Ethereum (<a href="https://www.coindesk.com/price/ethereum/" target="_blank">ETH</a>), the largest <a href="https://www.coindesk.com/learn/how-do-ethereum-smart-contracts-work/" target="_blank">smart-contracts</a> blockchain, for years has had <a href="https://www.coindesk.com/layer2/2022/04/13/reminder-the-merge-wont-solve-ethereums-scaling-woes-by-itself/" target="_blank">a scalability </a>issue. As more users joined the Ethereum ecosystem, the network became more expensive and slower to use.

To solve part of that issue, starting in 2019, Ethereum community members came out with their own scaling solutions, <a href="https://www.coindesk.com/learn/what-are-layer-2s" target="_blank">called layer 2s</a>, or rollups. Optimism (OP) was one of the first on the market.

Now, <a href="https://www.coindesk.com/learn/what-is-optimism/" target="_blank">Optimism’s technology</a> is widely used by many entities to create their own layer-2 networks. In 2024, Kraken, Uniswap, World Network (formerly Worldcoin) and Sony’s Blockchain Lab all tapped Optimism’s tech to create their own scaling blockchains. As the OP team has been able to convince some of crypto’s largest institutions to use their technology and join its ecosystem, Optimism’s founding team, led by Jing Wang, is nominated for CoinDesk’s 2024 Most Influential list. This profile is part of CoinDesk's Most Influential 2024 package. For all of this year's nominees, click here.

“If you have to put the finger on the pulse of the lifeline of the Optimism Collective, it is Jing Wang,” said Ben Jones, another co-founder of Optimism and a director at the Optimism Foundation, to CoinDesk in an interview.

The founding team consists of some Ethereum OGs including Wang, Jones, <a href="https://www.coindesk.com/consensus-magazine/2023/12/04/karl-floerschs-optimism-tech-paved-the-way-for-coinbases-base-blockchain" target="_blank">Karl Floersch</a>, Mark Tyneway, Kelvin Fichter and Kevin Ho. But their story dates back to 2016 when Wang was introduced to Floersch, a former researcher at the Ethereum Foundation (EF), ahead of creating Optimism.

B.O. (Before Optimism)

“The first time that we met, we were in a circle. We were all talking, and every time a new person entered the circle, Jing would make it a specific point to make them feel included, and ask them a specific question, to integrate them into the rest of the experience,” said Jones when asked about his first solo encounter with Wang.

“That's definitely not changed. In fact, she’s become only more capable of that kind of stuff at larger and larger scales at the time as a leader of the Collective.”

Read more: <a href="https://www.coindesk.com/tech/2024/11/06/is-optimisms-superchain-winning-the-ethereum-layer-2-race" target="_blank">Is Optimism's 'Superchain' Winning the Ethereum Layer-2 Race?</a>

Wang got her start in crypto first through the Bitcoin world, but expressed frustration with the lack of women participating in that developer ecosystem, <a href="https://www.youtube.com/watch?v=v7WlciSNGwg" target="_blank">according to a talk she gave</a> at a16z’s crypto startup school in July 2023. It was Vitalik Buterin, the Ethereum creator who also used to be a Bitcoin maxi, who convinced her to look into Ethereum, and introduced her to Floersch.

At the EF, Floersch took Wang under his wing, and gave her a “textbook” writing project. (The other project that was offered to her was a coding project, but ultimately was given to another mentee, Hayden Adams, who eventually created Uniswap from that, the largest decentralized cryptocurrency exchange on Ethereum today, <a href="https://defillama.com/protocols/Dexes/Ethereum" target="_blank">according to</a> DefiLlama.)

The “textbook” project that Wang began to focus her time on was Plasma, a scaling design that predates rollups, which eventually became the precursor to what Optimism is today.

“That’s pretty f****** crazy,” said Wang at <a href="https://www.youtube.com/watch?v=v7WlciSNGwg" target="_blank">the a16z talk</a> about the beginnings of Optimism and Uniswap, “but that’s how it started.”

Plasma was mostly an academic exercise that focused on scaling transactions on Ethereum. But eventually Wang, alongside Floersch, created the Plasma Group, a non-profit that pushed forward scaling research.

According to Wang, after the Plasma Group was created, she saw that people really wanted a layer 2 with lower fees and fast transactions, so they pivoted and came up with sketches for an optimistic rollup.

Because Plasma was a nonprofit, it was hard for the team to find enough funding to turn their research into products. “We were fed up with trying to convince anybody other than our crazy selves to join a research nonprofit that was accepting donations, and were hoping that continued to work,” said Jones to CoinDesk. “We were building very important public goods, and scaling infrastructure that needed to happen with blockchain to take over the world, and just nobody was funding it.”

“So part of what we did was we vowed to never have somebody else have to be in that situation again, as we turned towards Optimism and built out the Optimism Collective,” Jones added.

