Today’s Polkadot price analysis reveals that prices are on a prevailing downtrend that has been seen since yesterday’s market rally. The 1.61 percent drop in prices has decreased DOT to $5.97 from the intraday high of $6.07. The downtrend will likely continue in the near term as DOT prices are trading close to the lower boundary of the descending channel.

The support for DOT prices is present at $5.94, and a breakdown below this level could see DOT enter into a freefall towards the $5.50 region, while a move above $6.00 is required for bulls to take control of the market. The Market cap for Polkadot stands at $6.94 billion, and the 24-hour trading volume is recorded at $166 million.

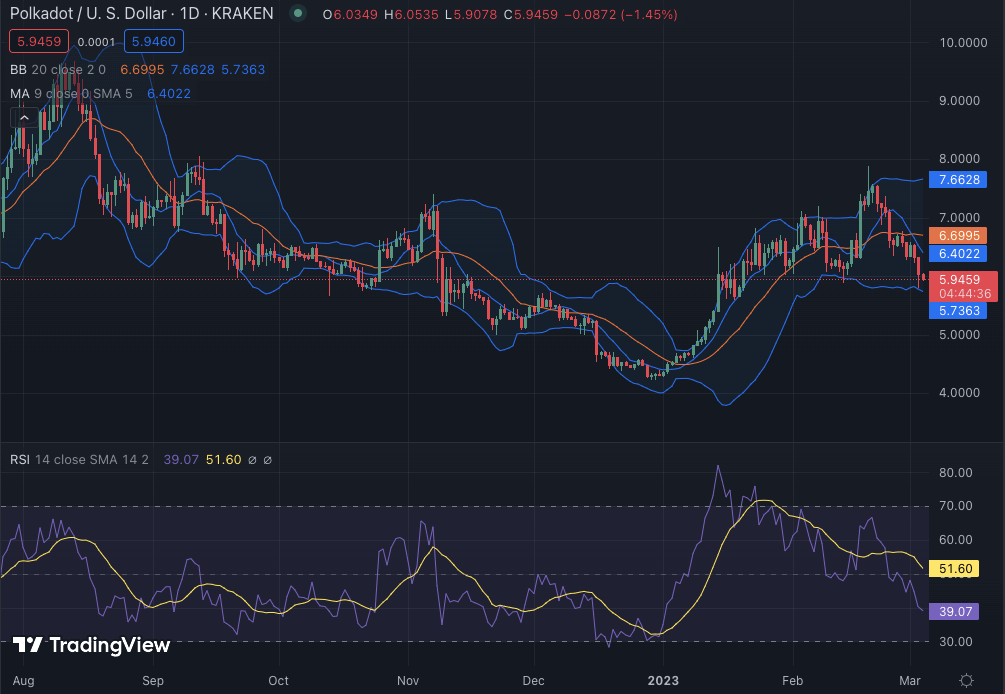

Polkadot price analysis 1-day chart: DOT goes down to $5.97

The 24-hour Polkadot price analysis indicates a downward trend for the market as the selling momentum remained high during the day. The bears have successfully tackled the unfavorable circumstances as no considerable bullish efforts have been seen. The price is now at $5.97 and further devaluation will follow if the selling activity experiences a further rise.

The technical indicators signal a continuation of the bearish trend as the RSI indicator is under the 39.07 level and heading towards oversold conditions. The sell-off from the highs has taken DOT prices below the key support level at $5.94 and also below the 20-day moving average (MA) at $6.40. The 20-day moving average (MA) and the 50-day MA are trending downward, which is a sign that the bears are in control of the market. The Bollinger bands have also narrowed, which is an indication of low volatility in the market.

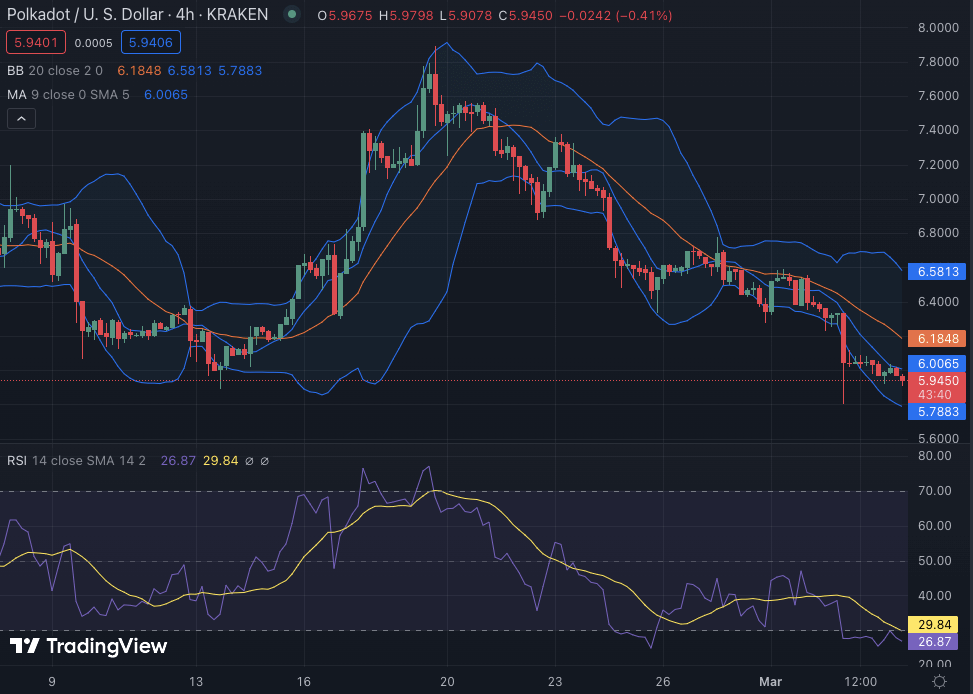

Polkadot price action on a 4-hour price chart: Bearish trend line intact

The 4-hour Polkadot price analysis chart shows a descending channel as the price is trading inside the descending channel. The downtrend will continue if the price breaks below $5.97, and this can result in a decline of the current price toward the $5.94 region.

The upper Bollinger band is at $6.58, which may act as stiff resistance for Polkadot prices in the near term, while the lower boundary of the Bollinger band is at $15.78, which is likely to act as strong support for DOT prices in the near term. The Relative Strength Index (RSI) indicator is at 26.87 and is currently below the 50 level, which is a sign that the market is in bearish territory. The 4-hour Moving average is at $6.00, which is above the current price.

Polkadot price analysis conclusion

Polkadot price analysis shows a bearish market sentiment formed during today’s opening of the market as bears continue to dominate the market. The technical indicators are also indicating a bearish market, and further price decline is expected in the near term. Bulls might attempt to take control of the market if they push prices above $6.07.