Polkadot is a project created to combat the interoperability issue of the blockchain industry. While there is an array of similar projects with the same goal, Polkadot stands out as a proven success with an ecosystem of 500+ different projects capable of interacting easily with one other. In this piece, we will discuss some of the projects in the Polkadot ecosystem with the potential for massive growth in the coming years.

The Polkadot Ecosystem – An Overview

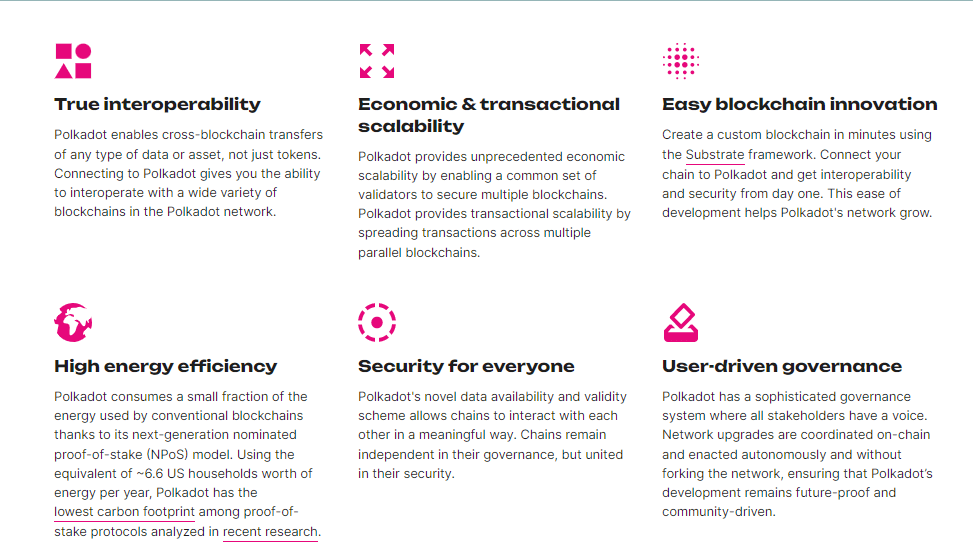

Polkadot is a network protocol that facilitates interaction between specialized blockchains, thereby allowing the seamless transfer of any data across any type of blockchain. Polkadot is also a secure and scalable network for building decentralized applications (dApps) and blockchains using the Substrate development framework.

Polkadot was launched in May 2020. It is the flagship project of the Web3 Foundation, a Swiss foundation created to fund the development of applications for decentralized web software protocols. The Web3 Foundation was co-founded by Dr.Gavin Wood, the visioner of Polkadot, who published the project’s white paper as far back as October 2016.

Polkadot was created to promote true blockchain interoperability by enabling the cross-chain transfer of any form of data or asset, not just tokens. To this end, Polkadot has a unique architecture consisting of four main structures – the relay chain, parachains, parathreads, and bridges.

- The relay chain is the core network of the Polkadot ecosystem. It is responsible for maintaining the cross-chain interoperability of all chains on the Polkadot network. Also, all blockchains on Polkadot share the same security with the Polkadot relay chain.

- Parachains are individual blockchains connected to the relay chain. Although Polkadot has a “shared-security model,” each parachain is an independent blockchain with its own token and network rules. Blockchains are usually required to lease a slot to operate as a parachain on the Polkadot network.

- Parathreads are similar to Parachains but operate a pay-as-you-go model. These blockchains do not need to lease a parachain slot as they only work when needed. These chains have a slower block time but still, share the same security and interoperability as the Polkadot network.

- Bridges are protocols that allow parachains and parathreads to interact with external networks such as Ethereum and Bitcoin.

With these elements, Polkadot is able to create a cross-chain environment that enables scalability, security, and interoperability. Due to these merits, the Polkadot network has quickly developed into a vibrant ecosystem, with a continuous influx of new projects.

Here is a Polkadot ecosystem coins list based on market cap. You should note that this list is not exhaustive but only provides an overview of the top pick for 2023.

Polkadot Ecosystem Coins List

The Polkadot ecosystem plays a pivotal role in the dynamic landscape of blockchain technology. Its significance lies in its capacity to foster web3 interoperability, allowing different blockchain networks to communicate and collaborate seamlessly.