Optimism’s technological growth

Optimism <a href="https://www.coindesk.com/business/2020/02/11/plasma-became-optimism-and-it-might-just-save-ethereum" target="_blank">was created in 2019</a> and the network was up and running by the end of 2021. Later, the company running Optimism split into two entities, OP Labs BPC, the main developer firm helping build the Optimism blockchain, and the Optimism Foundation, which helps steward Optimism’s governance system as well as pushes ecosystem growth.

Wang was the CEO of Optimism BPC before the split, and became the Foundation’s CEO and executive director at the time of the split in 2022.

Optimism’s blockchain is powered by a technology called optimistic <a href="https://www.coindesk.com/layer2/2022/02/16/ethereums-rollups-arent-all-built-the-same/" target="_blank">rollups</a>, which bundle large amounts of transaction data into digestible batches, making it cheaper to transact on it than on Ethereum. Rollups have become so popular that a spew of them have popped up since Optimism went live. Other notable names include Arbitrum, Blast, zkSync, Polygon, Starknet and Scroll.

As the major rollups started to gain traction, a new trend emerged from the leading layer-2 projects, what can be known as “<a href="https://www.coindesk.com/tech/2023/06/28/ethereums-layer-2-teams-want-you-to-clone-their-code/" target="_blank">blockchain in a box</a>,” where the teams encouraged developers to clone their code, so they could spin up their own layer 2s. For Optimism, its <a href="https://www.coindesk.com/tech/2023/08/23/coinbases-chosen-blockchain-brand-sees-zero-threat-from-zero-knowledge/" target="_blank">framework became known as</a> the OP Stack, and was released in 2023, during the blockchain’s <a href="https://www.coindesk.com/tech/2023/06/06/optimism-completes-bedrock-hard-fork-in-pursuit-of-superchain" target="_blank">big upgrade called</a> “Bedrock.”

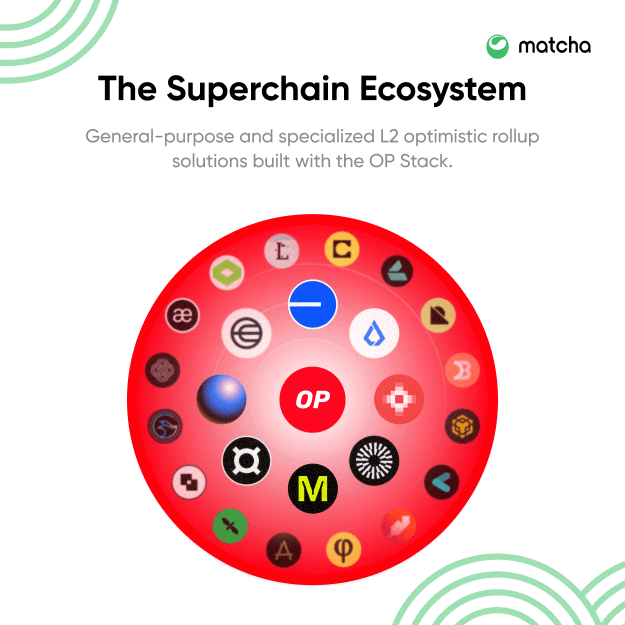

Chains under the OP Stack would join the “Superchain,” <a href="https://docs.optimism.io/stack/explainer" target="_blank">a network of blockchains</a> built with Optimism’s technology that would be interoperable, allowing for liquidity to be shared across chains while all adhering to Optimism’s governance and ethos, <a href="https://community.optimism.io/welcome/welcome-overview" target="_blank">known as the Collective</a>. The Superchain is also supposed to address the idea of fragmentation, making it easier for all the blockchains <a href="https://www.coindesk.com/tech/2024/08/12/optimism-pushes-for-interoperability-between-affiliated-blockchains" target="_blank">in that ecosystem to communicate</a> with each other and transfer funds more seamlessly.

“That's very important to us: that developers have a good experience and don't have to treat each of these individual chains in a complete and total silo, because it's going to make their lives easier as well,” Jones said.

Competitors like Arbitrum, Polygon, and zkSync also started to release their stacks, and quickly the battle to win over users and companies to build on their kits heated up.

The first major client of the OP Stack was Coinbase’s Base network, <a href="https://www.coindesk.com/tech/2023/08/09/coinbase-officially-launches-base-blockchain-milestone-for-a-public-company" target="_blank">bringing the largest U.S. exchange on-chain</a> in August 2023. Since then, many other major companies in the crypto industry have also come out with their own layer-2s, and tapped the OP Stack to roll that out. <a href="https://www.coindesk.com/tech/2024/10/10/uniswap-developer-unveils-own-layer-2-network-unichain-built-on-optimism-tech" target="_blank">Uniswap</a>, <a href="https://www.coindesk.com/tech/2024/04/17/worldcoin-sam-altmans-crypto-project-is-building-a-layer-2-chain" target="_blank">World</a>, Kraken, and Sony’s <a href="https://www.coindesk.com/tech/2024/08/23/sony-electronics-pioneer-behind-walkman-starts-own-blockchain-soneium" target="_blank">Blockchain Labs</a> all announced their layer-2s that will be built with OP Stack this year, making Optimism the clear winner.

