.5%). Likewise, it was pointed out that people who made $10k+ can be barely seen on the pie chart.

Only a small percentage of tokens on Pump.fun are graduating

In the last 24 hours, less than 160 tokens out of 10.7k tokens have actually graduated to Raydium from Pump.fun. The remaining either stayed stagnant or lost their volume and liquidity as traders rushed out to take profits or cut their losses. This means that most tokens could not even hit a market cap of $60,000 after which the bonding curve’s funds would have transferred to a Raydium liquidity pool, and the token would have considered graduated.

Yet despite the fact that traders are becoming more doubtful about the memecoin super-cycle, the revenues generated by Pump.fun are nearing all-time highs. Between 10th August and 17th August, the platform made $6.3 million, double of the weekly average of $2.5 million in April. This figure is 50% higher as compared to its average weekly revenues in May.