Polkadot is a blockchain platform that stands out for its innovative approach to addressing key challenges within the blockchain industry. It offers a streamlined and efficient solution to the issue of blockchain interoperability, allowing different blockchain networks to interact and share information seamlessly.

As a decentralized blockchain platform, Polkadot embodies the principles of transparency, security, and decentralization. It solves some of the most pressing challenges within the blockchain industry. As we dive into this article, the objective is to provide readers with a clear and concise compilation of coins that thrive within the Polkadot ecosystem.

At its core, Polkadot enables the creation of multiple blockchains, known as parachains, which can operate independently while still being able to communicate and share data. This unique feature sets Polkadot apart, as it resolves the longstanding problem of isolated blockchains that cannot effectively collaborate.

One of Polkadot’s key features is its ability to facilitate cross-blockchain transfers of various data types and assets, not limited solely to cryptocurrencies. This opens up a world of possibilities for developers and users, making it a hub for creating innovative blockchain applications and decentralized services.

Polkadot’s mission is to create a cohesive and interconnected blockchain ecosystem where different networks can work together harmoniously. By providing a framework for interoperability and scalability, Polkadot aims to propel the blockchain industry forward and usher in the era of web3, where decentralized technologies can reach their full potential.

Investing in cryptocurrencies within the Polkadot ecosystem presents a compelling opportunity in the ever-evolving world of blockchain technology. Polkadot, a decentralized blockchain platform, has gained recognition for its innovative approach to solving fundamental challenges in the blockchain industry. This section will explore why investing in Polkadot ecosystem coins is advantageous and emphasize the importance of diversification in a cryptocurrency portfolio.

Advantages of Polkadot Ecosystem Coins

Interoperability

One of the standout features of the Polkadot ecosystem is its emphasis on interoperability. Traditional blockchain networks often operate in isolation, leading to fragmentation and inefficiency. However, Polkadot breaks down these barriers by enabling different blockchain networks to communicate and share data seamlessly.

Coins within the Polkadot ecosystem benefit from this interoperability, as they can leverage the power of collaboration with other chains. This feature expands their utility beyond the limitations of a single blockchain, enhancing their potential for real-world applications.

Scalability

Scalability is a critical factor in blockchain technology. The need for higher throughput becomes evident as more users and applications join a blockchain network. Polkadot addresses this challenge by allowing the creation of multiple parachains, which are individual blockchains that can run in parallel. These parachains enhance scalability, making transactions faster and more efficient. Coins associated with Polkadot can benefit from improved performance, making them attractive for various use cases.

Innovation Hub

Polkadot has emerged as a vibrant hub for innovation in the blockchain space. Its ecosystem is characterized by a constant stream of developments, including creating new decentralized applications (dApps) and services. Developers are drawn to the platform’s flexibility and the potential to build cutting-edge solutions. This innovation bolsters the ecosystem and contributes to the long-term growth prospects of associated coins.

Security

Security is paramount in the world of cryptocurrencies. Polkadot employs a unique consensus mechanism known as Nominated Proof-of-Stake (NPoS), which enhances the network’s security. This design reduces the risk of malicious attacks and vulnerabilities, instilling confidence in the ecosystem. For investors, the assurance of robust security measures is crucial when considering investment options.

Diversification

Diversification is a fundamental principle of investment strategy, and it applies equally to the cryptocurrency market. While flagship cryptocurrencies like Bitcoin and Ethereum continue to dominate the landscape, investing in coins within the Polkadot ecosystem can diversify one’s portfolio.

Relying solely on a single blockchain network exposes investors to network-specific risks. By including Polkadot ecosystem coins, investors spread their risk across different assets, reducing exposure to cryptocurrency fluctuations.

Diversifying a cryptocurrency portfolio is not just a recommendation; it’s a strategy that can help mitigate risk. The cryptocurrency market is known for its volatility, and while it offers significant growth potential, it also carries inherent uncertainty.

By diversifying, investors reduce their dependency on the performance of a single cryptocurrency and spread their investments across various assets. This strategy can enhance portfolio stability and offer a more balanced approach to cryptocurrency investment.

