Polkadot price analysis shows a bearish trend in today’s session, with the price slipping below $6.10 and finding support at this level. The bears now have control of the market but still have to break through strong resistance, which is currently present at around $6.42. The selling pressure has increased in the past few days and this is likely to continue over the coming days.

The 24-trading volume has decreased significantly since hitting a weekly high of $207 million and is currently at around $203 million. This could be an indication that the bulls are losing momentum and the bearish trend could continue for some time. The market capitalization is still quite strong at $7.10 billion, but this could change quickly if the bears take control of the market.

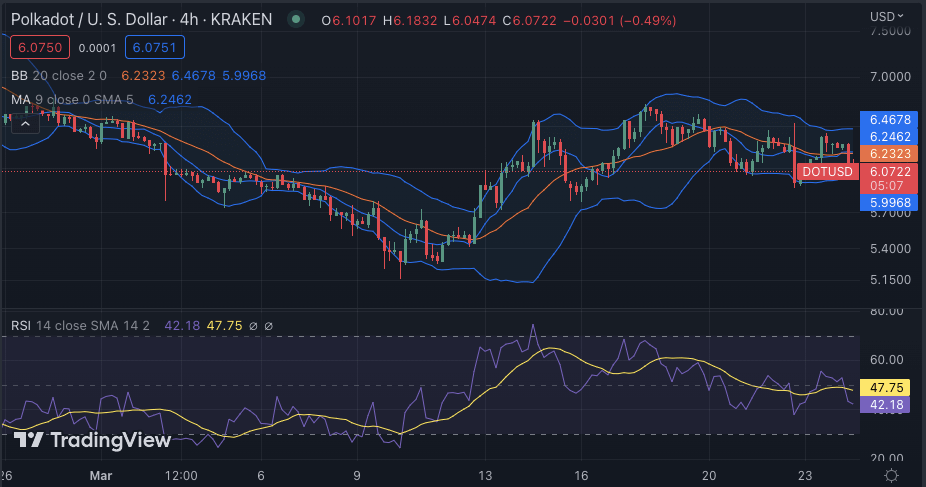

Polkadot price analysis 4-hour chart: DOT struggles to break out of the descending triangle

The 4-hour chart shows that Polkadot price analysis is trading within a descending triangle pattern, with resistance at $6.42 and support at $6.10. The price action has been quite choppy over the past few days, but there have been no major breakouts or breakdowns from this pattern yet. The Bulls need to break out of the triangle and push the price above $6.42 in order to take control of the market, otherwise, DOT could continue declining toward its next major support level at around $5.90.

The Moving Average (MA) value is currently set at $6.24 and is showing signs of a bearish crossover. The Relative Strength Index (RSI) value is also in the neutral region at $42.18, indicating that neither the bulls nor the bears have control of the market at this time. The volatility is quite low at present, indicating that the market could remain range-bound in the coming days. The Bollinger bands are slowly converging, which suggests that a big move is on the horizon. The upper Bollinger band is currently at $6.46, while the lower Bollinger band is set at $5.99.

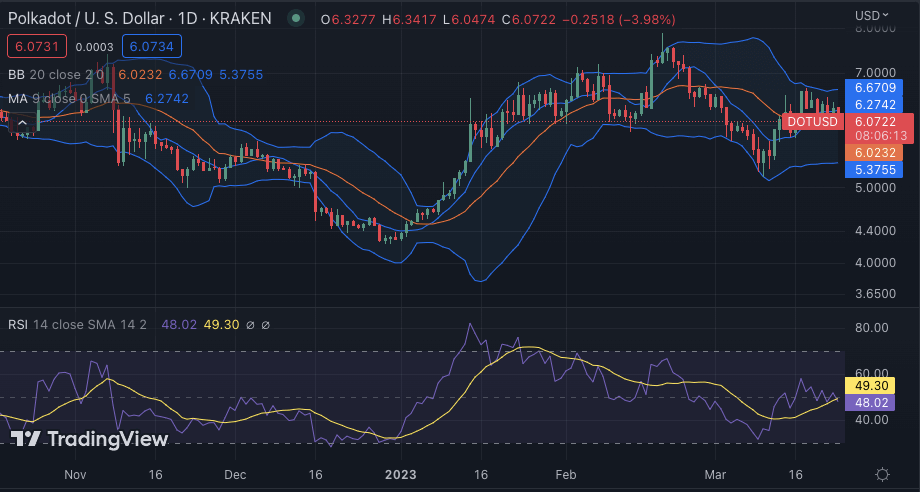

DOT/USD 1-day price chart: Bears debase coin value ruining further chances of improvement

The 1-day Polkadot price analysis is indicating that the price has undergone a major decline today. That has been made possible by the bears who have been able to interrupt the successive bullish wins. The bears have taken the price value down to $6.10, which has been surprising as there were some hopes that the price could reach $6.50.

The Daily technical indicators are currently showing bearish signs for the coin. The 20-SMA and 50-SMA are both trending downwards. The RSI is still in a neutral position, but it is slowly moving toward the oversold region. The Bollinger bands are squashing the price action and could be ready to expand in either direction. The upper band is currently at $6.67, while the lower band is set at $5.37.

Polkadot price analysis conclusion

Overall, Polkadot price analysis shows that the bearish trend has resumed and a break of the $6.42 resistance could see DOT/USD decline further. The bulls need to take control of the market quickly and push the price above the resistance level to avoid further losses. The technical indicators show that a breakout or breakdown could be imminent. If the bulls can take control of the market and push DOT/USD back up toward the $6.50 level, then we could see a reversal in the trend and a potential price appreciation for the coin.