The Polkadot price analysis shows buyers pushing DOT prices higher, with the Bulls gaining market control. The price has broken above the $6.41 level and is currently trading at $6.52. The altcoin is trading inside a bulling channel, with the support at $6.30 and resistance at $7.00. If buyers can break through the $7.00 resistance, the market could reach a price of $7.8 and potentially higher.

On the downside, if the buyers fail to break through the $7.00 resistance, Polkadot could fall back towards support at $6.30 or possibly as low as $5.50 if there is bearish momentum in the market.

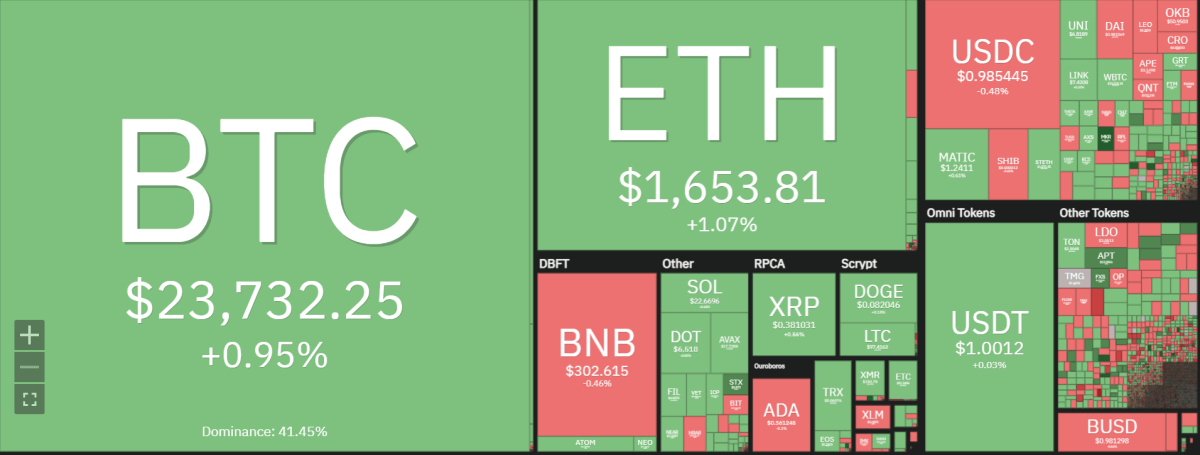

Despite having traded bearishly for most of the day, Polkadot has recovered in the past few hours, gained 0.91% in the last 24 hours, and is currently trading at $6.52, as per CoinMarketCap data. The market cap for DOT stands at $7.5 billion, with a 24-hour trading volume of $270 million.

