Polkadot price analysis shows a bearish trend after the DOT price dropped to a low of $5.42. DOT/USD is currently trading in the red due to selling pressure, which is negative overall. The coin’s value had recovered earlier today, but a recent selloff has disrupted the trend, resulting in a decrease of nearly 0.52%. The DOT/USD has a trading volume of $314 billion and a market capitalization of $6.34 billion, which is slightly lower than the previous day’s value.

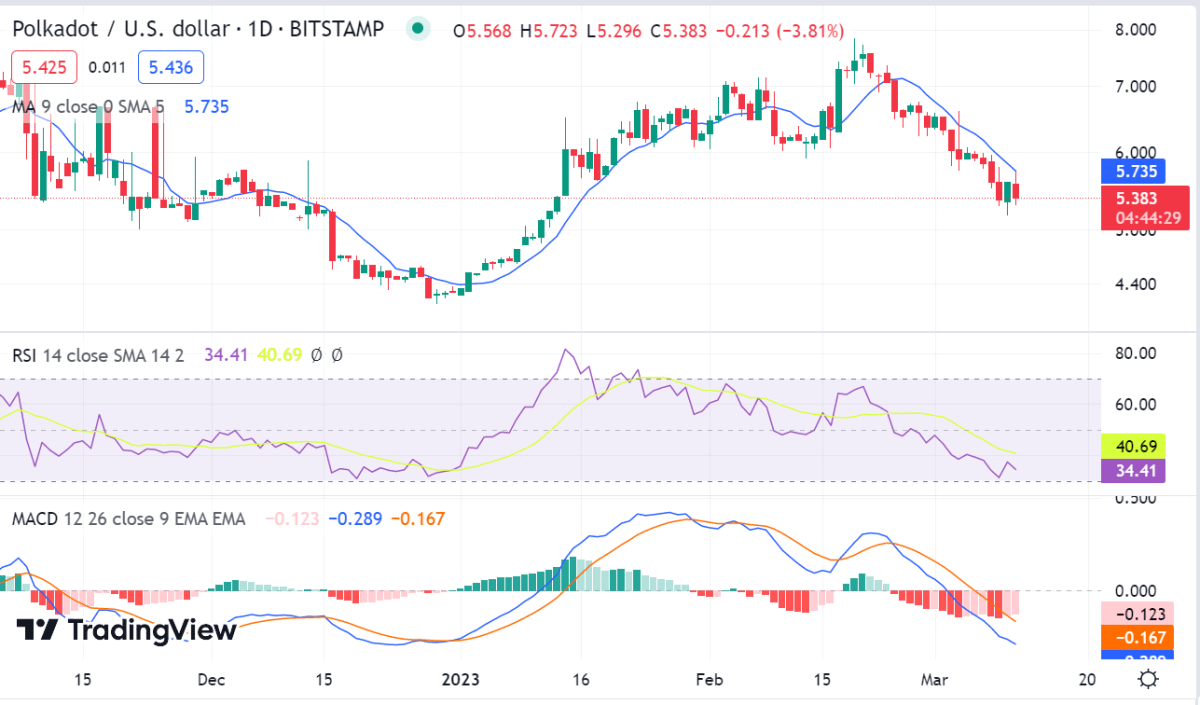

Polkadot price analysis 1-day price chart: Bearish pressure still persists

According to the 1-day price chart for Polkadot price analysis, there has been a decline in price today. After reaching a high of $5.68 earlier today, However, a brief period of recovery saw the price recover to $5.29, but this was soon followed by a decrease in price. The resistance level is seen at $5.30, which is being tested by bearish forces, while the support level is seen at $5.29, which has been playing a significant role in keeping the price from further decline.

The volatility for DOT is comparatively high, and the Bollinger bands movement shows both ends on a downslope with their average line above the price level, which shows the price might go down in the coming time. The Relative strength index (RSI) is in the lower half of the neutral zone at 34.41 indexes, and the moving average is at $5.73 above the price level. The MACD indicator is reddish in color, presenting a bearish trend, but the histograms’ light red color shows not a very intense bearish trend but a clear indication of active selling activity happening at the time.

Polkadot price analysis: Recent developments and further technical indications

The 4-hour price chart for Polkadot price analysis shows the price breakout was upwards at the start of the trading session, but the price function turned downwards four hours back. The bearish activity has reignited and has been gaining strength for the last four hours as the price has been corrected to $5.42.

The technical indicators for DOT/USD pair are well inclined towards the selling option, as the moving averages remain above the price level. The MACD indicator is still bearish as the histograms are mostly red in color, and the MACD line and the signal line are heading downwards. The RSI is trading at a steep downward curve at an index of 40.73, indicating the selling activity in the market as it falls into the neutral range from the overbought range.

Polkadot price analysis conclusion

The Polkadot price analysis suggests a bearish trend is going on. The bears have successfully reversed the bullish trend and have decreased the price level significantly. Selling pressure is expected to continue as the support is still further below, but we expect the DOT to not fall below the $5.29 level in the coming time.