Polkadot price analysis is bearish today, as we have seen consolidation and failure to recover over the last 24 hours. Therefore, DOT/USD is ready to decline further and push back toward the $5.48 support. Resistance for Polkadot price analysis is set at $5.88, and support is found at $5.48, either of which can be broken depending on the market movements. With a market valuation of $6 billion and a decline in trading activity, the DOT/USD 24-hour trading volume has dropped to $269 million.

Polkadot price movement in the last 24 hours: Traders fear a short-term price drop

Polkadot 1-day price analysis shows bears are pulling the price down and seem successful in their attempts. Price is progressively falling as bears maintain their dominance. The last few hours had no real impact on the cryptocurrency. Today, the DOT/USD pair fluctuated between $5.48 and $5.88; it is now trading at $5.80 at the time of writing.

The MACD indicator is reddish in color, presenting a bearish trend, but the histograms’ light red color shows not a very intense bearish trend but a clear indication of active selling activity happening at the time. The volatility for Polkadot is comparatively high, and the Bollinger bands movement shows both ends on a downslope with their average line above the price level, which shows the price might go down in the coming time. The Relative strength index (RSI) is in the bearish zone, below the 50 level, and has moved closer to the oversold region.

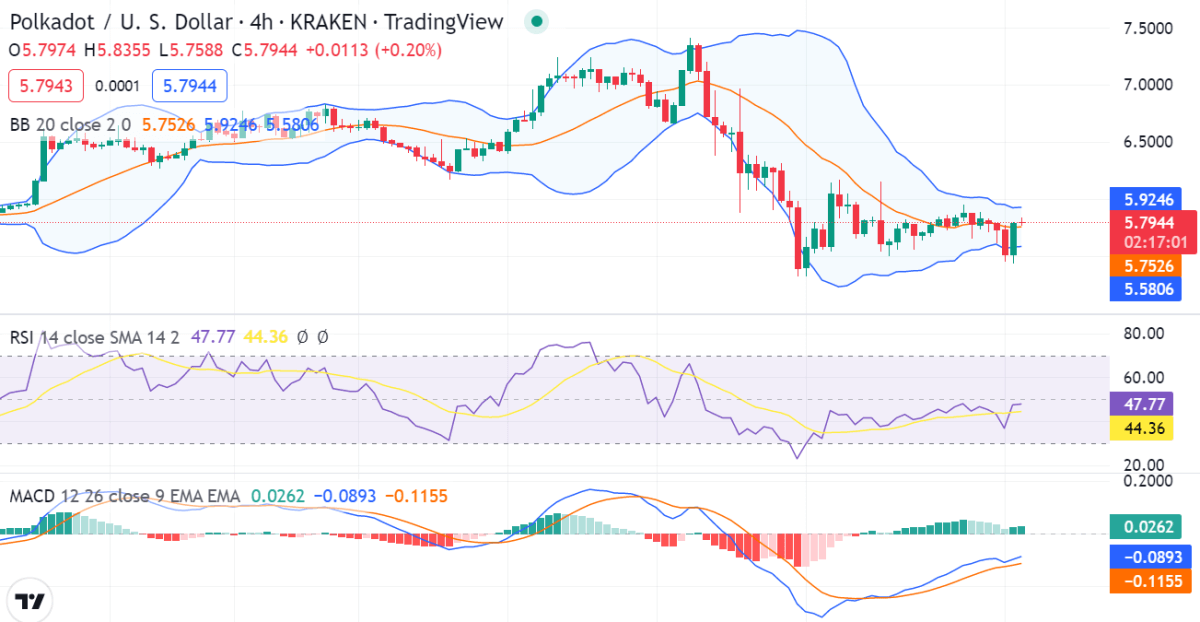

Polkadot price analysis 4-hour chart: DOT shows progress upwards and technical indications

The 4-hour price chart for Polkadot price analysis shows price is favoring the bulls. Bulls have successfully formed a short-term upwards-trending price line. A robust buying activity is going on at the time of writing as the price is going past the $5.80 mark. The Bollinger Band indicator shows declining volatility with the upper band at $5.92 and the lower band at $5.58.

The RSI also remains in bullish territory, currently at 44.36. The MACD indicator shows a strong bullish crossover as the signal line moves above the MACD line.

Polkadot price analysis conclusion

Polkadot price analysis suggests the short-term outlook is bullish, with the longer-term bearish. Although the daily moving average convergence divergence (MACD) is currently positive, it may soon be creating a lower high, which, if the trend persists, might signal a potential reversal. A permanent move above the $5.88 resistance could still realize the bullish target in November.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.