Polkadot price analysis is bearish as the crypto’s value has dropped below the $6.00 level. DOT/USD is currently trading at $5.89 after a brief period of consolidation between $6.20 and $5.73. The DOT/USD pair had earlier found support at $5.73 but was unable to move higher and breached below it. The resistance for DOT/USD lies at $5.89, which, if broken, can lead to a move toward the $6.30 Resistance level.

The DOT price analysis has decreased by 4.77 percent in the past 24 hours. The market capitalization for the crypto is currently at $6.6 billion, and the 24-hour trading volume for DOT is $290 million.

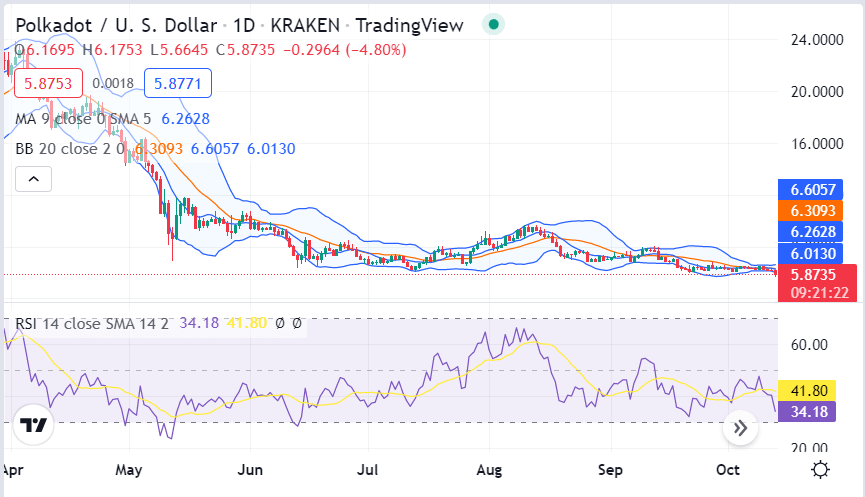

Polkadot price analysis for 1-day price chart: Support for DOT/USD is present at $6.20

The 1-day Polkadot price analysis chart shows that the crypto has been on a downtrend for the last 24-hours. The bears have been in control of the Polkadot markets after encountering bullish pressure around $6.50. Since then, the price has been on a downward spiral and is currently trading below the $6.00 level. The bearish momentum has been continuing over the past two days, and today, the trend is the same. The price has been lowered to the $5.89 level after the latest drop.

The moving averages shown on the 1-day chart are bearish as the 50-day moving average has crossed below the 200-day moving average. This indicates that the market is in a bearish phase, and the prices are likely to continue to fall. The Relative Strength Index is at 41.80 and is close to the oversold zone, which indicates that the prices are likely to see a bounce back in the near future. The Bollinger bands are also close to each other, which indicates that the market is consolidating and a breakout is likely to happen soon.

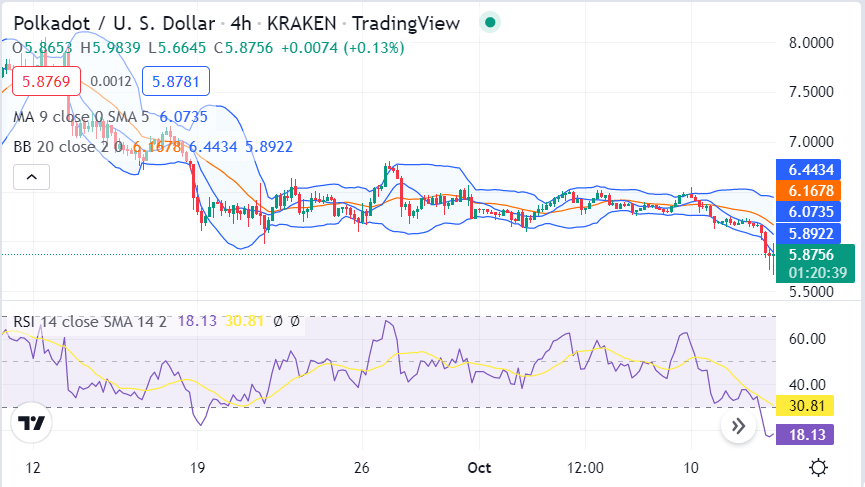

DOT/USD 4-hour price analysis: Latest developments

Polkadot price analysis reveals the market’s volatility following an opening movement. This means that the price of Polkadot is becoming more prone to the movement towards either extreme, showing further declining dynamics. The Bollinger’s band’s upper limit is $6.16, while the lower boundary at $5.73 coincides with the current market price and immediate support level.

Polkadot price analysis shows the Relative Strength Index (RSI) indicator is at the oversold zone with a value of 30.81. This means that DOT is undervalued at the moment, and a price rebound may occur in the near term, pushing the asset’s price up to around $6.00. However, if the RSI keeps falling, it will confirm a downtrend and might lead to a new DOT all-time low. The 50-MA is located at $6.16 and continues to decline, while the 200-MA is located much further below at $5.70. This indicates that the general market trend is bearish in the mid-term.

Polkadot price analysis conclusion

Polkadot price analysis reveals the cryptocurrency to follow a strong downwards trend with much more room for bearish activity. However, the bears have currently taken over the market, and the declining volatility favors the bears. As a result, they are likely to push prices toward $6.20 in the near term.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.