Coinspeaker

PlanB Reaffirms Bullish Stance for Bitcoin Based on Stock-to-Flow (S2F) Model

The ongoing mainstream adoption of the cryptocurrency market around the world has not prevented Bitcoin (BTC) price from being trapped in a downward spiral since March this year. However, several technical and fundamental models predict that Bitcoin price could soon break out to a new all-time high (ATH) before the end of this year.

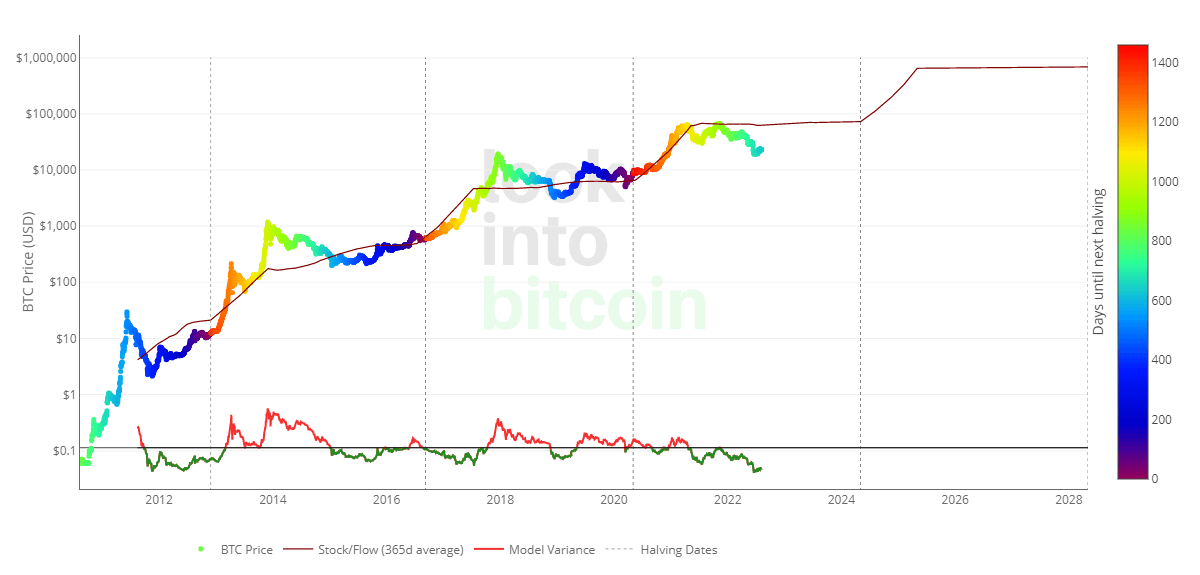

According to crypto analyst PlanB, popularly known for his stock-to-flow (S2F) model that accurately predicted Bitcoin price action in the 2021 cycle, Bitcoin price is still in a macro bull market despite the ongoing choppy trend.

Bitcoin is still in a bull market!

My market analysishttps://t.co/GpNT5BjwYZ pic.twitter.com/UBnmbSKlg3

— PlanB (@100trillionUSD) August 8, 2024

Rising Bitcoin Demand

The rate of Bitcoin adoption around the world has significantly spiked since the approval of spot BTC ETFs in the United States and other jurisdictions earlier this year. More institutional investors led by MicroStrategy Inc (NASDAQ: MSTR) and Metaplanet Inc have gradually adopted the Bitcoin strategy to bolster their respective investment portfolios and balance sheets.

According to on-chain data, institutional investors with more than 1k Bitcoins in their balance, excluding exchanges and miners, have been aggressively accumulating in the past few months. For instance, long-term investors of Bitcoin added more than 184,500 BTC coins in the past few weeks, regardless of the volatility.

Institutions are buying up #Bitcoin

Meanwhile retail is scared or sleeping pic.twitter.com/s2qg5cObXt

— Quinten | 048.eth (@QuintenFrancois) August 8, 2024

Meanwhile, the US spot Bitcoin ETFs, led by BlackRock’s IBIT, currently hold BTC coins worth about $50 billion. On Wednesday, the US spot Bitcoin ETFs accumulated coins worth around $45 million while BTC miners were rewarded half the purchased amount.

Worth noting that Bitcoin’s hash rate has risen to an all-time high after a notable decline following the fourth halving event, which significantly increased the mining difficulty. As a result, the Bitcoin network is more secure than ever before with more players involved in the mining industry.

Midterm BTC Price Expectations

From a technical standpoint, Bitcoin price has been consolidating in a bullish flag in the past five months, which could lead to a major breakout soon. As Coinspeaker previously noted, the current Bitcoin price correction is similar to the 2015-2017 post-halving bull cycle.

Additionally, some experts have compared the recent Bitcoin price crash to $49K to the 2020 Black Thursday caused by the Covid-19 breakout.

With August and September expected to remain relatively bearish for Bitcoin and the entire crypto industry, a potential bullish breakout in October and November could pump the flagship coin toward $100k.

However, the Bitcoin market is expected to begin bleeding to the altcoin industry, triggering the much-anticipated altseason. Already, Bitcoin’s dominance has risen to a major resistance level above 57 percent, with the weekly Relative Strength Index (RSI) suggesting an inevitable reversal on the horizon.

PlanB Reaffirms Bullish Stance for Bitcoin Based on Stock-to-Flow (S2F) Model