Crypto influencer Pauly0x has unexpectedly made nearly $1 million by demanding Ethereum transfers to his yougetnothing.eth wallet. With a tweet calling the Bitcoin sector “an absolute joke,” this experiment drew much attention and more than $1 million in just seven minutes. The episode demonstrates the crypto sphere’s quirkiness and unpredictability.

Pauly0x swoops $1 million in Ethereum transfers

According to media reports, a crypto influencer named Pauly0x made close to $1 million after requesting Ethereum transfers from fans to his yougetnothing.eth wallet. In response, the social media influencer called the cryptocurrency industry “an absolute joke” on Twitter.

Pauly0x made a public Ethereum address available to the public on May 30. A GIF of the “You Get Nothing!” a scene from Charlie and the Chocolate Factory was attached to it.

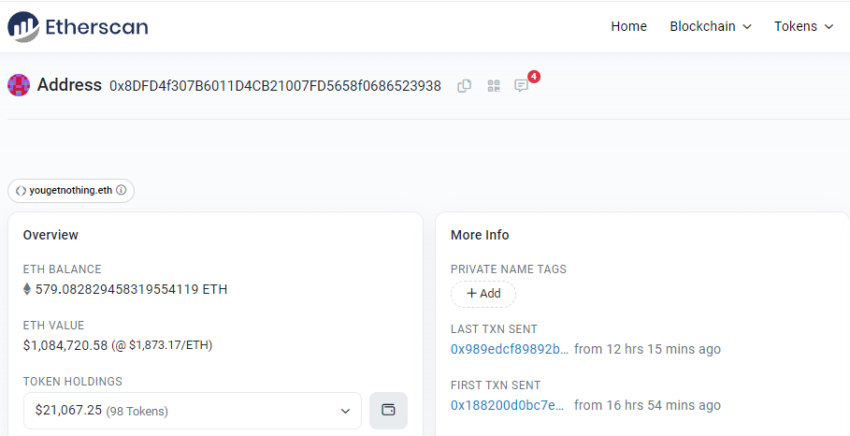

After the first seven minutes, Pauly stated that the account had received about $80 in Ethereum. The tweet received 1.2 million views in a single day, helping the total to surpass $1 million. Etherscan shows more than 579 ETH in the wallet at the time of publication.

On Twitter, Pauly congratulated those who joined the “million dollar club” on May 31, adding that they will “literally receive nothing.” He stated,

If there is anything you learn from following this account,” he said, “I hope you should never take any of these literal A**CLOWNS seriously.

PaulyOX

Users of the Pepe community responded to the announcement by using Pepe the Frog, the mascot of the infamous PEPE meme coin, as a pump.

Harrison, an on-chain auditor, discovered that the address received about $600,000 from 3,000 transactions. Even the balance of 43 wallets, greater than 0.5 ETH, was transmitted. It is fascinating that various sums are repeated throughout the transfers, even if these are just hypotheses. Three addresses sent 10 ETH, while the other ten sent between 5 and 7 ETH. 42 addresses sent one ETH, while six addresses sent between three and four.

According to Etherscan, one of the addresses that sent 10 ETH was first active on May 22. Oddly, the first transaction to that wallet was 544 ETH from the crypto loan exchange MEXC.

Ethereum market faces investor holdings drop

Recent research indicates that the Ethereum market is currently experiencing severe difficulties. Data from the on-chain analytics company Glassnode suggest a significant drop in prominent investors’ holdings.

According to data, the whales, or Ethereum addresses with 1,000 or more tokens, have dropped to a 10-month low of 6,268. This low was previously recorded in November 2022, when a total of 6,270 was marginally higher.

Notably, the value of whale holdings is falling, which is usually a bearish sign, implying that institutional investors may be losing faith in the near-term prospects of Ethereum. According to analysts, such a change in the attitudes of large investors frequently has a discernible effect on the market.

The whales play a vital role since the size of their transactions might affect the price of Ethereum. Ethereum has moved closer to the 50-day Exponential Moving Average (EMA) simultaneously.

Technically speaking, the second-largest cryptocurrency might consolidate at this level. Analysts contend that the declining trade volume may, nonetheless, have an impact on the stability of Ethereum’s price. Numerous causes may have contributed to these changes among whale investors.

Despite a decline in the number of Ethereum whale addresses, holdings have continued to grow quickly. This suggests that even though some investors decide to sell their assets, some are optimistic about the asset. Another factor to consider is that some whales may be reallocating their assets in response to market trends, while others may be collecting profits after Ethereum’s recent surges.

Analysts speculate that some whales may be reducing their holdings because of worries about the scalability of Ethereum and its high transaction costs. It is crucial to note that Ethereum is about to undergo a significant update to enhance scalability, security, and sustainability.

Investor sentiment may be impacted by this upgrade as the potential risks and advantages of the change become more apparent. Some investors may be concerned by whales’ declining Ethereum holdings since it may be a harbinger of investor dissent or a decline in the market. The ownership of Ethereum is one of many issues to be aware of right now, though.