The PC market is rebounding after a two year long decline. The first quarter of 2024 saw some major improvements, according to reports from IDC and Canalys. It is expected that the sales will continue to rise as new AI PC models hit the market. The primary factors of impact are considered the launching of AI PCs and other hardware upgrades with Windows 11, which have likely generated a lot of interest.

The fourth quarter of the last year was the time when the sales started recovering, but overall, the year appeared worst for PC sales as they declined to the lowest of the 17 years. But the bullish reports from IDC and Canalys show rebounding sales, and IDC reports 59.8 million shipments globally in the first quarter of 2024, which is 1.5% higher than the previous year.

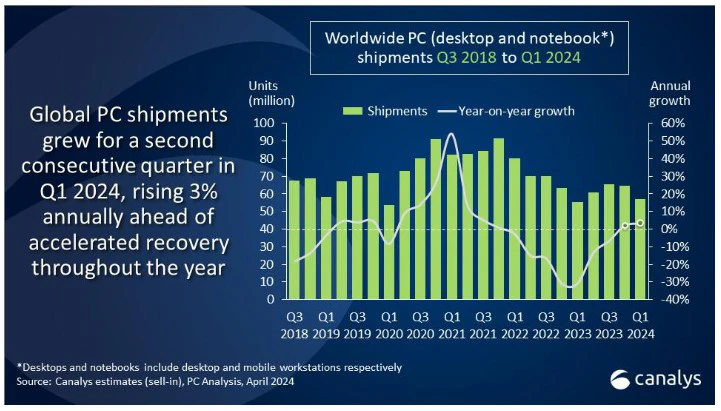

Canalys also shows a 3.2% increase in shipments of notebooks and desktops, which amounts to 572 million units in the first quarter of 2024. But the desktop shipment, including desktop workstations, went down by 0.4% to 12.1 million units. But at the same time, the notebook shipments, which include mobile workstations/laptops increased from 4.25 to 45.1 million units.

The report suggests that the growth, despite being modest, shows a recovery in sales driven by the demand for AI PCs, which is expected to increase further.

Ishan Dutt, Principal Analyst at Canalys, said,

“Growth in the first quarter of 2024 bodes well for a strong PC market throughout the year.”

Source: Ishan Dutt.

Macroeconomics may suppress PC market balance

Ishan Dutt also highlighted that the broader macroeconomic conditions in some markets continue to put a strain on PC demand. But he thinks that the market will improve in the coming months due to the available opportunities from the commercial users. Other customers might also want to upgrade and transition to Windows 11, which will also have a positive impact on sales.

According to Gartner analyst Mikako Kitagawa,

“The PC market has hit the bottom of its decline after a significant adjustment.”

He also said,

“Inventory was normalized in the fourth quarter of 2023, which had been an issue plaguing the industry for two years. This subtle growth suggests that demand and supply are finally balanced.”

Source: Mikako Kitagawa.

Kitagawa also issued a warning that the economic and geopolitical volatility could disturb the PC market again, making the balance short lived.

But according to Ishan Dutt, the introduction of AI PCs in the second quarter on a large scale will also drive the market up. He also thinks that the customers who held on to purchases after 2020 may also want to upgrade their systems, the reason being AI capability and better processors. It is estimated that almost 50 million PCs shipped in 2024 will have AI capability with a dedicated AI accelerator such as an NPU.

Top players in the PC market

Speaking of brands, Lenovo is in the lead position in PC sales for quarter one of 2024, seeing a growth of 8% and a market share of 24%. Lenovo shipped 13.7 million laptops and desktops. The second position is held by HP. But HP’s performance was mostly flat, with a growth rate of only 0.3% and a 21% market share. HP shipped a little more than 12 million units. Dell is third from the top, and the only brand with negative growth among the top five market players. Dell’s growth got hit and went negative by -2,22%, while selling 12.2 million PCs.

2023 was the year with the lowest PC demand at the start, attributed to high inflation and a bad economic outlook. High interest rates also played a role, resulting in low demand and a steep decline in sales. This year, these challenges are easing off, and global PC sales are finally returning to the level where they were before the pandemic. AI PCs are expected to generate demand despite their higher prices, but this will also bring opportunities for vendors.