Top Polkadot Ecosystem Coins

The Polkadot ecosystem has emerged as a dynamic and innovative space within the blockchain industry. Its unique architecture, designed to promote interoperability and scalability, has attracted many projects and cryptocurrencies.

These coins play a crucial role in the ecosystem and contribute to the broader blockchain landscape. Let’s dive into their unique features and purposes.

Polkadot (DOT)

Market Capitalization: Polkadot (DOT) is the flagship cryptocurrency of the Polkadot ecosystem, boasting a high market capitalization of $5.4B.

Utility: DOT serves as the native token of the Polkadot network and plays a pivotal role in its operations. It facilitates transactions, staking for network security, and governance, allowing DOT holders to participate in decision-making processes. Polkadot’s unique design also enables it to interconnect various blockchains, promoting cross-chain communication and data transfer.

Chainlink (LINK)

Market Capitalization: Chainlink (LINK) holds a significant market capitalization of $ 3.31B.

Utility: Chainlink is renowned for its decentralized Oracle services, vital for smart contracts to access real-world data accurately and securely. Within the Polkadot ecosystem, Chainlink ensures that smart contracts on different parachains can interact with external information sources seamlessly. This feature enhances the functionality of decentralized applications (dApps) and DeFi platforms on Polkadot.

Astar (ASTR)

Market Capitalization: Astar (ASTR) is an emerging player with a growing market capitalization of $314,989,369.

Utility: Astar is a parachain on Polkadot dedicated to decentralized finance (DeFi). It aims to provide DeFi applications with a robust platform for lending, trading, and yield farming activities. Astar’s focus on financial services positions it as a critical contributor to the DeFi ecosystem within Polkadot.

Moonbeam (GLMR)

Market Capitalization: Moonbeam (GLMR) is witnessing rising market capitalization and is now at $133,004,674.

Utility: Moonbeam stands out as a bridge between Polkadot and the Ethereum network. It allows Ethereum developers to port their projects to Polkadot, fostering interoperability efficiently. By providing compatibility with Ethereum’s tools and smart contract languages, Moonbeam aims to accelerate the adoption of Polkadot.

Kusama (KSM)

Market Capitalization: Kusama (KSM) is a notable player within the Polkadot ecosystem and has a market capitalization of around $172,450,395.

Utility: Kusama serves as a canary network for Polkadot, enabling developers to experiment with new features and upgrades before implementing them on the leading Polkadot network. Kusama’s role in testing and experimentation enhances the overall reliability of the network.

Pros and Cons of Five Notable Coins

Polkadot (DOT)

Pros: DOT benefits from a robust ecosystem, enabling interoperability and scalability. Its on-chain governance fosters adaptability and consensus.

Cons: The complexity of Polkadot’s technology may pose a barrier to entry for some projects. Its governance model can also lead to disputes.

Chainlink (LINK)

Pros: Chainlink’s decentralized oracle services are in high demand, making it a vital component of DeFi projects within Polkadot. Its broad integration across multiple blockchains is a strength.

Cons: LINK’s reliance on external data sources can expose it to potential vulnerabilities. Competition in the oracle space is fierce.

Astar (ASTR)

Pros: Astar’s focus on DeFi services within Polkadot positions it well for growth in the thriving DeFi sector. Its versatility in supporting various DeFi activities is a plus.

Cons: Astar faces competition from established DeFi projects as an emerging player. Building a robust user base will be a challenge.

Moonbeam (GLMR)

Pros: Moonbeam’s compatibility with Ethereum tools and smart contract languages simplifies the migration of Ethereum projects to Polkadot. This Ethereum-Polkadot bridge is a unique advantage.

Cons: Moonbeam competes with other Ethereum-compatible networks, and success depends on attracting Ethereum developers.

Kusama (KSM)

Pros: Kusama’s role as a testing ground for Polkadot upgrades and innovations enhances the reliability of the Polkadot ecosystem. Its agile governance system allows for rapid decision-making.

Cons: Kusama’s experimental nature may be unsuitable for risk-averse investors. Price volatility can be significant.

Considerations for Investors

Investing in coins within the Polkadot ecosystem offers promising opportunities, but investors must consider this space carefully. Here are key factors to keep in mind:

- Research and Due Diligence: Thorough research is crucial before investing in any coin. Understand the project’s utility, its team, and its long-term goals. Explore the project’s whitepaper and roadmap to gain insights into its vision and execution plans.

