The recent Polkdot price analysis for today shows bearish momentum driving it downwards. The DOT/USD is 3.71% down since the early trading to $6.33 and is currently at $6.07. The bearish pressure has pushed the price below the resistance level of $6.37, which was the previous high. However, there is still support at the $5.87 level.

The low trading volume, however, suggests that the prices may not move much in the near future unless there is a significant sentiment shift or an important news update. Currently, the trading volume is currently at $290 million, which is down from the previous day. Looking at the market cap for cryptocurrency is at $7.04 billion, with a decrease of 3.26%.

The most of the cryptocurrencies today are trading in red, with Bitcoin and Ethereum both being down -4% and -.3.68 percent, respectively. This can be attributed to the market-wide sell-off that has been present in the market for the past few days.

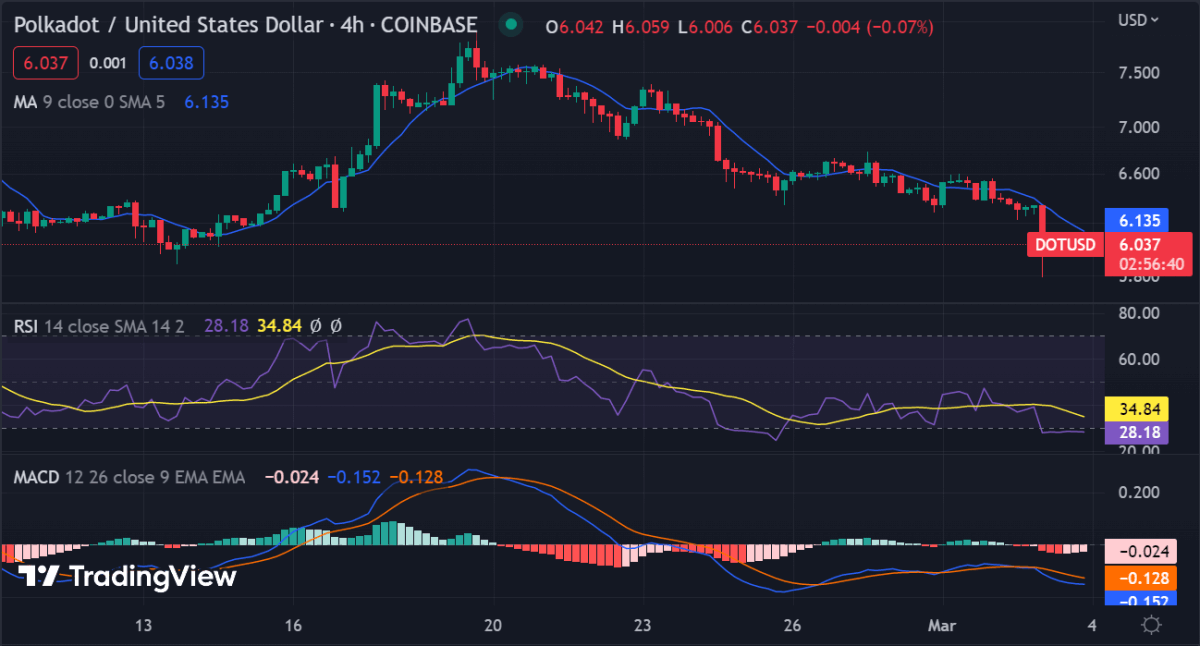

Polkadot price analysis on a 4-hour chart: DOT/USD forms a bearish flag pattern

Looking at the 4-hour chart, Polkadot price analysis is forming a bearish flag pattern. The downward trend has been in play for most of the day, and this pattern is further confirmation of the short-term bearish trend. The price needs to be pushed above $6.20 in order for traders to get an indication that a reversal may be underway.

The DOT/USD is trading below the moving average (MA) line, indicating a bearish trend. The moving average is at $6.13 at the moment, but the price is trading much lower. The SMA 20 line and 50 lines are also trading below the current price, confirming the downward trend. The moving average converges divergence (MACD)indicator has shifted into the bearish zone, showing that selling momentum is strong in the market. The RSI curve has also dipped below 50 and is currently at 28.18, which further confirms that bears are dominating the market.

DOT/USD 24-hour price chart: Selling pressure is still strong at $6.07

The 24-hour chart for Polkadot price analysis shows strong selling pressure at the $6.07 level. The price has been hovering near this level for most of the day and is yet to make a significant move in either direction. The resistance levels on this chart are at $6.20, and the support levels are at $5.87, and if either of these levels is breached, then the price could start to move in that direction.

The 50-day and 200-day moving averages have both crossed over the current price, indicating a bearish trend in the short term. The MACD indicator is currently in the bearish zone as the MACD line has crossed below the signal line. The histogram bars have also turned red as more and more traders are opting for short positions. The RSI value stands at 40.40, indicating that the selling pressure is still strong in the market.

Polkadot price analysis conclusion

Overall, Polkadot price analysis shows a bearish trend in the near term with no sign of a reversal yet. The support levels at $5.87 will be tested, and if that level is breached, then the price could dive even further. The bulls and bears are in a tight contest, with bearish momentum currently dominating. The selling pressure is currently strong, and it will be interesting to see if the bulls can make a comeback in the coming days.