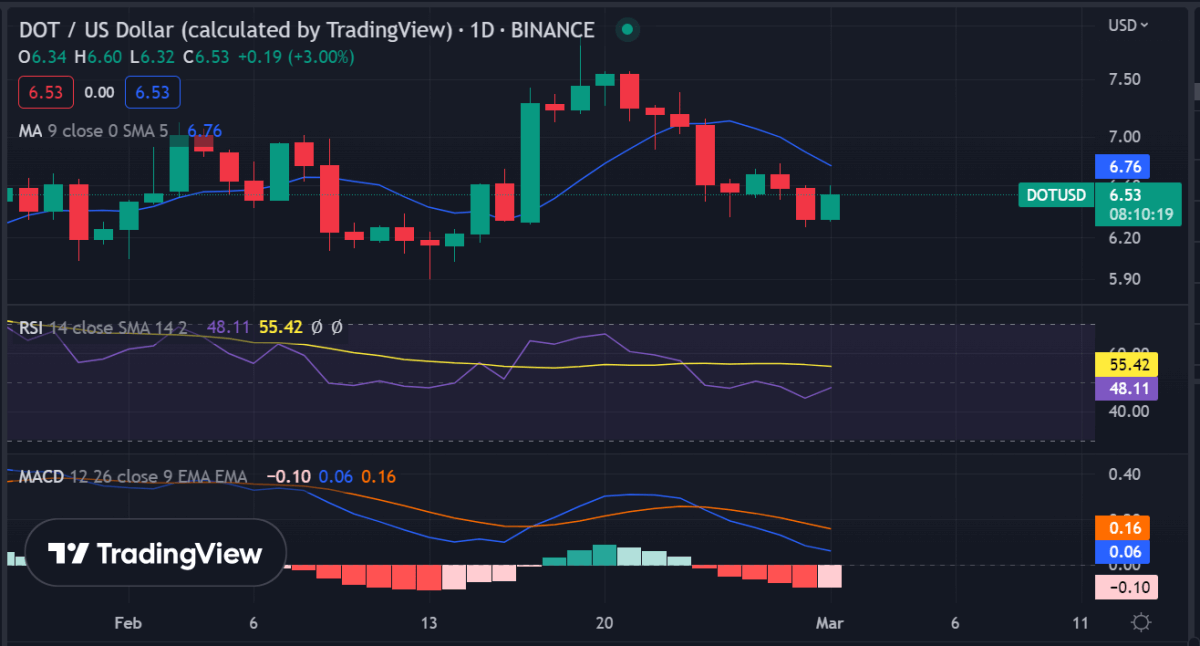

Polkadot price analysis 1-day chart: Bulls attempt to break the $7.0 resistance

The Polkadot price analysis 1-day chart shows Bulls pushing DOT prices higher, with the trading above the 20-day and 50-day moving averages. The RSI (Relative Strength Index) is currently in bullish territory, at 64.83 and there is room for further bullish movement if the buyers can break through the key $7.00 resistance level.

From a technical perspective, Polkadot is in an overall uptrend and has the potential to reach higher prices if buyers can maintain momentum and break through resistance levels. The sellers are still present but with reduced intensity. Since prices exceeded $6.41, they have been consolidating around this level.

The Exponential Moving Average EMA-20 is just above the price, which further confirms the bullish momentum. On the other hand, the MACD is exhibiting bullish divergence on the 50MA, thus adding credence to the bullish thesis.

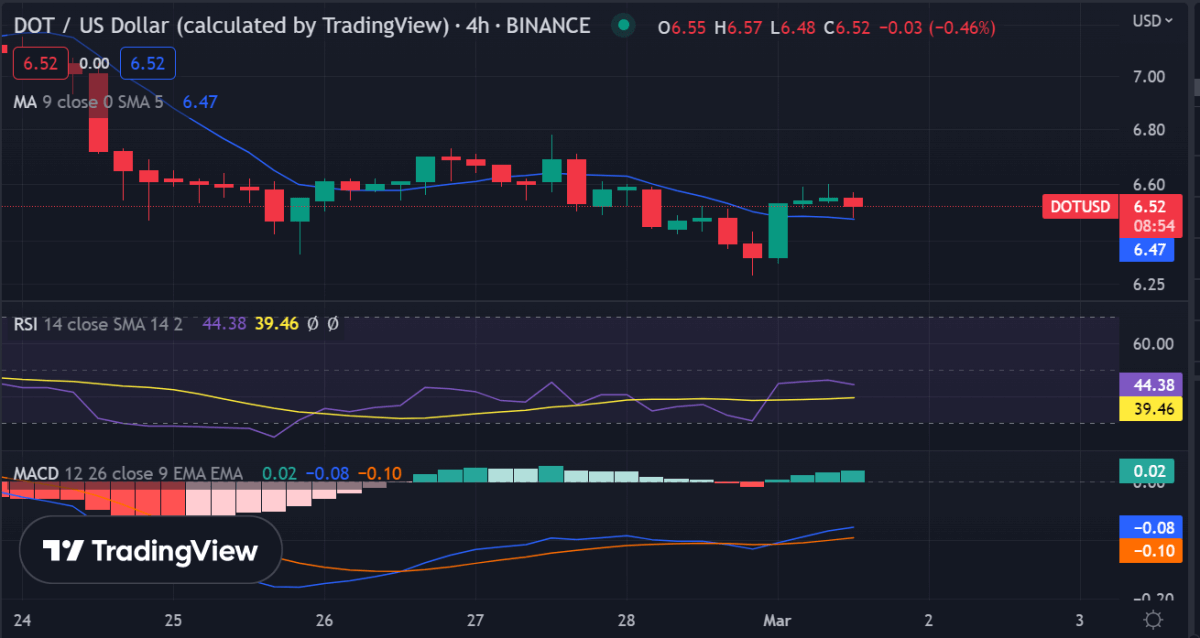

Polkadot price analysis 4-hour chart: DOT forms a bullish pattern

The 4-hour chart shows Polkadot forming a bullish pennant pattern. The $7.00 resistance level is still key for buyers to break, as it will indicate the potential for further price gains. The 4-hour Polkadot price analysis shows the bulls and bears trading in a tight range. The four-hour chart confirms an increasing trend as the price has covered an upward movement. The price has been consolidating around the $6.41 level but is facing strong resistance at $6.58. The bulls are trying to take control and break above the opposition, while the bears are trying to defend their position.

The technical indicators are signaling a bullish crossover, as the MACD is exhibiting a bullish crossover on the 4-hour chart and is above the zero-line. The RSI is hovering around 56, in what appears to be a mild bullish momentum.

Polkadot price analysis conclusion

Polkadot price analysis for today shows the bulls have the upper hand in the market. The bulls are attempting to break through the $7.00 resistance level, which could push the price higher if successful. On the other hand, if buyers fail to break through this key resistance level, prices could fall back toward support at $6.30 or possibly as low as $5.50 if there is bearish momentum in the market.