TL;DR Breakdown

- Polkadot price analysis suggests an upwards movement to $5.70

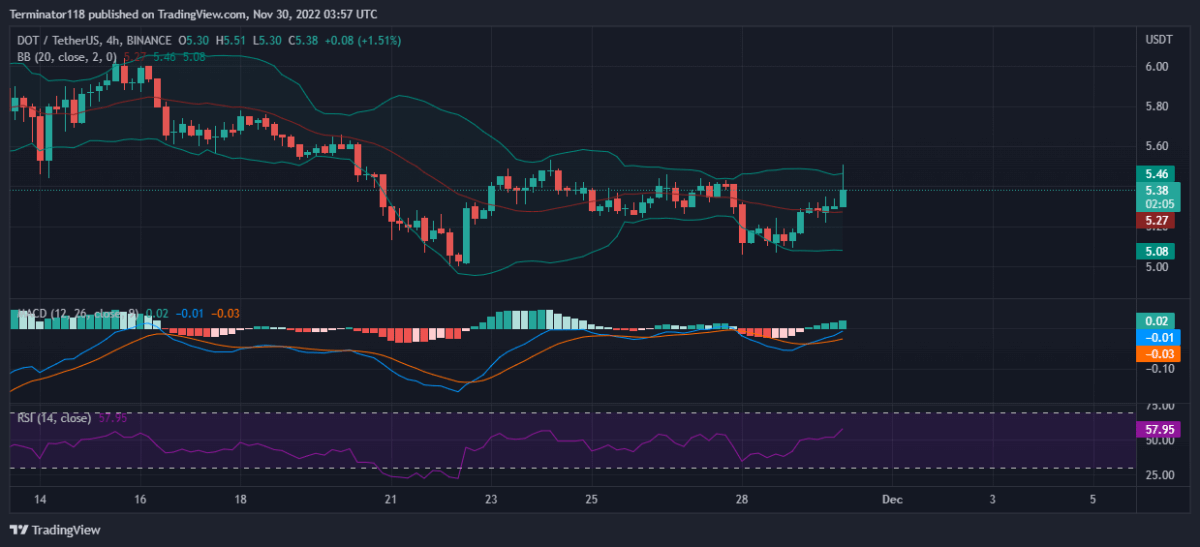

- The closest support level lies at $5.27

- DOT faces resistance at the $5.46 mark

The Polkadot price analysis shows that the DOT price action has recovered back to the $5.40 mark as the bulls charge above.

The broader cryptocurrency market observed a positive market sentiment over the last 24 hours as most major cryptocurrencies recorded negative price movements. Major players include ETH and XRP, recording an 6.90, and a 4.26 percent incline, respectively.

Polkadot price analysis: DOT returns to $5.40

The MACD is currently bullish, as expressed in the green color of the histogram. However, the indicator shows low bullish momentum as expressed in the low height of the histogram. On the other hand, the darker shade of the histogram suggests an increasing bullish momentum and indicates that the price is headed upwards.

The EMAs are currently trading close to the mean position as net price movement over the last ten days remains low. However, as the two EMAs diverge and move upwards, the buying activity is bound to rise. Currently, the 12-EMA is leading the run toward the mean line suggesting an increasing bullish activity in the markets.

The RSI has been trading in the neutral region for some time but it was trading below the mean level for the past few days. Now, the index has risen up and continues moving upwards as it trades at 57.95 at press time. The indicator issues no signals while the upwards slope shows bullish pressure.

The Bollinger Bands were narrow until yesterday but the sharp price movement from the $5.07 to the current $5.40 level has caused them to expand. At press time, the indicator’s bottom line provides support at $5.08 while the upper limit presents a resistance level at $5.46.

Technical analyses for DOT/USDT

Overall, the 4-hour Polkadot price analysis issues a buy signal, with 13 of the 26 major technical indicators supporting the bulls. On the other hand, four of the indicators support the bears showing low bearish presence in recent hours. At the same time, nine indicators sit on the fence and support neither side of the market.

The 24-hour Polkadot price analysis does not share this sentiment and issues a sell signal with 11 indicators suggesting a downward movement against five indicators suggesting an upwards movement. The analysis shows bearish dominance across the mid-term charts while low buying pressure for the asset across the same timeframe. Meanwhile, ten indicators remain neutral and do not issue any signals at press time

What to expect from Polkadot price analysis?

The Polkadot price analysis shows that the bearish pressure that caused the price to fall to $5.00 has mostly evaporated as the bulls are trying to make another attempt at the $5.50 level

Traders should expect DOT to move up toward the $5.50 mark where the key resistance lies. Traders should expect a bullish breakout to the $5.70 region as the mid-term technicals show a shift towards a bullish market. However, in case of a rejection, the price can be expected to drop to the $5.00 level continuing the consolidation.