Base is currently the second largest layer-2 with $9.8 billion in the protocol, ahead of OP which has $6.5 billion, <a href="https://l2beat.com/scaling/summary" target="_blank">according to L2 beat</a>. Of the 52 rollups that are live, 24 of them are built on OP Stack with $19 billion locked in them.

As of November 2024, layer 2s on the OP Stack accounted for 52.7% of all Ethereum layer-2 transactions, according to a spokesperson for the Optimism Foundation.

Jones attributes the success of OP Stack to how easy it is for developers to create their own chains. “There is a ton of complexity in just running a chain. And the reality is that just having good infrastructure that is reliable, that is easy to run, easy to maintain, and won't go down, is a super important part of the story,” he told CoinDesk.

Pay-For-Play: a winning strategy?

Competitors of Optimism have noted that part of OP’s strategy to get new networks to use their technology is to give <a href="https://www.coindesk.com/tech/2024/10/29/optimism-foundation-agreed-to-give-kraken-425m-of-op-tokens-in-layer-2-deal/" target="_blank">out large sums of OP tokens</a> in the form of grants. Officials at the Optimism Foundation previously told CoinDesk these grants are supposed to help developers kickstart their building on the stack, and in return are supposed to benefit the Collective and other networks in Optimism’s Superchain.

When Base went live, Coinbase shared that it would receive 118 million OP tokens, which was at $1.55 at the time of launch, worth about $182 million (at the time of writing, it's now worth $283 million.) In return, Base <a href="https://optimism.mirror.xyz/ciJzgxmb_fJU8wgiqrEXG_XYnAkuBrdG1biVk0BseiU" target="_blank">committed to share</a> 2.5% of its total revenue from sequencer fees or 15% of profits (whichever was higher) to the Collective as a contribution to Optimism’s ecosystem.

Since then, some projects have been less forthcoming about how many tokens they would receive from the Optimism Foundation for building on OP Stack. CoinDesk first reported that Kraken would receive 25 million OP tokens for building on OP Stack, <a href="https://www.coingecko.com/en/coins/optimism" target="_blank">worth $100 million</a> at the time of the deal, now worth $60 million.

According to officials at Kraken, the <a href="https://www.coindesk.com/tech/2024/10/29/optimism-foundation-agreed-to-give-kraken-425m-of-op-tokens-in-layer-2-deal" target="_blank">payout was in line</a> with other major projects received from Optimism.

Uniswap, Sony, and Worldcoin all declined to comment on how many tokens they will receive from Optimism over time. Other smaller projects have shared the number of OP tokens they will receive in grants. For instance, Celo will get 6.5 million tokens and BOB gets 750,000 tokens.

Optimism Foundation officials previously told CoinDesk they leave it up to the projects to disclose the amounts of their grants. A spokesperson shared with CoinDesk that the Optimism ecosystem has <a href="https://docs.google.com/spreadsheets/d/1qVMhLmmch3s6XSbiBe8hgD4ntMkPIOhc1WrhsYsQc7M/edit?gid=470961921#gid=470961921" target="_blank">been transparent about their treasury</a>, and that the Kraken deal falls under their

“partnerships fund,” which goes “to certain projects to help support initial development of the chain.”

“I think it's fair to call-out that there are many teams out there where grants are used as a very common practice in the industry,” Jones told CoinDesk. “We're not going to shy away from helping our developers grow, in an industry where grants are useful towards that.”

The lack of transparency around how many OP tokens are designated to chains raises questions about how much those grants factored into those deals.

But Jones argues that handing out OP tokens should not be looked at as just giving out money. These projects are using Optimism’s technology for free (since it's open-sourced) and are contributing to improve Optimism’s code and software. In other words, they are being awarded for their work on the larger OP ecosystem, which then gets contributed back to the Collective.

“I would also say that it's extremely important to understand that we are building a governance system which is intended to give the people in our positive-sum system a voice,” Jones said.

“I think the most important thing to drive home is that, one, this thing (OP Stack) is successful, even in the parts of the world where the grants are not factored,” Jones added. “Two, I think that it's just fundamentally reductive to talk about these grants in terms of like some amount of OP tokens, without understanding what those OP tokens are for. And I think it is absolutely a critical part of the strategy for us to unite the set of projects that make up the Superchain.”

Optimism’s bet is that easy technology plus grants will be a winning strategy. For now, though, only time will tell whether Optimism remains the winner for Ethereum scaling.