Polkadot price analysis shows further bearish reading, as price crashed more than 4 percent over the past 24 hours to move as low as $4.23. Since the 13 percent drop on December 16, today was the biggest downfall for DOT that took price more than 86 percent lower than this time last year at a high of $30.83. After trading horizontally for an extended period of time, DOT was expected to breakout and rally from the $4.5 support zone. However, today’s crash justifies an extremely bearish position of the token in the market.

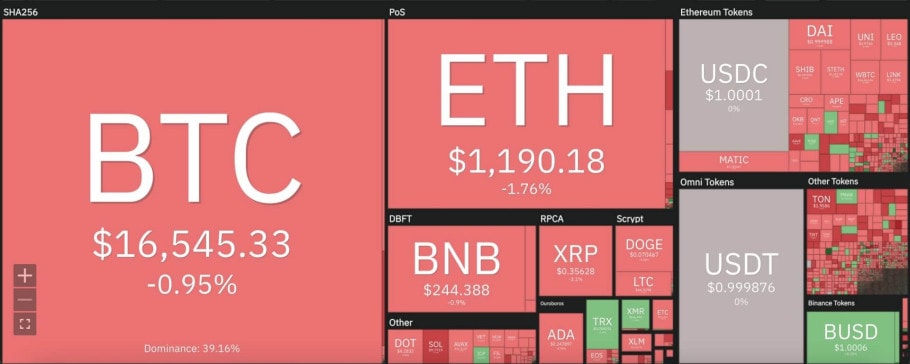

The larger cryptocurrency market lowered from yesterday’s positions, as Bitcoin dropped further below the $17,000 mark to move down to $16,500. Ethereum dropped 2 percent to $1,100, while leading Altcoins also showed minor downtrends across the board. Ripple lowered 3 percent to settle down at $0.35, whereas Cardano lost 5 percent to move down to $0.24. Meanwhile, Dogecoin dipped 4 percent to move as low as $0.07 and Solana crashed more than 12 percent to drop down to $9.77.

Polkadot price analysis: Bearish indicators dominate DOT daily chart

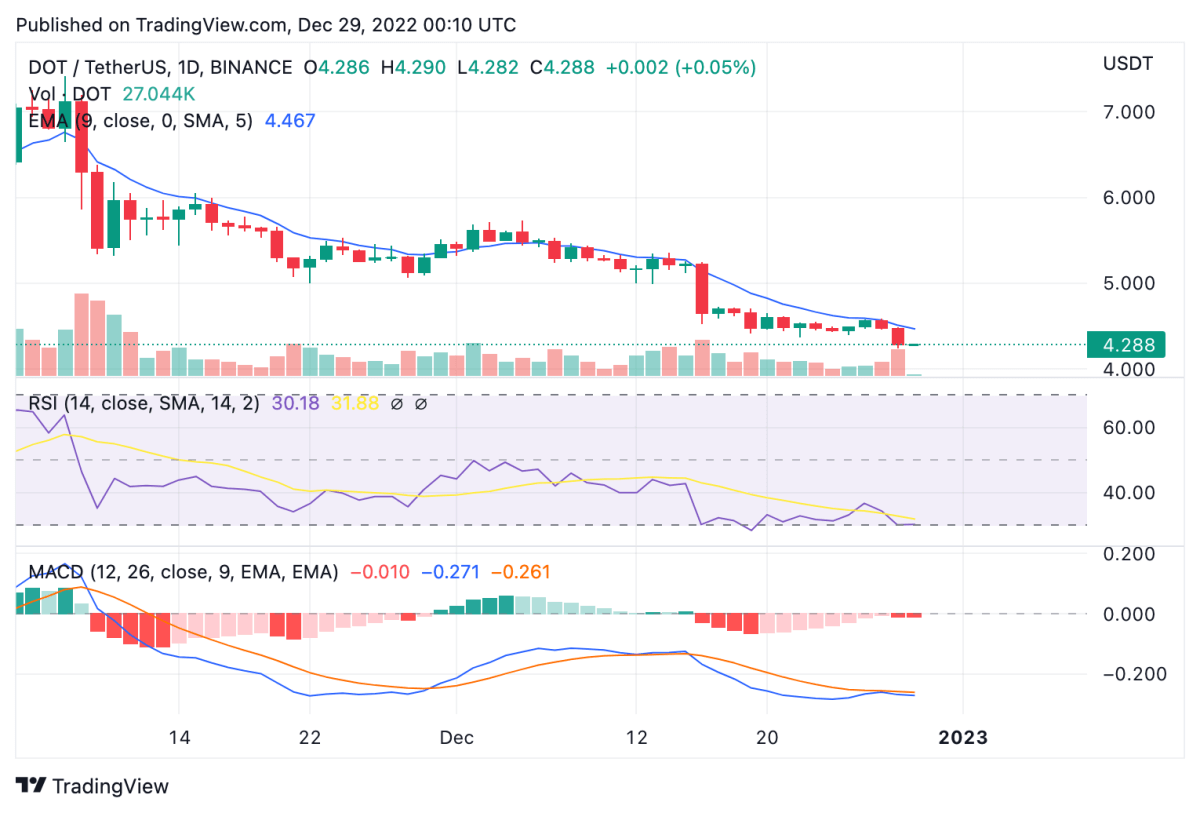

On the 24-hour candlestick chart for Polkadot price analysis, price can be seen forming a descending triangle pattern over the past 24 hours to move below the previous support zone at $4.5. DOT trading volume rose 52 percent today to complement the price dip, indicating that sellers contributed the majority action in the market. Price also dropped further below the 9 and 21-day moving averages over the past 24 hours, as well as the crucial 50-day exponential moving average (EMA) at $4.46.

The 24-hour relative strength index (RSI) can be seen dropping further into the oversold zone at 30.18, indicating severe bearish sentiment in the market for DOT. For a breakout to take place, RSI on the daily chart will have to move into a healthier state above the 45 mark. Meanwhile, the moving average convergence divergence (MACD) curve continues to show a bearish divergence below the signal line.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.