Polkadot price analysis reveals that the cryptocurrency has been overpowered by a bullish strike that started a few hours before. The strong drop in the price happened at the time when the market turned bearish, the DOT price has been struggling to stay afloat above the $6 mark. But the bears have pushed the price down to $5.95, and this could be a sign of further losses in the near future.

Polkadot has been unable to break past the resistance at the current level of $6.17 and is facing heavy selling pressure at this point. The recent bearish momentum can be attributed to the overall bearish sentiment in the crypto markets which has dragged down the prices of most major cryptocurrencies. The support for the token can be found at the $5.92 level and is currently acting as a cushion against further losses.

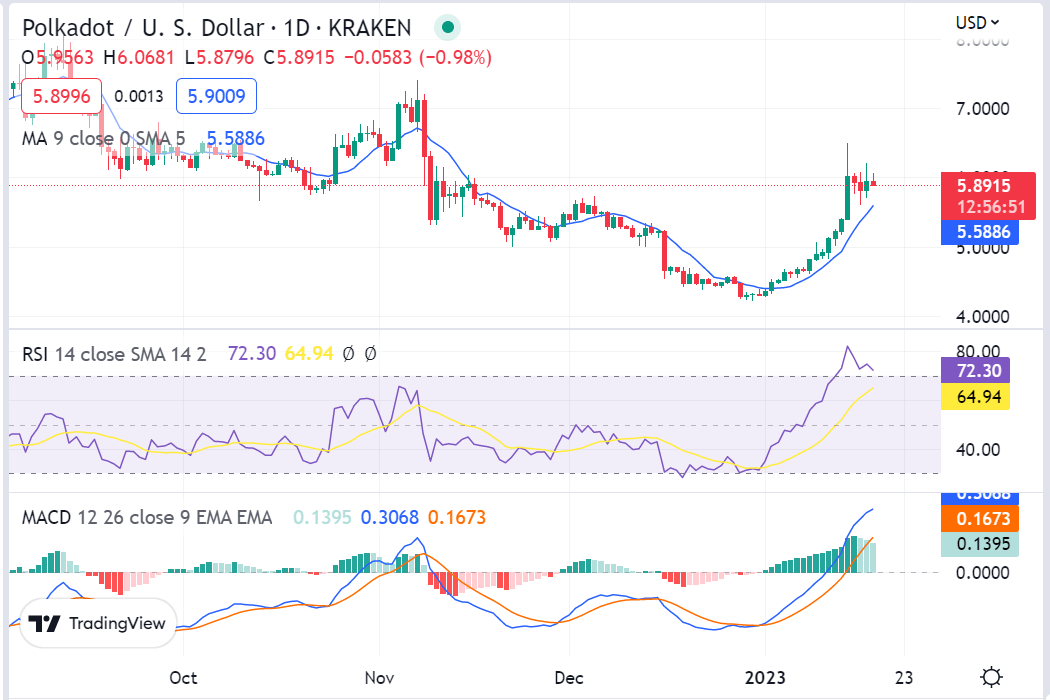

DOT/USD 1-day price chart: Polkadot unable to withstand the bearish pressure

The Polkadot price analysis on the one-day candlesticks chart reveals that the bulls have been in control of the cryptocurrency and pushed the coin a high of $6.17 in the past hours. However, this bullish streak was not enough to break the resistance at the $6.17 level and the bears have taken over since then pushing the price back down to $5.95 losing 0.68% percent. And If a further drop continues then DOT could face additional losses and test its support levels at around $5.92.

The RSI indicator for the DOT/USD pair is currently at 64.94 and suggests that the bears are in control of the market. The 50-day moving average is currently below the 200-day moving average, which indicates a bearish sentiment in the overall market. The MACD chart also shows a bearish crossover which could signal further losses in the near future. The moving average (MA) value is still standing at $5.58. The SMA 50 is currently below the SMA 200 which indicates that the long-term trend is bearish.

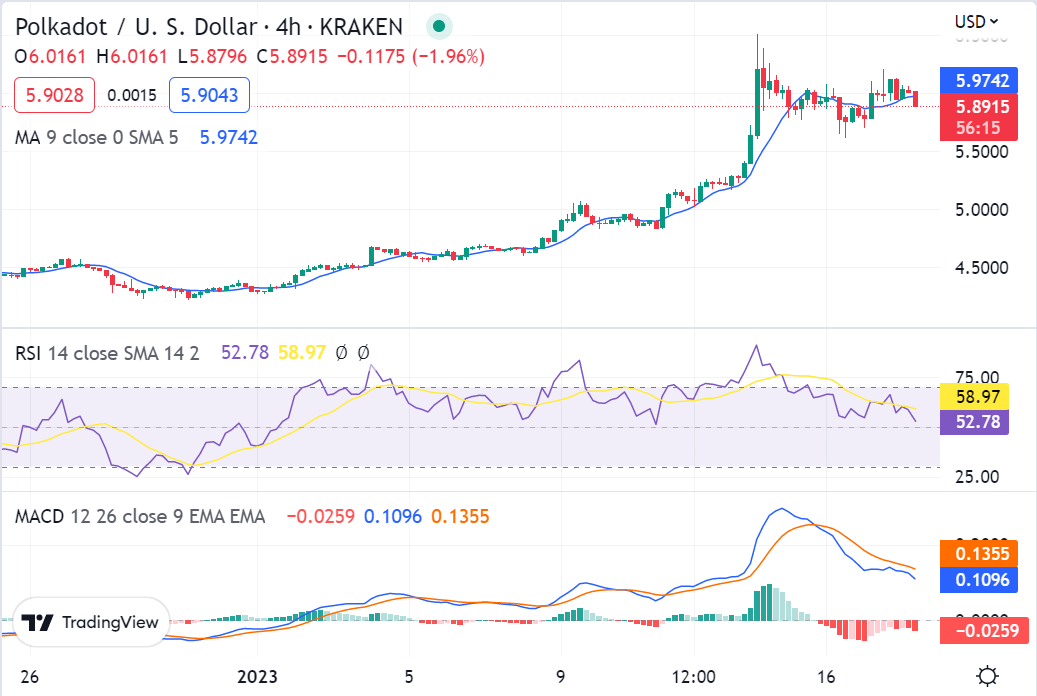

Polkadot price analysis on 4-hour chart: DOT reconfirms the struggle against bears

On the four-hour candlestick chart, the Polkadot price analysis shows a bearish trend. The bears have managed to keep control of the market, pushing the prices back down after a brief attempt at reaching the $6 mark. The next coming hours will be crucial in determining whether the bulls have enough strength to rally or not. The RSI indicator is currently at 58.97, indicating a neutral sentiment.

The MACD chart shows a bearish crossover and is signaling potential losses in the near future. The SMA 50 and 200 are both below the current price level, indicating that there could be more room for the bears to take control of the market. The moving average indicator is currently standing at around $5.97 and is still bearish.

Polkadot price analysis conclusion

Polkadot price analysis confirms that the bears have been maintaining their lead quite successfully for the past few hours after the price last peaked at $6.17. The price has decreased today as well and is standing at the $5.95 position at the time of writing, and the bearish momentum may intensify in the coming hours.