- Market Volatility: Cryptocurrency markets are known for their extreme volatility. Prices can fluctuate significantly in a short period. Investors should be prepared for sudden price swings and only invest what they can afford to lose.

- Diversification: Diversifying your cryptocurrency portfolio can help spread risk. Instead of putting all funds into one coin, consider investing in a mix of assets, including different cryptocurrencies and asset classes.

- Long-Term Perspective: While day trading is an option, many successful cryptocurrency investors adopt a long-term perspective. Holding assets for an extended period can yield higher returns and reduce the impact of short-term price fluctuations.

- Security: Ensure your investments are stored securely in reputable wallets or exchanges. Use hardware wallets for added security and enable two-factor authentication wherever possible.

- Regulatory Considerations: Keep an eye on regulatory developments in cryptocurrency, as regulations can affect the market and investment opportunities.

Challenges of Polkadot Ecosystem Coins

- Interoperability Complexity: While Polkadot’s interoperability is a strength, it also presents challenges. Developing parachains and ensuring smooth communication between them demands a high level of technical expertise, which can be a hurdle for projects.

- Market Volatility: As with most cryptocurrencies, coins within the Polkadot ecosystem face price volatility. This can be a challenge for investors looking for stable and predictable returns.

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving. Coins must navigate changing regulations, which can impact their operations and user base.

- Competition: The Polkadot ecosystem is highly competitive, with various projects vying for attention and resources. Standing out in this crowded field can be challenging.

- Adoption and Network Effects: Achieving widespread adoption and building a strong network effect can be difficult. Projects need to attract users and developers to gain momentum.

Where to Buy Polkadot ecosystem tokens?

The table below shows a list of cryptocurrency exchanges where these Polkadot ecosystem tokens can be easily purchased.

| Polkadot Token | Exchanges Available |

| Polkadot (DOT) | Binance, FTX, Coinbase Exchange, Gate.io, KuCoin, etc. |

| Chainlink (LINK), | Binance, Coinbase Exchange, FTX, KuCoin, Gate.io, etc. |

| Compound (COMP) | Binance, Coinone, Coinbase Exchange, Bithumb, FTX, etc. |

| Kusama (KSM) | Binance, Kraken, KuCoin, Bithumb, Gate.io, Huobi Global, etc. |

| Ankr (ANKR) | Binance, Coinbase Exchange, Kucoin, Bithumb, Huobi Global, etc. |

| 0x (ZRX) | Binance, Coinbase Exchange, Bithumb, Huobi Global, Bitfinex, etc. |

| Ontology (ONT) | Binance, Huobi Global, Bithumb, Gate.io, KuCoin, etc. |

| Moonbeam (GLMR) | Binance, KuCoin, Gate.io, Huobi Global, Kraken, etc. |

| MXC (MXC) | Gate.io, Huobi Global, KuCoin, Coinbase Exchange, Bithumb, etc. |

| Energy Web Token (EWT) | KuCoin, Kraken, Gate.io, CoinEx, BitMart, etc. |

Final Thoughts

The list above shows a list of tokens on the Polkadot network, which we have earmarked as favorable investment assets for the future. However, this is not investment advice. Always conduct further research before investing in any coin. In addition, you should check out other tokens in the Polkadot ecosystem, as the network boasts numerous tokens with good prospects.

The Polkadot ecosystem emerges as a dynamic and promising realm for cryptocurrency enthusiasts. Its core features, such as robust interoperability and scalability, set it apart in the blockchain landscape. However, investors and developers must tread this path cautiously, conducting thorough research and adopting a long-term perspective.

The cryptocurrency market’s notorious volatility demands prudent risk management and diversification of portfolios. As this ecosystem evolves, staying informed and vigilant is critical to navigating its opportunities effectively.

We encourage readers to delve deeper into the Polkadot ecosystem, monitoring its vibrant developments and exploring emerging projects. By doing so, individuals can seize the potential benefits while minimizing risks, ensuring a more informed approach to investment and participation in this exciting blockchain frontier.

Curious about the Polkadot Network? You may also want to read: