Polkadot price analysis reveals a relatively upbeat approach today; the price has gained most of its lost value. In recent days, there has been a notable upsurge in the overall market sentiment favoring DOT (Polkadot), leading to a significant appreciation in its value. On May 18, the cryptocurrency witnessed an abrupt increase from $5.45 to $5.26. Subsequently, it sustained positive momentum throughout the day, ultimately rebounding to a peak value of $5.42. On May 20, 2023, the price of DOT reached significant heights, reaching a pinnacle of $5.42 and maintaining this elevated level throughout the day. Currently, the cryptocurrency’s price exhibits relative stability, hovering around $5.42.

As of today, Polkadot (DOT) is priced at $5.43, with a 24-hour trading volume of $195.58 million. It has a market capitalization of $5.36 billion and a market dominance of 0.47%. Over the past 24 hours, the DOT price has increased by 1.25%. Currently, the sentiment for Polkadot’s price prediction is bearish, and the Fear & Greed Index indicates a neutral sentiment with a value of 48.

The circulating supply of Polkadot is currently 987.58 million DOT out of a maximum supply of 1.00 billion DOT. The yearly supply inflation rate is 10.02%, resulting in the creation of 89.92 million DOT in the last year. In terms of market cap, Polkadot is ranked #6 in the Proof-of-Stake Coins sector and #10 in the Layer 1 sector.

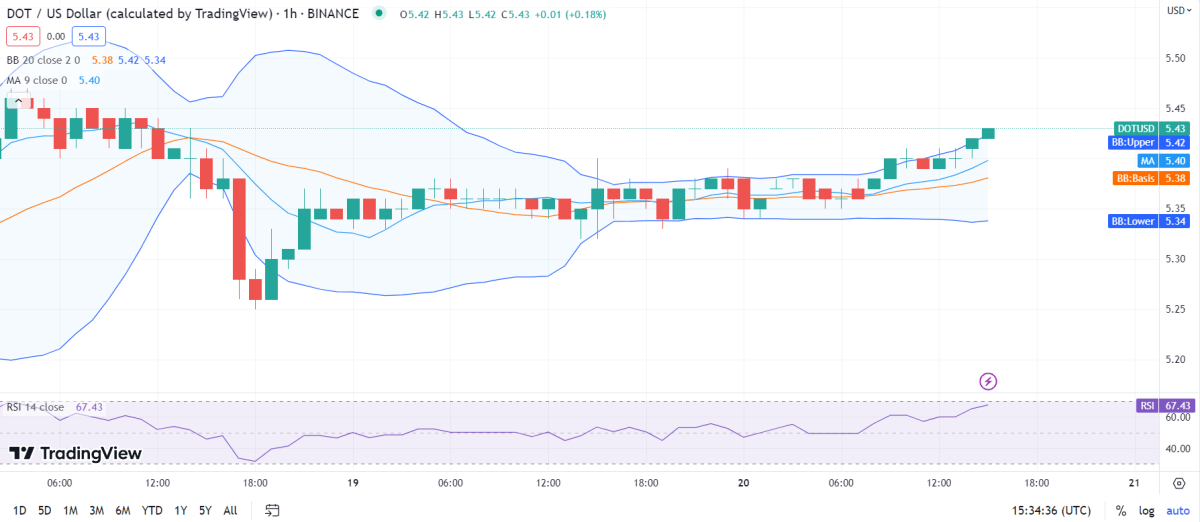

DOT/USD 1-hour price analysis: Recent updates

Polkadot price analysis highlights the presence of market volatility during the uncertain opening movement, leading to increased susceptibility of DOT prices to volatile fluctuations. Consequently, the upper limit of the Bollinger Bands stands at $5.42, serving as a support level for DOT. In contrast, the lower limit of the Bollinger Bands, situated at $5.34, represents a robust support zone for Polkadot.

The DOT/USD pair has recently exhibited a bullish trend by crossing below the Moving Average curve, implying positive market sentiment. Moreover, the price of DOT demonstrates upward momentum, signifying a high probability of approaching the resistance level. Should a breakout transpire, it is anticipated to induce heightened volatility, thereby significantly amplifying market unpredictability. Consequently, it is crucial for traders to closely monitor the market dynamics and adjust their strategies accordingly.

Polkadot price analysis reveals the Relative Strength Index (RSI) score to be 67, which falls above the upper-neutral region. The RSI score follows an upward movement towards the overvaluation region, signifying future inflation. The DOT/USD price has found a stable place within the market and has anchored itself there. The dominance of buying activity causes the RSI to increase.

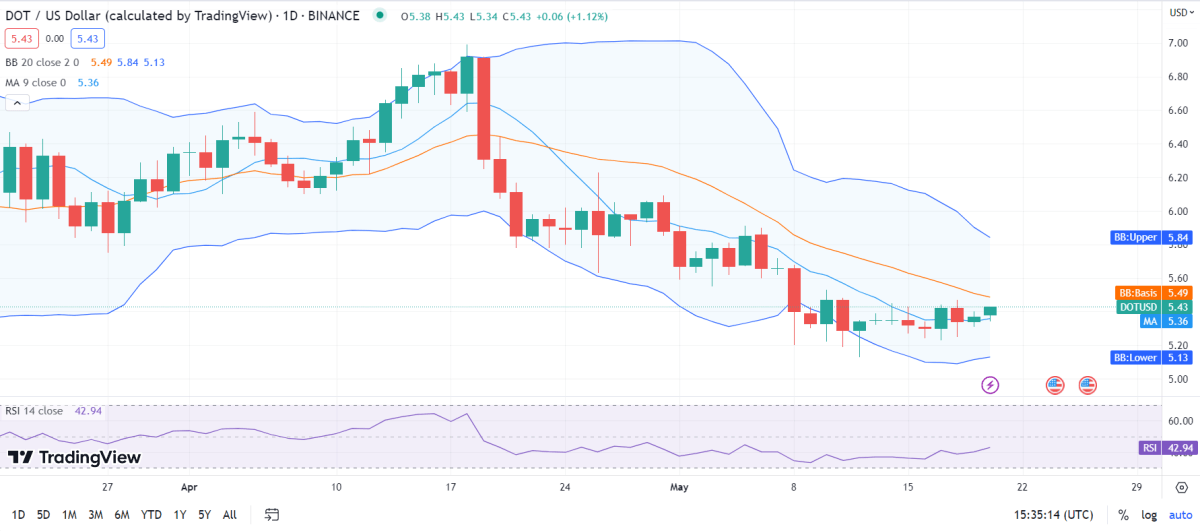

Polkadot price analysis for 1-day

Polkadot price analysis reveals the market volatility is currently exhibiting a gradual decline, characterized by the convergence of the resistance and support bands. This convergence indicates a reduction in price fluctuations, resulting in a decreased susceptibility of the cryptocurrency’s price too volatile changes. The upper limit of the Bollinger Bands is identified at $5.84, representing a strong resistance level for Polkadot. Consequently, surpassing this level may pose significant challenges for the price to overcome. Conversely, the lower limit of the Bollinger Bands is established at $5.1

, signifying the strongest support level for Polkadot.

The DOT/USD price has recently crossed below the Moving Average curve, indicating a bearish movement in the market. However, the price is currently exhibiting an upward trend, showing positive dynamics. This suggests that the bulls are gaining strength and have the potential to dominate the market in the coming weeks. The price seems to be stabilizing in a secure position, and the volatility bands do not appear to pose a significant threat to the bullish sentiment. If the bulls make strategic moves, they may establish a long-term regime and maintain control over the market.

Polkadot price analysis, the Relative Strength Index (RSI) is currently at 42, indicating a relatively stable state for the cryptocurrency. This RSI value places Polkadot in the lower-neutral region, suggesting a balance between buying and selling pressures. It does not necessarily indicate a dominant selling trend at the moment.

Polkadot Price Analysis Conclusion

The Polkadot price analysis suggests that the cryptocurrency possesses significant potential for positive movement in the market. Currently, the market is exhibiting a steady upward trend, indicating ongoing positive activity. Furthermore, there appears to be ample room and potential for further upward movement in the future. This analysis indicates a favorable outlook for Polkadot.