Polkadot price analysis reveals a relatively upbeat approach today; the price has gained most of its lost value. In recent days, there has been a notable upsurge in the overall market sentiment favoring DOT (Polkadot), leading to a significant appreciation in its value. On May 25, the cryptocurrency witnessed an abrupt increase from $5.16 to $5.28. Subsequently, it sustained positive momentum throughout the day, ultimately rebounding to a peak value of $5.29. On May 27, 2023, the price of DOT reached significant heights, reaching a pinnacle of $5.29 and maintaining this elevated level throughout the day. Currently, the cryptocurrency’s price exhibits relative stability, hovering around $5.29.

Polkadot’s present market conditions indicate that it is currently priced at $5.30, with a trading volume of $158.68 million over the past 24 hours. Its market capitalization stands at $5.23 billion, and it holds a market dominance of 0.46%. Notably, the price of Polkadot has experienced a 1.29% increase in the last 24 hours. At present, the sentiment for Polkadot’s price prediction leans towards a bearish outlook. Additionally, the Fear & Greed Index indicates a neutral value of 48.

Polkadot currently has a circulating supply of 987.58 million DOT tokens out of a maximum supply of 1.00 billion DOT tokens. The yearly supply inflation rate stands at 10.02%, resulting in the creation of 89.92 million DOT tokens over the past year. In terms of market capitalization, Polkadot holds the sixth position in the Proof-of-Stake Coins sector and is ranked tenth in the Layer 1 sector.

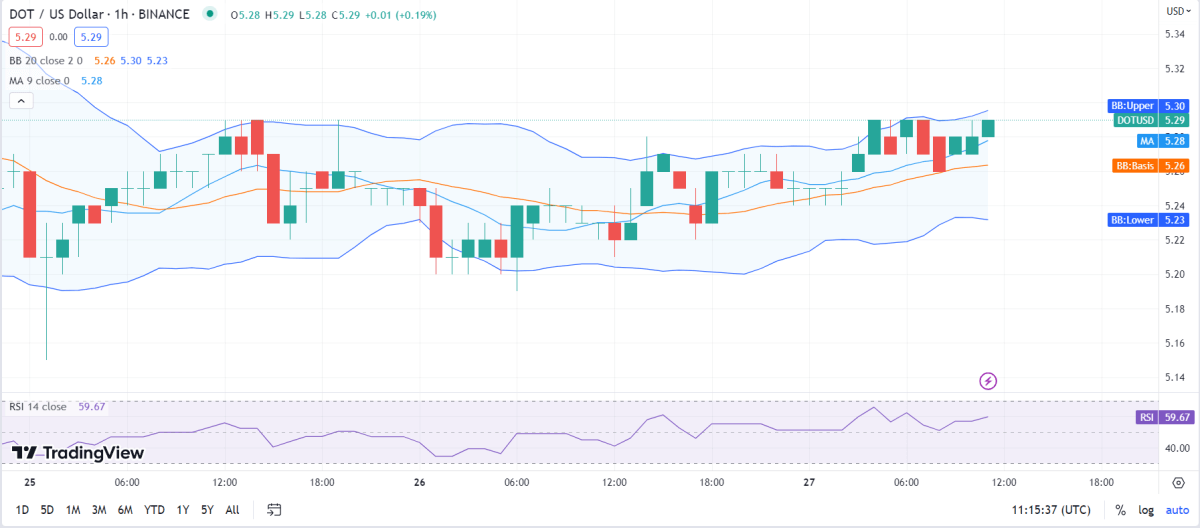

DOT/USD 1-hour price analysis: Recent updates

Polkadot price analysis highlights the presence of market volatility during the uncertain opening movement, leading to increased susceptibility of DOT prices to volatile fluctuations. Consequently, the upper limit of the Bollinger Bands stands at $5.30, serving as the strongest resistance level for DOT. In contrast, the lower limit of the Bollinger Bands, situated at $5.23, represents a robust support zone for Polkadot.

The DOT/USD pair has demonstrated a recent bullish trend as it surpassed the Moving Average curve, suggesting a positive market sentiment. Furthermore, the price of DOT is showing upward momentum, indicating a strong likelihood of approaching the resistance level. If a breakout occurs, it is expected to result in increased volatility, leading to a higher level of market unpredictability. As a result, traders should exercise caution and closely observe the market dynamics in order to adapt their strategies accordingly.

Polkadot’s price analysis shows an RSI score of 59, indicating it is above the upper-neutral region and trending toward overvaluation. The DOT/USD pair has stabilized in the market and is supported at its current level. The increasing RSI suggests a dominant buying activity.

Polkadot price analysis for 1-day

Polkadot price analysis indicates that market volatility is gradually decreasing, as evidenced by the convergence of the resistance and support bands. This convergence suggests a reduction in price fluctuations, making the cryptocurrency less susceptible to volatile changes. The upper limit of the Bollinger Bands is identified at $5.46, serving as a strong resistance level for Polkadot. Surpassing this level may pose significant challenges for the price to overcome. On the other hand, the lower limit of the Bollinger Bands is set at $5.22, representing the strongest support level for Polkadot.

The DOT/USD price has recently moved below the Moving Average curve, indicating a bearish trend in the market. However, despite this, the price is currently showing an upward trend and displaying positive dynamics. This suggests that the bulls are gaining strength and have the potential to take control of the market in the upcoming weeks. The price seems to be stabilizing in a secure position, and the volatility bands do not seem to pose a significant threat to the bullish sentiment. If the bulls make strategic moves, they have the opportunity to establish a long-term regime and maintain dominance over the market.

Polkadot price analysis reveals that the Relative Strength Index (RSI) is currently at 41, indicating a relatively stable state for the cryptocurrency. This RSI value positions Polkadot in the lower-neutral region, suggesting a balance between buying and selling pressures. It does not necessarily indicate a dominant selling trend at this time.

Polkadot Price Analysis Conclusion

The Polkadot price analysis suggests that the cryptocurrency possesses significant potential for positive movement in the market. Currently, the market is exhibiting a steady upward trend, indicating ongoing positive activity. Furthermore, there appears to be ample room and potential for further upward movement in the future. This analysis indicates a favorable outlook for Polkadot.